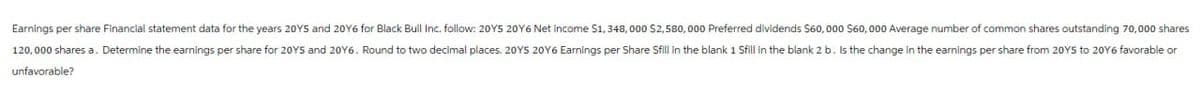

Earnings per share Financial statement data for the years 2015 and 20Y6 for Black Bull Inc. follow: 20Y5 20Y6 Net income $1,348,000 $2,580,000 Preferred dividends $60,000 $60,000 Average number of common shares outstanding 70,000 shares 120,000 shares a. Determine the earnings per share for 20YS and 20Y6. Round to two decimal places. 20YS 2016 Earnings per Share Sfill in the blank 1 Sfill in the blank 2 b. Is the change in the earnings per share from 2015 to 20Y6 favorable or unfavorable?

Q: Mungo Ltd has entered into two contacts involving financial instruments as follows. On 1 July 2020,…

A: The bond issuer, or the borrower who raised the funds, must record the bonds as a financial…

Q: Sheridan Inc., which produces a single product, has prepared the following standard cost sheet for…

A: 1.Total material variance = (SQ × SP) - Actual material costWhere:SQ is the standard quantity of…

Q: The following table shows the nominal returns on Brazilian stocks and the rate of inflation. a. What…

A: The expected market return is the average nominal return over the year. Stock risk is the percentage…

Q: A married decedent left the following inherited properties as part of his gross estate amounting to…

A: The amount that a person or individual will reduce from the gross income earned is called a…

Q: Check my work The Polaris Company uses a job-order costing system. The following transactions…

A: Step 1: Basics about journal entries.Journal entry is the primary step in recording the transactions…

Q: A flood destroyed Toshiaki Company's warehouse and all of its inventory. Toshiaki will use the gross…

A: The objective of the question is to calculate Toshiaki's historical gross profit percentage,…

Q: Answering the given question step by step with area

A: Let's get the total expenses: Total Expenses= $26,902Let's get the revenue:Average of car washed x…

Q: Perit Industries has $155,000 to invest. The company is trying to decide between two alternative…

A: Evaluating Project A:Initial Investment: Project A requires a total of $155,000 in upfront equipment…

Q: None

A: In the given scenario, Power Drive Corporation undergoes several transactions affecting its…

Q: Perez Company established a predetermined fixed overhead cost rate of $37 per unit of product. The…

A: Given,Predetermined fixed overhead cost rate = $ 37 per unitPlanned units = 6,100 unitsActual fixed…

Q: Urmilaben

A: Analyzing Further Processing for Dorsey Company:We can determine the financial…

Q: 3. T-Bill Pricing (1.0 points) A dealer quotes a 220-day US Treasury Bill trading at a discount of…

A: 3.Let's calculate the equivalent yield for the 220-day US Treasury Bill.First, let's find the…

Q: Manji

A: The objective of the question is to calculate the cost per equivalent unit for direct materials and…

Q: (a) Which compensation method (the old one or the new one) will the manager prefer? Please explain…

A: The remuneration that is awarded to an employee in exchange for their services or their…

Q: The four actors below have just signed a contract to star in a dramatic movie about relationships…

A: The present value of a contract amount represents the current worth of future cash flows discounted…

Q: Required information Skip to question [The following information applies to the questions displayed…

A: Inventory Valuation Methods for Collier Co.We can calculate the cost assigned to ending inventory…

Q: A. Using itemized deductions, determine the income tax payable at the end of the year (TRAIN LAW)…

A: Income tax: The income tax refers to the amount that is paid by the taxpayer to the tax authority of…

Q: Use the 2021 FICA tax rates, shown, to answer the following question. If a taxpayer is self-employed…

A: In this scenario, we're calculating the FICA taxes for a self-employed taxpayer who earns $156,000…

Q: On April 12, 2023, Prism Ltd., a camera lens manufacturer, paid cash of $555,800 for real estate…

A: Step 1:Allocation of lumpsum cost to individual PPE asset: (a)(b)(c)PPE AssetAppraised ValuesRatio…

Q: am.111.

A: The objective of the question is to record the adjusting entries for the transactions that occurred…

Q: Noura Company offers an annual bonus to employees (to be shared equally) if the company meets…

A: Step 1: Step 2: Step 3: Step 4:

Q: Why the equation I use is not the same as the answer even it is also finding the pv? And the…

A: The objective of the question is to understand why the present value calculation used in the…

Q: Domestic

A: Part 1)Payback period is the period within which the investments (cash outflows) are recovered by…

Q: ! Required information [The following information applies to the questions displayed below.] Preble…

A: 8) To compute direct labor cost be included in the flexible budget: Direct labor cost be included in…

Q: None

A:

Q: Ashvinbhai

A: Reference: Allocation of Service Department Costs | Managerial Accounting. (n.d.).…

Q: Tesla Worksheet for Mortage # Date Monthly Payment Principal Interest Current…

A: The loan Amortization schedule prepared in step 1 with PMT and PPMT functions shown in Step 2Journal…

Q: None

A: BOND LRATE = 5%, 7%, 10%NPER =18PMT = $1000*9% = $90FV = $1000PV(RATE,NPER, - PMT - FV) BOND SRATE…

Q: Mr. and Mrs. Roque is a philanthropist couple who gave many donations in times of need. In 2020,…

A: Income tax: The income tax refers to the amount that is paid by the taxpayer to the tax authority of…

Q: On March 1, Derby Corporation (a U.S.-based company) expects to order merchandise from a supplier in…

A: a-1. Journal Entries: On March 1:To record forward contract:Dr. Forward Contract Receivable:…

Q: Flounder Hardware Limited reported the following amounts for its cost of goods sold and Inventory:…

A: Step 1: Step 2:

Q: None

A: Residual income = Net operating income-(Average operating assets*Minimum Required rate of…

Q: Question 2 A). Briefly explain the behavior of Variable costs and Fixed costs. Ge B). Jessica Daniel…

A: Variable costs and fixed costs are fundamental concepts in business finance. Understanding their…

Q: Define Income Statement, Statement of Owners Equity, Balance Sheet, and Cash Flow Statement. How do…

A: The Income Statement, also known as the Profit and Loss Statement, is a financial report that shows…

Q: The accountant of a Japan Surplus business in the Philippines budgeted P112,294 on the monthly…

A: Value-Added Tax, commonly known as VAT, is a consumption tax applied at various stages of the…

Q: 15. Helen Barns wishes to purchase a new home and borrows $389,000 with a repayment plan of 25…

A: Step 1: The calculation of the annual payment AB1Borrowings (PV) $3,89,000.00 2Years (N)253Interest…

Q: Domestic

A: Part 2: Explanation1. Calculate the other expenses per customer:Fixed other expenses / Estimated…

Q: Weld Corporation is constructing a plant for its own use. Weld capitalizes interest on an annual…

A: ( c ) ACCOUNT NAME Dr.Cr.DEC. 31Building11,197,050 Interest Expenses29,750 Cash…

Q: Mr. F married, under absolute community, died on May 14, 2019, leaving the following: Family Home…

A: When determining inheritance taxes, funeral costs are frequently subtracted from the dead person's…

Q: Carl's Connection manufactures add-on products for the automobile industry. The manager at Carl's…

A: To calculate the residual income (RI) for each alternative, we'll use the formula: \[ \text{RI} =…

Q: am.105.

A: Ranking the support departments based on the percentage of service provided to others:HR:Provides…

Q: Meman

A: To determine financial advantage or disadvantage of new customer order's:Financial disadvantage by…

Q: None

A: The price elasticity of demand at any price p is calculated asE(p)=dpdq∗qp From the question , the…

Q: Shaak Corporation uses customers served as its measure of activity. The company bases its budgets on…

A: Part 2: ExplanationStep 1: Calculate the actual revenue:Actual revenue = Customers served * Revenue…

Q: Rahul

A: The objective of the question is to calculate the cost per equivalent unit for direct materials and…

Q: Lexington Garden Supply paid $160,000 for a group purchase of land, building, and equipment. At the…

A: Step 1:Apportionment of the lumpsum purchase price among the individual asset:AssetMarke…

Q: 4a. Michelin is considering going "lights out" in the mixing area of the business that operates…

A: The "cash flow before tax" means the amount of money that is made or spent by an enterprise or…

Q: am.100.

A: 1. **Retained Earnings:** This account is debited with the value of the stock dividend declared,…

Q: Jessa is a resident of Australia and has a taxable income of $46639 for year ended 2019. Required:…

A: The image you sent me is a word problem asking for the basic income tax liability of Jessa, a…

Q: Marin, Inc. leases a piece of equipment to Bucks Company on January 1, 2020. The contract stipulates…

A: Journal entries are entered in the book based on the double-entry bookkeeping principle which…

Step by step

Solved in 2 steps

- Earnings per share Financial statement data for the years ended December 31 for Black Bull Inc. follows: 2016 2015 Net income 2,485,700 1,538,000 Preferred dividends 50,000 50,000 Average number of common shares outstanding 115,000 shares 80,000 shares a. Determine the earnings per share for 2016 and 2015. b. Does the change in the earnings per share from 2015 to 2016 indicate a favorable or an unfavorable trend?Rebert Inc. showed the following balances for last year: Reberts net income for last year was 3,182,000. Refer to the information for Rebert Inc. above. Also, assume that the market price per share for Rebert is 51.50. Required: 1. Compute the dollar amount of preferred dividends. 2. Compute the number of common shares. 3. Compute earnings per share. (Note: Round to two decimals.) 4. Compute the price-earnings ratio. (Note: Round to the nearest whole number.)Rebert Inc. showed the following balances for last year: Reberts net income for last year was 3,182,000. Refer to the information for Rebert Inc. above. Also, assume that the dividends paid to common stockholders for last year were 2,600,000 and that the market price per share of common stock is 51.50. Required: 1. Compute the dividends per share. 2. Compute the dividend yield. (Note: Round to two decimal places.) 3. Compute the dividend payout ratio. (Note: Round to two decimal places.)

- Chen Corporation began 2012 with the following stockholders equity balances: The following selected transactions and events occurred during the year: a. Issued 10,000 shares of common stock for 60,000. b. Purchased 1,200 shares of treasury stock for 4,800. c. Sold 2,000 shares of treasury stock for 11,000. d. Generated net income of 94,000. e. Declared and paid the full years dividend on preferred stock and a dividend of 1.00 per share on common stock outstanding at the end of the year. Chen Corporation maintains several paid-in capital accounts (Paid-in Capital in Excess of Par, Paid-in Capital from Treasury Stock, etc.) in its ledger, but combines them all as Additional paid-in capital when preparing financial statements.Selected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 2016, were as follows: a. Issued 15,000 shares of 0 par common stock at 0, receiving cash. b. Issued 4,000 shares of 80 par preferred 5% stock at 100, receiving cash. c. Issued 500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. d. Declared a quarterly dividend of 0.50 per share on common stock and 1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. e. Paid the cash dividends declared in (d). f. Purchased 7,500 shares of Solstice Corp. at 40 per share, plus a 150 brokerage commission. The investment is classified as an available-for-sale investment. g. Purchased 8,000 shares of treasury common stock at 33 per share. h. Purchased 40,000 shares of Pinkberry Co. stock directly from the founders for 24 per share. Pinkberry has 125,000 shares issued and outstanding. Equinox Products Inc. treated the investment as an equity method investment. i. Declared a 1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. j. Paid the cash dividends to the preferred stockholders. k. Received 27,500 dividend from Pinkberry Co. investment in (h). l. Purchased 90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, at their face amount plus accrued interest of 375. The bonds are classified as a held- to-maturitv long-term investment. m. Sold, at 38 per share, 2,600 shares of treasury common stock purchased in (g). n. Received a dividend of 0.60 per share from the Solstice Corp. investment in (f). o. Sold 1,000 shares of Solstice Corp. at 545, including commission. p. Recorded the payment of semiannual interest on the bonds issued in (c) and the amortization of the premium for six months. The amortization is determined using the straight-line method, q. Accrued interest for three months on the Dream Inc. bonds purchased in (1). r. Pinkberry Co. recorded total earnings of 240,000. Equinox Products recorded equity earnings for its share of Pinkberry Co. net income. s. The fair value for Solstice Corp. stock was 39.02 per share on December 31, 2016. The investment is adjusted to fair value, using a valuation allowance account. Assume Valuation Allowance for Available-for-Sale Investments had a beginning balance of zero. Instructions Journalize the selected transactions. After all of the transactions for the year ended December 31, 2016, had been posted [including the transactions recorded in part (1) and all adjusting entries], the data that follows were taken from the records of Equinox Products Inc. a. Prepare a multiple-step income statement for the year ended December 31, 2016, concluding with earnings per share. In computing earnings per share, assume that the average number of common shares outstanding was 100,000 and preferred dividends were 100,000. (Round earnings per share to the nearest cent.) b. Prepare a retained earnings statement for the year ended December 31, 2016. c. Prepare a balance sheet in report form as of December 31, 2016. Income statement data: Advertising expense 150,000 Cost of merchandise sold 3,700,000 Delivery expense 30,000 Depreciation expense -office buildings and equipment 30,000 Depreciation expensestore buildings and equipment 100,000 Dividend revenue 4,500 Gain on sale of investment 4,980 Income from Pinkberry Co. investment 76,800 Income tax expense 140,500 Interest expense 21,000 Interest revenue 2,720 Miscellaneous administrative expense 7.500 Miscellaneous selling expense 14,000 Office rent expense 50,000 Office salaries expense 170,000 Office supplies expense 10,000 Sales 5,254,000 Sales commissions 185,000 Sales salaries expense 385,000 Store supplies expense 21,000 Retained earnings and balance sheet data: Accounts payable 194,300 Accounts receivable 545,000 Accumulated depreciationoffice buildings and equipment 1,580,000 Accumulated depreciationstore buildings and equipment 4,126,000 Allowance for doubtful accounts 8,450 Available for sale investments (at cost) 260,130 Bonds payable. 5%. due 2024 500,000 Cash 246,000 Common stock, 20 par (400,000 shares authorized; 100,000 shares issued. 94,600 outstanding) 2,000,000 Dividends: Cash dividends for common stock 155,120 Cash dividends for preferred stock 100,000 Goodwill 500,000 Income tax payable 44,000 Interest receivable 1,125 Investment in Pinkberry Co. stock (equity method) 1,009,300 Investment in Dream Inc. bonds (long term) 90,000 Merchandise inventory [December 31, 2016). at lower of cost (FIFO) or market 778,000 Office buildings and equipment 4.320,000 Paid-in capital from sale of treasury stock 13,000 Excess of issue price over parcommon stock 886,800 Excess of issue price over parpreferred stock 150,000 Preferred 5% stock. 80 par (30,000 shares authorized; 20,000 shares issued] 1,600,000 Premium on bonds payable 19,000 Prepaid expenses 27,400 Retained earnings, January 1, 2016 9,319,725 Store buildings and equipment 12,560,000 Treasury stock (5,400 shares of common stock at cost of 33 per share) 178,200 Unrealized gain (loss) on available for sale investments (6,500) Valuation allowance for available for sale investments (6,500)Selected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 2016, were as follows: a. Issued 15,000 shares of 20 par common stock at 30, receiving cash. b. Issued 4,000 shares of 80 par preferred 5% stock at 100, receiving cash. c. Issued 500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. d. Declared a quarterly dividend of 0.50 per share on common stock and 1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. e. Paid the cash dividends declared in (d). f. Purchased 7,500 shares of Solstice Corp. at 40 per share, plus a 150 brokerage commission. The investment is classified as an available-for-sale investment. g. Purchased 8,000 shares of treasury common stock at 33 per share. h. Purchased 40,000 shares of Pinkberry Co. stock directly from the founders for 24 per share. Pinkberry has 125,000 shares issued and outstanding. Equinox Products Inc. treated the investment as an equity method investment. i. Declared a 1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. j. Paid the cash dividends to the preferred stockholders. k. Received 27,500 dividend from Pinkberry Co. investment in (h). l. Purchased 90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, at their face amount plus accrued interest of 375. The bonds are classified as a heldtomaturity long-term investment. m. Sold, at 38 per share, 2,600 shares of treasury common stock purchased in (g). n. Received a dividend of 0.60 per share from the Solstice Corp. investment in (f). o. Sold 1,000 shares of Solstice Corp. at 45, including commission. p. Recorded the payment of semiannual interest on the bonds issued in (c) and the amortization of the premium for six months. The amortization is determined using the straight-line method. q. Accrued interest for three months on the Dream Inc. bonds purchased in (l). r. Pinkberry Co. recorded total earnings of 240,000. Equinox Products recorded equity earnings for its share of Pinkberry Co. net income. s. The fair value for Solstice Corp. stock was 39.02 per share on December 31, 2016. The investment is adjusted to fair value, using a valuation allowance account. Assume Valuation Allowance for Available-for-Sale Investments had a beginning balance of zero. Instructions 1. Journalize the selected transactions. 2. After all of the transactions for the year ended December 31, 2016, had been posted [including the transactions recorded in part (1) and all adjusting entries], the data that follows were taken from the records of Equinox Products Inc. a. Prepare a multiple-step income statement for the year ended December 31, 2016, concluding with earnings per share. In computing earnings per share, assume that the average number of common shares outstanding was 100,000 and preferred dividends were 100,000. (Round earnings per share to the nearest cent.) b. Prepare a retained earnings statement for the year ended December 31, 2016. c. Prepare a balance sheet in report form as of December 31, 2016.

- Statement of Retained Earnings Landon Corporation was organized on January 2, 2014, with the investment of $100,000 by each of its two stockholders. Net income for its first year of business was $85,200. Net income increased during 2015 to $125,320 and to $145,480 during 2016. Landon paid $20,000 in dividends to each of the two stockholders in each of the three years. Required Prepare a statement of retained earnings for the year ended December 31, 2016.Given the following year-end information for Somerset Corporation, compute its basic earnings per share. Net income, 13,000 Preferred dividends declared, 4,000 Weighted average common shares for the year, 4,500Chen Corporation began 2012 with the following stockholders equity balances: The following selected transactions and events occurred during the year: a. Issued 10,000 shares of common stock for 60,000. b. Purchased 1,200 shares of treasury stock for 4,800. c. Sold 2,000 shares of treasury stock for 11,000. d. Generated net income of 94,000. e. Declared and paid the full years dividend on preferred stock and a dividend of 1.00 per share on common stock outstanding at the end of the year. Chen Corporation maintains several paid-in capital accounts (Paid-in Capital in Excess of Par, Paid-in Capital from Treasury Stock, etc.) in its ledger, but combines them all as Additional paid-in capital when preparing financial statements. Open the file STOCKEQ from the website for this book at cengagebrain.com. Enter the formulas in the appropriate cells on the worksheet. Then fill in the columns to show the effect of each of the selected transactions and events listed earlier. Enter your name in cell A1. Save the completed worksheet as STOCKEQ2. Print the worksheet. Also print your formulas. Check figure: Total stockholders equity balance at 12/31/12 (cell G21). 398,800.