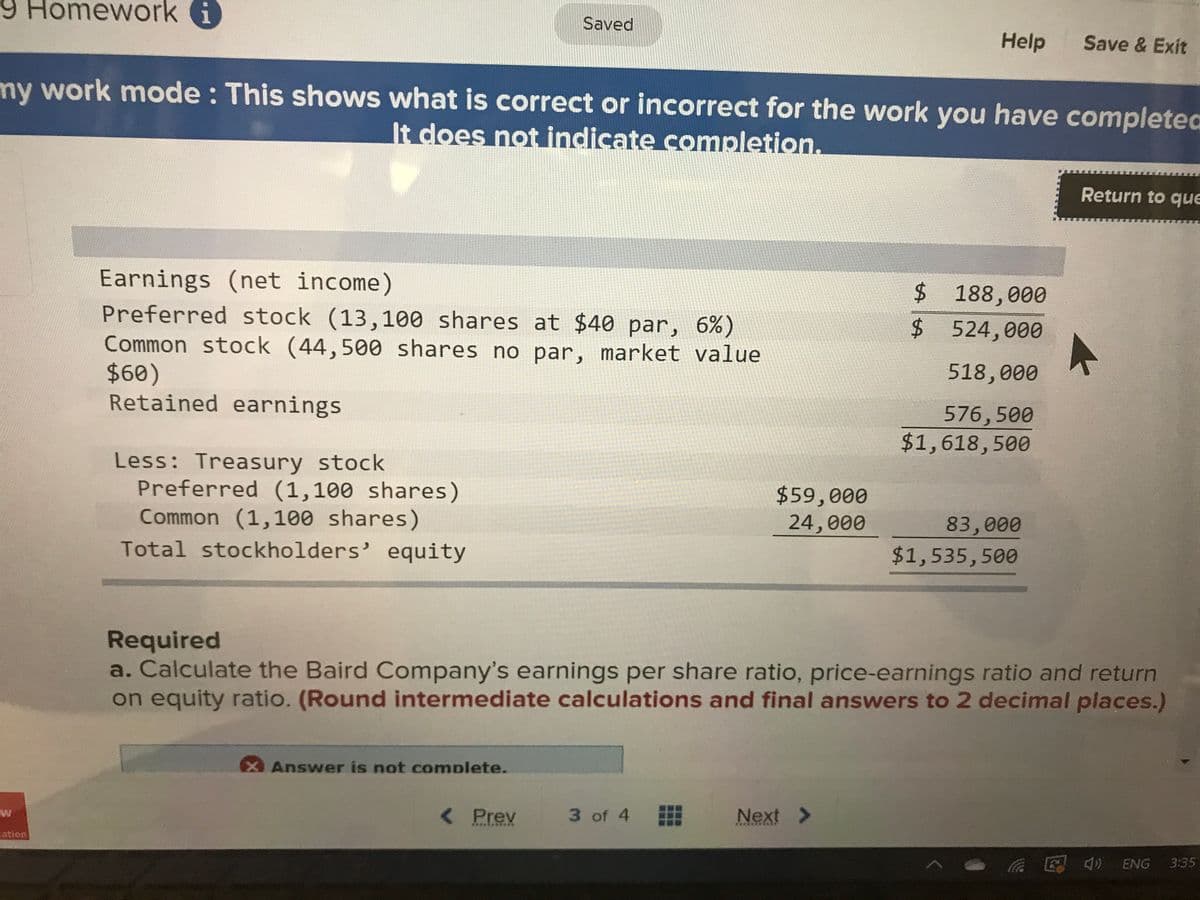

Earnings (net income) Preferred stock (13,100 shares at $40 par, 6%) Common stock (44,500 shares no par, market value $60) Retained earnings $ 188,000 $ 524,000 518,000 576,500 $1,618,500 Less: Treasury stock Preferred (1,100 shares) Common (1,100 shares) $59,000 24,000 83,000 $1,535,500 Total stockholders' equity Required a. Calcul on equity ratio. (Round intermediate calculations and final answers to 2 decimal places.) the Baird Company's earnings per share ratio, price-earnings ratio and return

Earnings (net income) Preferred stock (13,100 shares at $40 par, 6%) Common stock (44,500 shares no par, market value $60) Retained earnings $ 188,000 $ 524,000 518,000 576,500 $1,618,500 Less: Treasury stock Preferred (1,100 shares) Common (1,100 shares) $59,000 24,000 83,000 $1,535,500 Total stockholders' equity Required a. Calcul on equity ratio. (Round intermediate calculations and final answers to 2 decimal places.) the Baird Company's earnings per share ratio, price-earnings ratio and return

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter21: Corporations: Taxes, Earnings, Distributions, And The Statement Of Retained Earnings

Section: Chapter Questions

Problem 1CP: CHALLENGE PROBLEM This problem challenges you to apply your cumulative accounting knowledge to move...

Related questions

Question

Transcribed Image Text:9 Homework i

Saved

Help

Save & Exit

my work mode : This shows what is correct or incorrect for the work you have completed

It does not indicate completion.

Return to que

Earnings (net income)

Preferred stock (13,100 shares at $40 par, 6%)

Common stock (44,500 shares no par, market value

$60)

Retained earnings

$188,000

$ 524,000

518,000

576,500

$1,618,500

Less: Treasury stock

Preferred (1,100 shares)

Common (1,100 shares)

$59,000

24,000

83,000

$1,535,500

Total stockholders' equity

Required

a. Calculate the Baird Company's earnings per share ratio, price-earnings ratio and return

on equity ratio. (Round intermediate calculations and final answers to 2 decimal places.)

Answer is not complete.

W

< Prev

3 of 4

Next >

...*.

ation

- a E 4) ENG

3:35

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage