East Point Retail, Inc., sells professional women's apparel through company-owned retail stores. Recent financial information for East Point is provided below (all numbers in thousands). Fiscal Year 3 Fiscal Year 2 Net income $134,300 $69,200 Interest expense 2,700 10,300 Fiscal Year 3 Fiscal Year 2 Fiscal Year 1 Total assets (at end of fiscal year) $3,600,642 $3,425,000 $2,935,000 Total stockholders' equity (at end of fiscal year) 1,085,144 1,063,656 781,678 Assume the apparel industry average return on total assets is 8.0%, and the average return on stockholders' equity is 15.0% for the year ended April 2, Year 3. a. Determine the return on total assets for East Point for fiscal Years 2 and 3. Round to one decimal place. Fiscal Year 3 % Fiscal Year 2 % b. Determine the return on stockholders' equity for East Point for fiscal Years 2 and 3. Round to one decimal place. Fiscal Year 3 Fiscal Year 2 % c. The return on stockholders' equity is * the return on total assets due to the use of leverage.

East Point Retail, Inc., sells professional women's apparel through company-owned retail stores. Recent financial information for East Point is provided below (all numbers in thousands). Fiscal Year 3 Fiscal Year 2 Net income $134,300 $69,200 Interest expense 2,700 10,300 Fiscal Year 3 Fiscal Year 2 Fiscal Year 1 Total assets (at end of fiscal year) $3,600,642 $3,425,000 $2,935,000 Total stockholders' equity (at end of fiscal year) 1,085,144 1,063,656 781,678 Assume the apparel industry average return on total assets is 8.0%, and the average return on stockholders' equity is 15.0% for the year ended April 2, Year 3. a. Determine the return on total assets for East Point for fiscal Years 2 and 3. Round to one decimal place. Fiscal Year 3 % Fiscal Year 2 % b. Determine the return on stockholders' equity for East Point for fiscal Years 2 and 3. Round to one decimal place. Fiscal Year 3 Fiscal Year 2 % c. The return on stockholders' equity is * the return on total assets due to the use of leverage.

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter4: Profitability Analysis

Section: Chapter Questions

Problem 25PC: Fitch sells casual apparel and personal care products for men, women, and children through retail...

Related questions

Question

Practice Pack

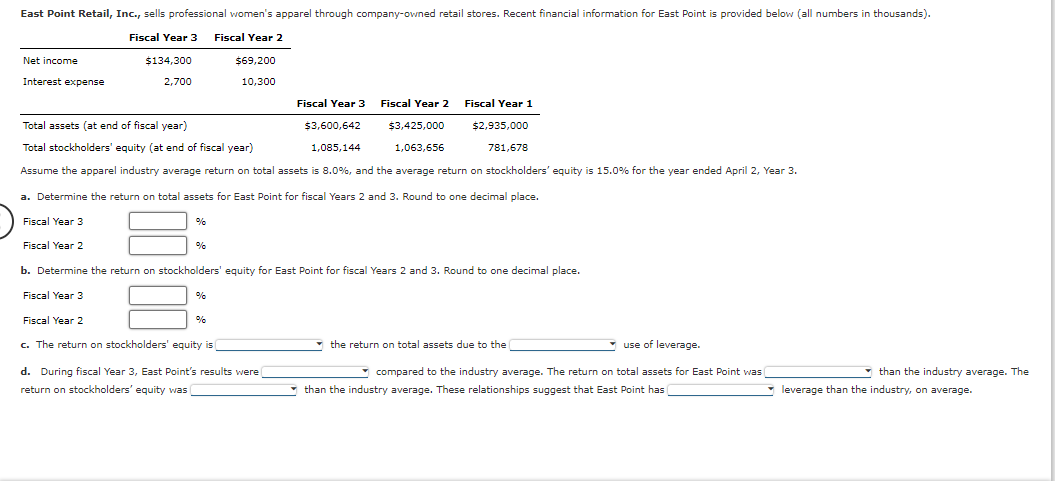

Transcribed Image Text:East Point Retail, Inc., sells professional women's apparel through company-owned retail stores. Recent financial information for East Point is provided below (all numbers in thousands).

Fiscal Year 3

Fiscal Year 2

Net income

$134,300

$69,200

Interest expense

2,700

10,300

Fiscal Year 3

Fiscal Year 2

Fiscal Year 1

Total assets (at end of fiscal year)

$3,600,642

$3,425,000

$2,935,000

Total stockholders' equity (at end of fiscal year)

1,085,144

1.063,656

781,678

Assume the apparel industry average return on total assets is 8.0%, and the average return on stockholders' equity is 15.0% for the year ended April 2, Year 3.

a. Determine the return on total assets for East Point for fiscal Years 2 and 3. Round to one decimal place.

Fiscal Year 3

Fiscal Year 2

b. Determine the return on stockholders' equity for East Point for fiscal Years 2 and 3. Round to one decimal place.

Fiscal Year 3

Fiscal Year 2

0%

c. The return on stockholders' equity is

* the return on total assets due to the

use of leverage.

d. During fiscal Year 3, East Point's results were

* compared to the industry average. The return on total assets for East Point was

than the industry average. The

return on stockholders' equity was

* than the industry average. These relationships suggest that East Point has

* leverage than the industry, on average.

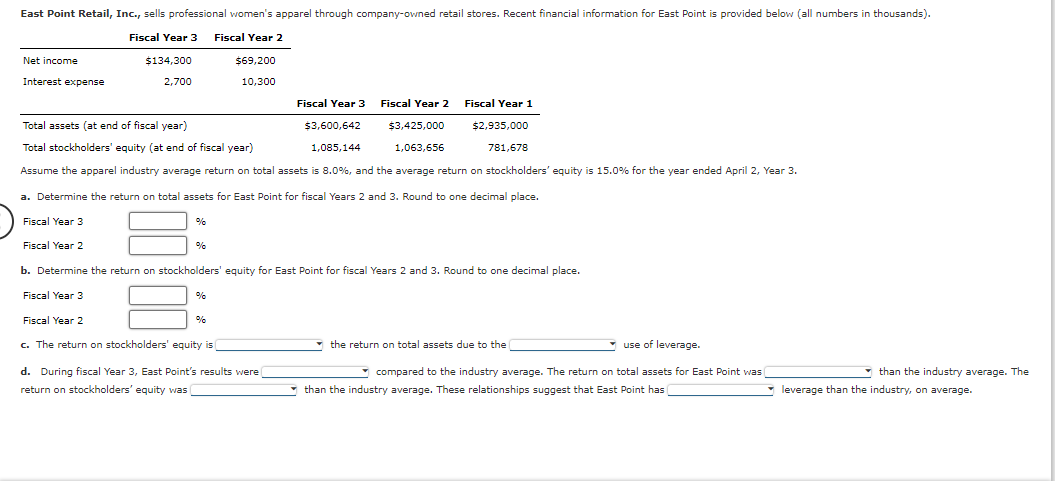

Transcribed Image Text:East Point Retail, Inc., sells professional women's apparel through company-owned retail stores. Recent financial information for East Point is provided below (all numbers in thousands).

Fiscal Year 3

Fiscal Year 2

Net income

$134,300

$69,200

Interest expense

2,700

10,300

Fiscal Year 3

Fiscal Year 2

Fiscal Year 1

Total assets (at end of fiscal year)

$3,600,642

$3,425,000

$2,935,000

Total stockholders' equity (at end of fiscal year)

1,085,144

1.063,656

781,678

Assume the apparel industry average return on total assets is 8.0%, and the average return on stockholders' equity is 15.0% for the year ended April 2, Year 3.

a. Determine the return on total assets for East Point for fiscal Years 2 and 3. Round to one decimal place.

Fiscal Year 3

Fiscal Year 2

b. Determine the return on stockholders' equity for East Point for fiscal Years 2 and 3. Round to one decimal place.

Fiscal Year 3

Fiscal Year 2

0%

c. The return on stockholders' equity is

* the return on total assets due to the

use of leverage.

d. During fiscal Year 3, East Point's results were

* compared to the industry average. The return on total assets for East Point was

than the industry average. The

return on stockholders' equity was

* than the industry average. These relationships suggest that East Point has

* leverage than the industry, on average.

Expert Solution

Step 1

Solution:-

a) Calculation of Return on total assets as follows:-

Return on Total Assets

= Operating Profit (EBIT) /Average Total Assets

Better your learning with

Practice Pack

Better your learning with

Practice Pack

Learn your way

Includes step-by-step video

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning