Earl Grey Golf Corp. has 25,000 shares of common stock outstanding, and the market price for a share of stock at the end of 2018 was $43. What is the price-earnings ratio? (Round the intermediate calculations to 2 decimal places. Round the final answer to 2 decima places.) Price-earnings ratio What are the dividends per share? (Round the final answer to 2 decimal places. Omit $ sign in your response.) Dividends $ 0.80 per share What is the market-to-book ratio at the end of 2018? (Do not round intermediate calculations. Round the final answer to 2 decimal places.) Market-to-book ratio 24.56 times PEG ratio f the company's growth rate is 9%, what is the PEG ratio? (Round the intermediate calculations to 2 decimal places. Round the final answer to 2 decimal places.) 7.23 times times

Earl Grey Golf Corp. has 25,000 shares of common stock outstanding, and the market price for a share of stock at the end of 2018 was $43. What is the price-earnings ratio? (Round the intermediate calculations to 2 decimal places. Round the final answer to 2 decima places.) Price-earnings ratio What are the dividends per share? (Round the final answer to 2 decimal places. Omit $ sign in your response.) Dividends $ 0.80 per share What is the market-to-book ratio at the end of 2018? (Do not round intermediate calculations. Round the final answer to 2 decimal places.) Market-to-book ratio 24.56 times PEG ratio f the company's growth rate is 9%, what is the PEG ratio? (Round the intermediate calculations to 2 decimal places. Round the final answer to 2 decimal places.) 7.23 times times

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter13: Financial Statement Analysis

Section: Chapter Questions

Problem 13.10E

Related questions

Question

Ee.68.

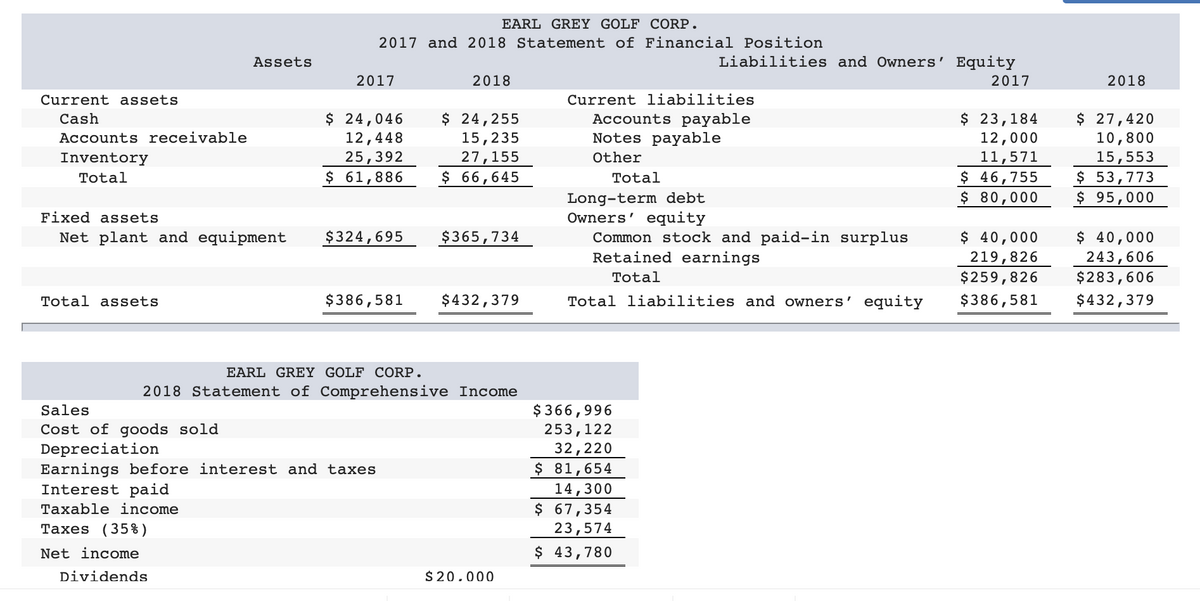

Transcribed Image Text:Current assets

Cash

Accounts receivable

Inventory

Total

Fixed assets

Net plant and equipment

Total assets

Assets

Sales

Cost of goods sold

Depreciation

EARL GREY GOLF CORP.

2017 and 2018 Statement of Financial Position

2017

$ 24,046

12,448

25,392

$ 61,886

$324,695

$386,581

Earnings before interest and taxes

Interest paid

Taxable income

Taxes (35%)

Net income

Dividends

2018

$ 24,255

15,235

27,155

$ 66,645

$365,734

EARL GREY GOLF CORP.

2018 Statement of Comprehensive Income

$432,379

$20.000

Current liabilities

Accounts payable

Notes payable

Other

Total

Liabilities and Owners' Equity

2017

Long-term debt

Owners' equity

Common stock and paid-in surplus

Retained earnings

Total

Total liabilities and owners' equity

$366,996

253,122

32,220

$ 81,654

14,300

$ 67,354

23,574

$ 43,780

$ 23,184

12,000

11,571

$ 46,755

$ 80,000

$ 40,000

219,826

$259,826

$386,581

2018

$ 27,420

10,800

15,553

$ 53,773

$ 95,000

$ 40,000

243,606

$283,606

$432,379

Transcribed Image Text:Additions to retained earnings

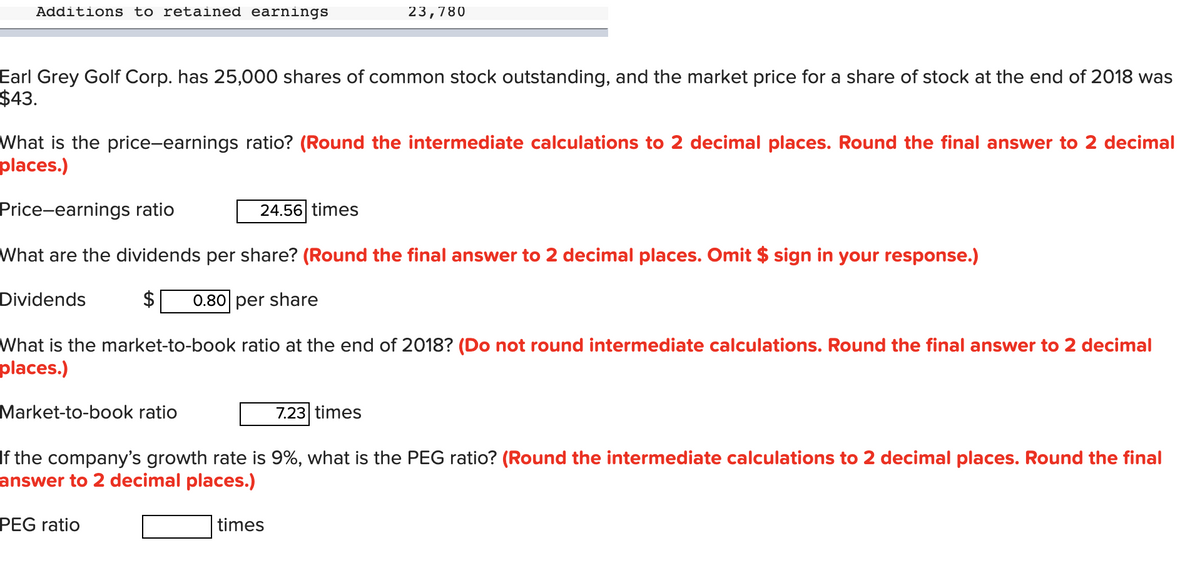

Earl Grey Golf Corp. has 25,000 shares of common stock outstanding, and the market price for a share of stock at the end of 2018 was

$43.

What is the price-earnings ratio? (Round the intermediate calculations to 2 decimal places. Round the final answer to 2 decimal

places.)

Price-earnings ratio

What are the dividends per share? (Round the final answer to 2 decimal places. Omit $ sign in your response.)

Dividends

Market-to-book ratio

24.56 times

23,780

0.80 per share

What is the market-to-book ratio at the end of 2018? (Do not round intermediate calculations. Round the final answer to 2 decimal

places.)

PEG ratio

7.23 times

If the company's growth rate is 9%, what is the PEG ratio? (Round the intermediate calculations to 2 decimal places. Round the final

answer to 2 decimal places.)

times

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning