еBook Calculator Inferring Accounts Receivable Amounts At the end of 2019, Karras Inc. had a debit balance of $141,120 in its accounts receivable. Additionally, Karras had a credit balance in its allowance for doubtful accounts of $4,350 and $9,420 at the beginning and end of the year, respectively. During the year, Karras made credit sales of $1,530,000, collected receivables in the amount of $1,445,700, and recorded bad debt expense of $83,750. Compute the amount of accounts receivable that Karras wrote off during the year and the amount of accounts receivable at the beginning of the year. Accounts Receivable written off $4 Accounts Receivable at 1/1/2019 ( Previous Next> Check My Work All work saved. Email Instructor Save and Exit Submit Assignment for Grading MacBook Pro CSearch or type URL %2# %$4 & 3 4 6 delete E T Y U J C V N command option Yevenut. opreahny Σ * 00

еBook Calculator Inferring Accounts Receivable Amounts At the end of 2019, Karras Inc. had a debit balance of $141,120 in its accounts receivable. Additionally, Karras had a credit balance in its allowance for doubtful accounts of $4,350 and $9,420 at the beginning and end of the year, respectively. During the year, Karras made credit sales of $1,530,000, collected receivables in the amount of $1,445,700, and recorded bad debt expense of $83,750. Compute the amount of accounts receivable that Karras wrote off during the year and the amount of accounts receivable at the beginning of the year. Accounts Receivable written off $4 Accounts Receivable at 1/1/2019 ( Previous Next> Check My Work All work saved. Email Instructor Save and Exit Submit Assignment for Grading MacBook Pro CSearch or type URL %2# %$4 & 3 4 6 delete E T Y U J C V N command option Yevenut. opreahny Σ * 00

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 12E: Inferring Accounts Receivable Amounts At the end of 2019, Karras Inc. had a debit balance of 141,120...

Related questions

Question

Transcribed Image Text:еBook

Calculator

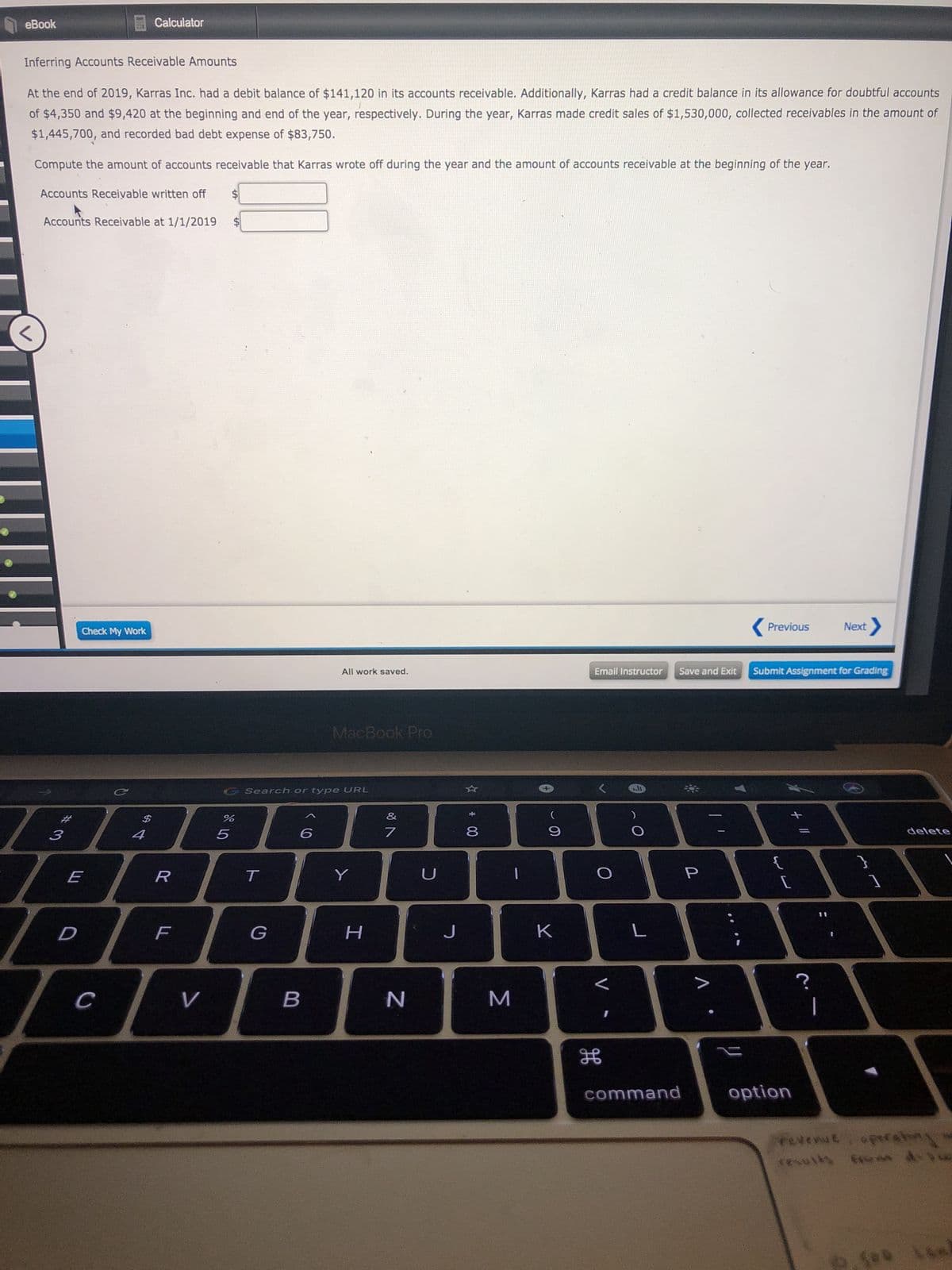

Inferring Accounts Receivable Amounts

At the end of 2019, Karras Inc. had a debit balance of $141,120 in its accounts receivable. Additionally, Karras had a credit balance in its allowance for doubtful accounts

of $4,350 and $9,420 at the beginning and end of the year, respectively. During the year, Karras made credit sales of $1,530,000, collected receivables in the amount of

$1,445,700, and recorded bad debt expense of $83,750.

Compute the amount of accounts receivable that Karras wrote off during the year and the amount of accounts receivable at the beginning of the year.

Accounts Receivable written off

$4

Accounts Receivable at 1/1/2019

( Previous

Next>

Check My Work

All work saved.

Email Instructor

Save and Exit

Submit Assignment for Grading

MacBook Pro

CSearch or type URL

%2#

%$4

&

3

4

6

delete

E

T

Y

U

J

C

V

N

command

option

Yevenut. opreahny

Σ

* 00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning