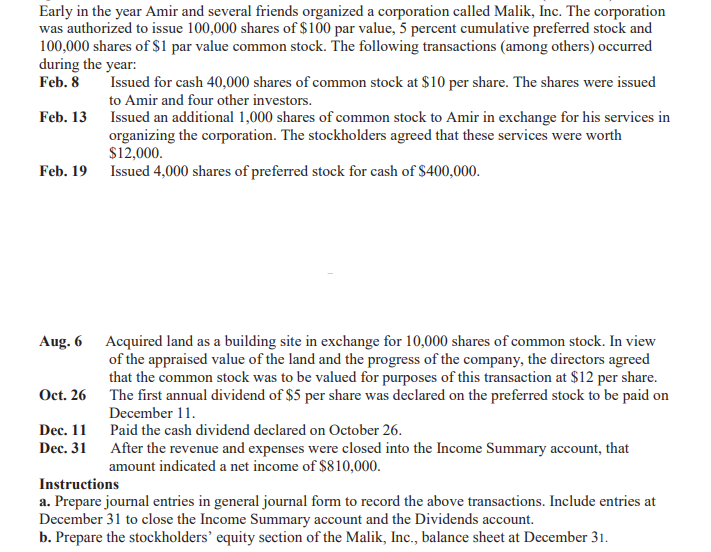

Early in the year Amir and several friends organized a corporation called Malik, Inc. The corporation was authorized to issue 100,000 shares of $100 par value, 5 percent cumulative preferred stock and 100,000 shares of S1 par value common stock. The following transactions (among others) occurred during the year: Feb. 8 Issued for cash 40,000 shares of common stock at $10 per share. The shares were issued to Amir and four other investors. Feb. 13 Issued an additional 1,000 shares of common stock to Amir in exchange for his services in organizing the corporation. The stockholders agreed that these services were worth $12,000. Feb. 19 Issued 4,000 shares of preferred stock for cash of $400,000. Aug. 6 Acquired land as a building site in exchange for 10,000 shares of common stock. In view of the appraised value of the land and the progress of the company, the directors agreed that the common stock was to be valued for purposes of this transaction at $12 per share. Oct. 26 The first annual dividend of $5 per share was declared on the preferred stock to be paid on December 11. Dec. 11 Paid the cash dividend declared on October 26. Dec. 31 After the revenue and expenses were closed into the Income Summary account, that amount indicated a net income of $810,000. Instructions a. Prepare journal entries in general journal form to record the above transactions. Include entries at December 31 to close the Income Summary account and the Dividends account. b. Prepare the stockholders’ equity section of the Malik, Inc., balance sheet at December 31.

Early in the year Amir and several friends organized a corporation called Malik, Inc. The corporation was authorized to issue 100,000 shares of $100 par value, 5 percent cumulative preferred stock and 100,000 shares of S1 par value common stock. The following transactions (among others) occurred during the year: Feb. 8 Issued for cash 40,000 shares of common stock at $10 per share. The shares were issued to Amir and four other investors. Feb. 13 Issued an additional 1,000 shares of common stock to Amir in exchange for his services in organizing the corporation. The stockholders agreed that these services were worth $12,000. Feb. 19 Issued 4,000 shares of preferred stock for cash of $400,000. Aug. 6 Acquired land as a building site in exchange for 10,000 shares of common stock. In view of the appraised value of the land and the progress of the company, the directors agreed that the common stock was to be valued for purposes of this transaction at $12 per share. Oct. 26 The first annual dividend of $5 per share was declared on the preferred stock to be paid on December 11. Dec. 11 Paid the cash dividend declared on October 26. Dec. 31 After the revenue and expenses were closed into the Income Summary account, that amount indicated a net income of $810,000. Instructions a. Prepare journal entries in general journal form to record the above transactions. Include entries at December 31 to close the Income Summary account and the Dividends account. b. Prepare the stockholders’ equity section of the Malik, Inc., balance sheet at December 31.

Chapter14: Corporation Accounting

Section: Chapter Questions

Problem 8PB: Tent Tarp Corporation is a manufacturer of outdoor camping equipment. The company was incorporated...

Related questions

Question

need solution

Transcribed Image Text:Early in the year Amir and several friends organized a corporation called Malik, Inc. The corporation

was authorized to issue 100,000 shares of $100 par value, 5 percent cumulative preferred stock and

100,000 shares of S1 par value common stock. The following transactions (among others) occurred

during the year:

Feb. 8

Issued for cash 40,000 shares of common stock at $10 per share. The shares were issued

to Amir and four other investors.

Feb. 13

Issued an additional 1,000 shares of common stock to Amir in exchange for his services in

organizing the corporation. The stockholders agreed that these services were worth

$12,000.

Feb. 19 Issued 4,000 shares of preferred stock for cash of $400,000.

Aug. 6 Acquired land as a building site in exchange for 10,000 shares of common stock. In view

of the appraised value of the land and the progress of the company, the directors agreed

that the common stock was to be valued for purposes of this transaction at $12 per share.

Oct. 26 The first annual dividend of $5 per share was declared on the preferred stock to be paid on

December 11.

Dec. 11 Paid the cash dividend declared on October 26.

Dec. 31 After the revenue and expenses were closed into the Income Summary account, that

amount indicated a net income of $810,000.

Instructions

a. Prepare journal entries in general journal form to record the above transactions. Include entries at

December 31 to close the Income Summary account and the Dividends account.

b. Prepare the stockholders’ equity section of the Malik, Inc., balance sheet at December 31.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning