Edmund O'Mally Associates reported short-term notes payable and Salales payable as E (Click the icon to view the short-term notes payable and salaries payable.) During 2018, O'Mally paid off both current liabilities that were left over from 2017, borrowed cash on short-term notes payable, and accrued salaries expense. Journalize all four of these transactions for O'Mally during 2018. Assume no interest on short-term notes payable of $15,500. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Data table Journalize the borrowing of the short-term notes payable in 2018. Debit Credit Date Accounts and Explanation 2018 2018 2017 Current Liabilities-partial: 2$ 17,300 $ 15,500 Short-term Notes Payable 3,900 3,700 Salaries Payable Journalize the accrual of the salaries expense for 2018. Debit Credit Print Done Date Accounts and Explanation 2018

Edmund O'Mally Associates reported short-term notes payable and Salales payable as E (Click the icon to view the short-term notes payable and salaries payable.) During 2018, O'Mally paid off both current liabilities that were left over from 2017, borrowed cash on short-term notes payable, and accrued salaries expense. Journalize all four of these transactions for O'Mally during 2018. Assume no interest on short-term notes payable of $15,500. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Data table Journalize the borrowing of the short-term notes payable in 2018. Debit Credit Date Accounts and Explanation 2018 2018 2017 Current Liabilities-partial: 2$ 17,300 $ 15,500 Short-term Notes Payable 3,900 3,700 Salaries Payable Journalize the accrual of the salaries expense for 2018. Debit Credit Print Done Date Accounts and Explanation 2018

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter9: Current Liabilities, Contingencies, And The Time Value Of Money

Section: Chapter Questions

Problem 9.2E

Related questions

Question

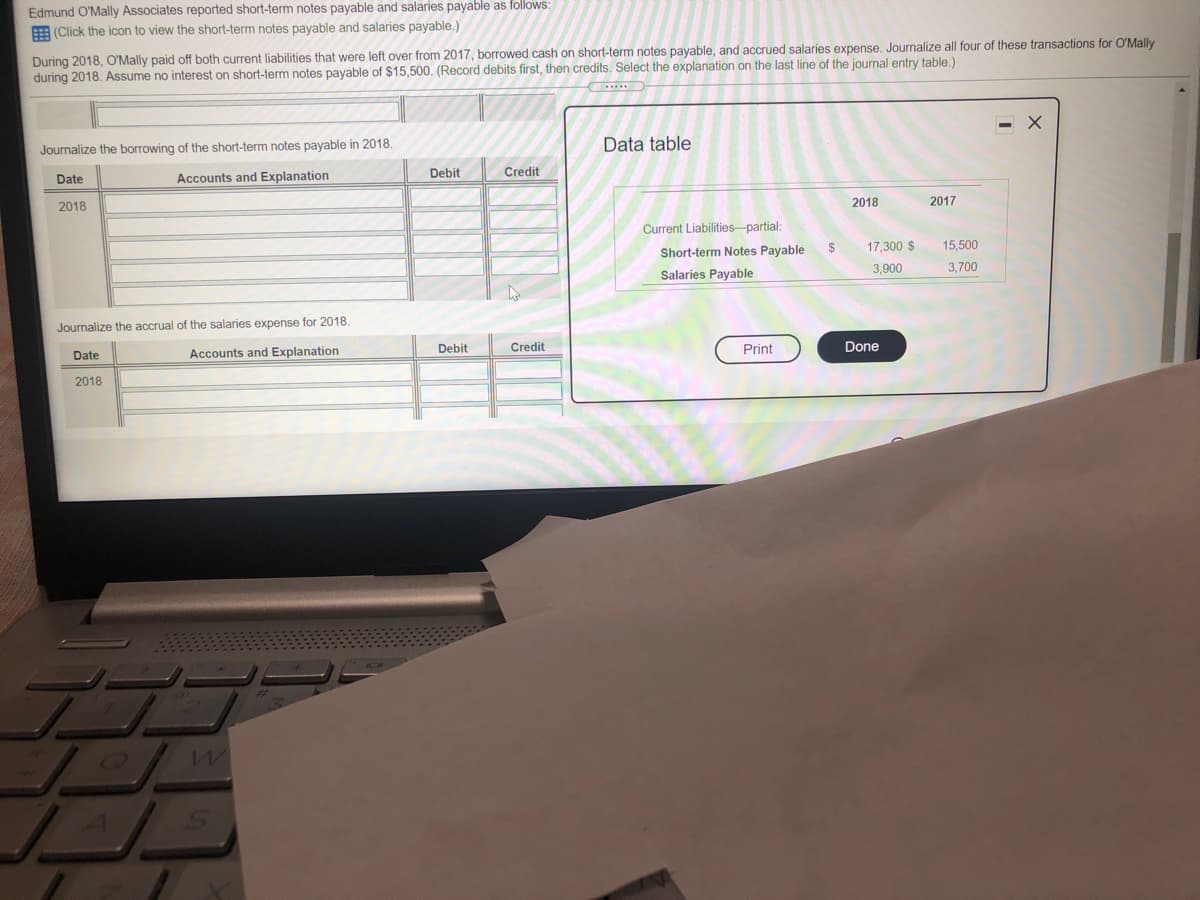

Transcribed Image Text:Edmund O'Mally Associates reported short-term notes payable and salaries payable as follows:

E (Click the icon to view the short-term notes payable and salaries payable.)

During 2018, O'Mally paid off both current liabilities that were left over from 2017, borrowed cash on short-term notes payable, and accrued salaries expense. Journalize all four of these transactions for O'Mally

during 2018. Assume no interest on short-term notes payable of $15,500. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.)

- X

Journalize the borrowing of the short-term notes payable in 2018.

Data table

Debit

Credit

Date

Accounts and Explanation

2018

2018

2017

Current Liabilities-partial:

2$

17,300 $

15,500

Short-term Notes Payable

3,900

3,700

Salaries Payable

Journalize the accrual of the salaries expense for 2018.

Accounts and Explanation

Debit

Credit

Print

Done

Date

2018

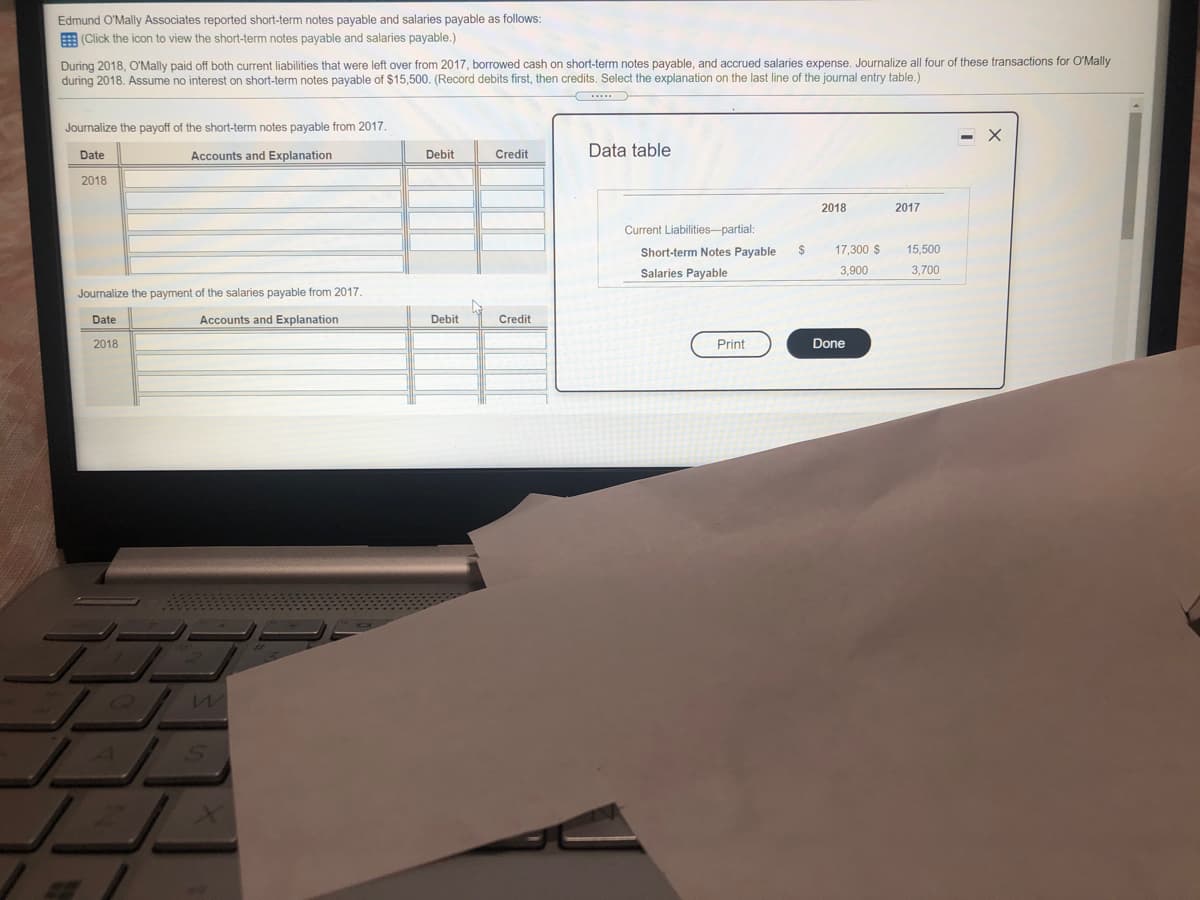

Transcribed Image Text:Edmund O'Mally Associates reported short-term notes payable and salaries payable as follows:

E (Click the icon to view the short-term notes payable and salaries payable.)

During 2018, O'Mally paid off both current liabilities that were left over from 2017, borrowed cash on short-term notes payable, and accrued salaries expense. Journalize all four of these transactions for O'Mally

during 2018. Assume no interest on short-term notes payable of $15,500. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.)

Journalize the payoff of the short-term notes payable from 2017.

Data table

Date

Accounts and Explanation

Debit

Credit

2018

2018

2017

Current Liabilities-partial:

Short-term Notes Payable

$

17,300 $

15,500

Salaries Payable

3,900

3,700

Journalize the payment of the salaries payable from 2017.

Date

Accounts and Explanation

Debit

Credit

2018

Print

Done

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning