edonated services be recorded?

Chapter3: Income Sources

Section: Chapter Questions

Problem 77P: During the last five months of the year, Dwana opens a new Internet telecommunications business...

Related questions

Question

Topic: Accounting For Non-Profit Organization

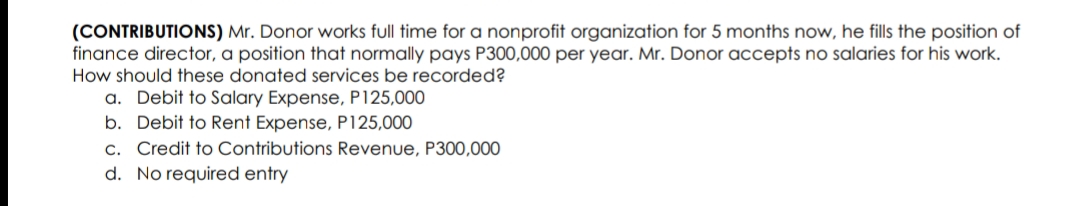

Transcribed Image Text:(CONTRIBUTIONS) Mr. Donor works full time for a nonprofit organization for 5 months now, he fills the position of

finance director, a position that normally pays P300,000 per year. Mr. Donor accepts no salaries for his work.

How should these donated services be recorded?

a. Debit to Salary Expense, P125,000

b. Debit to Rent Expense, P125,000

c. Credit to Contributions Revenue, P300,000

d. No required entry

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you