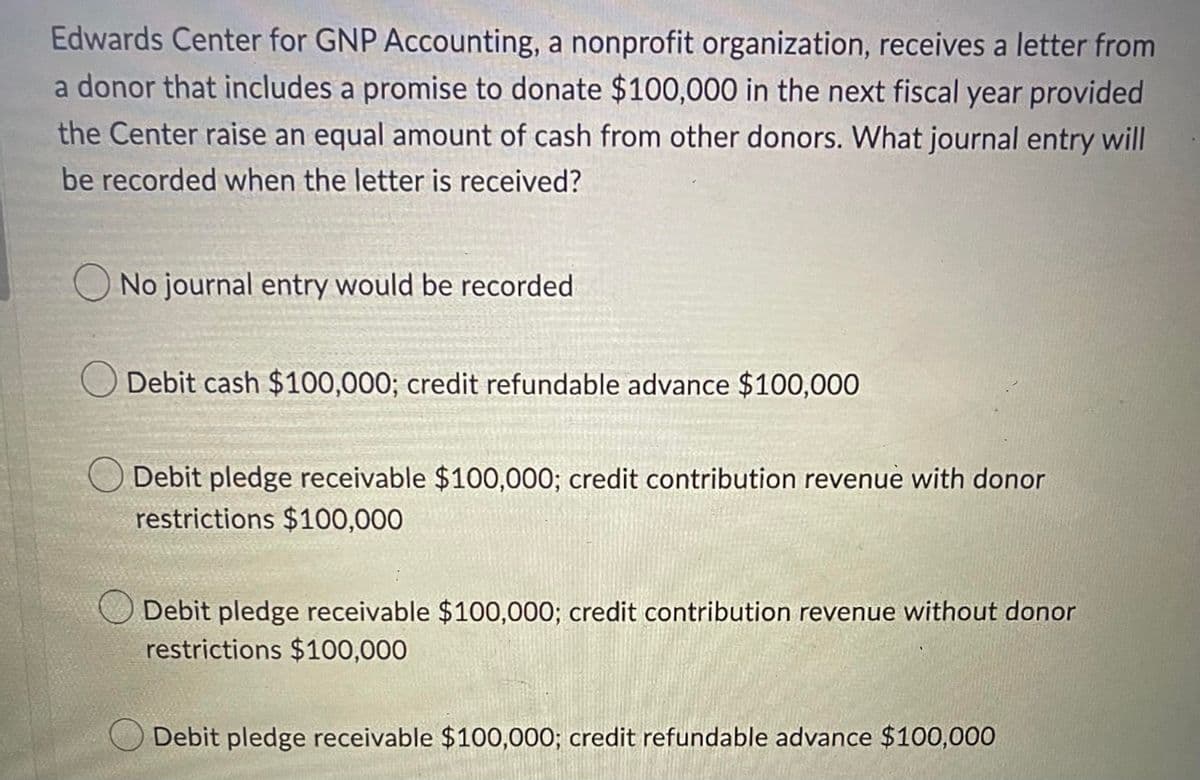

Edwards Center for GNP Accounting, a nonprofit organization, receives a letter from a donor that includes a promise to donate $100,000 in the next fiscal year provided the Center raise an equal amount of cash from other donors. What journal entry will be recorded when the letter is received? No journal entry would be recorded O Debit cash $100,000; credit refundable advance $100,000

Q: a. Determine the amount of deffered tax liability at December 31, 2020b. Compute the total amont of…

A: Lets understand the basics. Deferred tax arise due to taxable temporary difference arise due to book…

Q: Mr. Tristan Siy III established Siy Bookkeeping Services and had the following transactions for the…

A: Cash flow statement: It is a statement, which shows the flows of cash and cash equivalents for a…

Q: 9.On January 1, 2021, White Company acquired 25,000 shares of Black Company for P900,000. Black has…

A:

Q: Using accrual accounting, when is revenue recognized? A. When cash transfers B. When the…

A: There are two type of accounting merhods used in business. One is cash basis of accounting and other…

Q: Western Corporation, a calendar year, accrual basis corporation, reported $500,000 of net income…

A: Income Tax The most accurate definition of income tax is the amount of tax that the government…

Q: Charlie and his wife lived in the house for the last 15 years. In 2013 due to some unknown reasons,…

A: Here discuss about the details of the case which are incurred with the US Code § 121 for the sale of…

Q: Inventory Costing Method.

A: Methods of issuing the Material from store: THE Material purchased at first entered into the store…

Q: Private academic institutions and other special domestic businesses are exempt from the MCIT as long…

A: Coverage of MCIT MCIT covers corporations subject to normal rate of taxation. These corporations…

Q: with examples. Balance Sheet of Sinaco Limited is given as follows: June 30 Head of Account Year…

A: Decrease in fixed asset is because of depreciation. Net income is 25000 so increase in retained…

Q: Champion Company purchased and installed carpet in its new general offices on March 31 for a total…

A: Depreciation- In accounting depreciation refers to allocating the cost of assets over their useful…

Q: verlast Manufacturing Company uses a predetermined manufacturing overhead rate based on a percentage…

A: Job costing is one of the methods under cost accounting that helps to determine the cost of each…

Q: Equipment was acquired at the beginning of the year at a cost of $76,380. The equipment was…

A: Equipment is the non-current asset which is used by the entity for day to day operations so as to…

Q: ABC Corp receives a 4 year P400,000 non interest bearing note that requires 4 equal annual…

A: Non Interest bearing note is a type of note which has no stated interest.

Q: Parent Company issued 10-year, 15% bonds with a par value of $500,000 on January 1, 2020 for…

A: In the case of consolidation, all the intercompany transactions related to affiliate companies must…

Q: 32.ABC Store purchased P100,000 from XYZ Supplies on July 1, 20X1. Terms: 5%, 3%, 2/15, n/30. FOB…

A: Every business needs inventory for the purpose of use them in manufacturing purpose. Inventory may…

Q: Dynamo Manufacturing paid cash to acquire the assets of an existing company. Among the assets…

A: Introduction: Amortization expense is the write-off of an asset over its anticipated useful life,…

Q: The following transactions for the month of March have been journalized and posted to the proper O…

A: Accounting equation is one of the important concept in accounting. It has three important elements,…

Q: On July 1, 2018, Alaska Corp. issued 6,000 shares of its P 100 par ordinary share to Atty. Black as…

A: Introduction: A share is a type of corporate ownership unit. A share entitles this same holder to a…

Q: Question. Tamarisk, Inc.'s December 31, 2020 balance sheet showed the following: 6% preferred stock,…

A: One of the source used by the business organizations in order to raise the funds is issue of common…

Q: bided to liquidato On January 1, 20x1, the partners of ABC Co. decided to liquidate their…

A: Net Proceeds from sale Non cash assets= P 260,000 Cash= P 80,000 Total= P 260,000 + P 80,000 = P…

Q: Miller Company's most recent income statement follows: Total Sales (20,000 units) Less: Variable…

A: Income Statement - it is the statement which represent the information about the financial result of…

Q: Prepare the net sales portion only of this company's multiple-step income statement.

A: Sales revenue: sales revenue is the revenue earned by the company through sales Gross sales: Gross…

Q: The following information is available from the current period financial statements: Net income…

A: Introduction: Operating activities are a company's daily activities that involve making and selling…

Q: 4. PT Telcgreen as of December 31, 2018 has a cash balance in the Current Account of Rp.…

A: Cash and cash equivalents Cash and cash equivalents mean cash in hand or any highly liquid assets on…

Q: Sta Elena Construction & Development Corporation purchased a construction crane on January 1, 2019…

A: Introduction: If carrying value of an asset is more than the recoverable amount then the asset is…

Q: The Just in Time operating system with backflush pricing is used by Johnson Textiles Company. The…

A: Cost of goods sold: It is the cost incurred by a business that is directly related to the production…

Q: A company has 1,000 shares of $50 par value, 4.5% cumulative and nonparticipating preferred stock…

A: Paid in capital stock which was in common consist of preferred and common stock in total and it was…

Q: Required information [The following information applies to the questions displayed below.] Riverbend…

A: The company may purchase shares of another company. The company purchasing shares in another is…

Q: What assumption states that a business is able to financially continue operations and is not…

A: Accounting Principles- Accounting principles are the set of rules or principles defined for the…

Q: Prepare a multiple-step income statement. (Li either a negative sign preceding the number e.g.-

A: An income statement is a financial statement prepared at the end of the accounting year, to know the…

Q: Jackie Chan Leasing signs an equipment lease contract with Chris Tucker on January 1, 2020. The…

A: Answer - Working Note: Annual Lease Payment: Particulars Amount Fair value of asset…

Q: 1. The Judi Company purchased another entity for P8,000,000 cash. A schedule of the fair value of…

A: Goodwill refers to the value of the intangible assets which is linked or associated with the…

Q: An example of a qualified benefit is an employer-subsidized cafeteria.

A: Cafeteria Plan: It is the plan / system which provide benefit to the employees in the tax rate. It…

Q: Provide 3 unique problems with own solution on performance ratio below. Also provide textual…

A: Earnings per share indicate the earnings attributable per share. It indicates how much income is…

Q: 134

A: Petty cash refers to the small value of the cash in hand, paid or payable for minor expenses like…

Q: At a level of physical activity of 15,000 units, the total cost would be as follows using the cost…

A: The total costs are calculated as sum of fixed and variable costs of the production. Private higher…

Q: Mullis Corporation manufactures DVDs that sell for $5.20. Fixed costs are $35,000 and variable costs…

A: Breakeven point in Units = Fixed cost / Contribution margin per unit

Q: d. f. Pre-tax financial profit is P10,000,000 and income tax rate is 30% for the current and future…

A: "Since you have posted a question with multiple subparts, we will solve the first three subparts for…

Q: From the following details prepare statement of proprieta funds with as many details as possible.

A: Proprietary funds are the funds which are related to the owners of the business which is actually…

Q: A carpenter produced 200 sofas which he sold at k5000/ sofa, he incurred k5000 on raw materials, he…

A: Accounting Profit = Total Revenue – Explicit Costs Explicit cost are the actual cost of the…

Q: You were able to extract the following information from the records of Grey Corporation in…

A: Taxable temporary difference means those amount on which the tax will be charged on some later date.…

Q: PROBLEM 3 On June 30, 2018, Upton Inc. sold $3,000,000 (face value) of bonds. The bonds are dated…

A: >Bonds Payable are the source of finance for the companies. >The bondholders are…

Q: At the end of its last fiscal year, December 31, 2021, Sink Corporation had issued 360,000 shares of…

A: According to the question, we are required to prepare the journal entries. The journal entries: The…

Q: at least annually? Select the correct response: Land A trademark with an expected indefinite life A…

A: As per IAS 36 Impairment of asset - every assets needs to be carried at a value which is not more…

Q: Required information [The following information applies to the questions displayed below.] JDog…

A: Book-tax difference=JDog's share in Oscar's income-Dividend already reported in gross income

Q: The following information applies to the questions displayed below.]

A:

Q: Case 1: Fraud examination Karen, a friend of yours, recently started her own business, The Bike and…

A: Introduction: In today's culture, fraud is an enormously costly problem. Fraud examinations are…

Q: The following information is available from the current period financial statements: Net income…

A: Introduction: To determine the amount of cash generated by operating activities, the indirect method…

Q: 2.Gains and losses resulting from intercompany transactions between an investor and an associate are…

A: As per IAS 28 Gains and losses resulting from intercompany transactions between an investor and an…

Q: At the end of 2020, ABC Company had the following balances: $300,000 was paid for the sold…

A: Net income = Revenue - Expenses

Step by step

Solved in 2 steps

- In July 2022, a donor promises to donate $100,000 in cash to an NFP organization if the local NFP can raise the same amount ($100,000) from other donors by December 2022. How much revenue (if any) should the NFP recognize in July 2022? (do not use $ signs, commas or decimals in your answer) In July 2022, a donor promises to donate $100,000 in cash to an NFP organization on December 1, 2022. How much revenue (if any) should the NFP recognize in July 2022? (do not use $ signs, commas or decimals in your answer)A voluntary health and welfare entity receives $32,000 in cash from solicitations made in the local community. The charity receives an additional $1,500 from members in payment of annual dues. Members are assumed to receive benefits approximately equal in value to the amount of dues paid. How should this money be recorded? Choose the correct.a. Revenues of $33,500.b. Public support of $33,500.c. Public support of $32,000 and a $1,500 increase in the fund balance.d. Public support of $32,000 and revenue of $1,500.Seniors Moving, a non-profit, had the following: contributions of $200,000; stamps and paper to send to donors to request more money, $20,000; salaries for case works that help senior citizens (for Seniors Moving's mission), $150,000; various gifts to donors, $30,000. What amount would be program expenses? Would Senior Movers have to show information in a separate statement of functional expenses (yes), or could show program/support in another report (No)? 1. 200,000, Yes 2. 150,000, No 3. 200,000, No 4. 150,000, Yes

- Create a transaction report for the following February transactions for the Access to Learning nonprofif organization: - On Feb 1, the nonprofit paid $20,000 in salaries. - On Feb 2, the nonprofit used $5,000 in cash to pay down its accounts payable by that amount. - On Feb5, the nonprofit received $5,000 in cash from a foundation, and that donation had previously been recorded in accounts receivable. - On Feb 10, the executive director talked to a foundation program officer who said that the foundation would be giving a $25000 grant to the nonprofit within the next 2 months. - On Feb 15, the nonprofit incurred another $1,000 in salaries payable. - On Feb 20, the nonprofit received $5,000 in cash from pledges. - On Feb 22, the nonprofit received a second payment of $10,000 from the $50,000 foundation grant. - On Feb 23, the nonprofit conducted the workshops that were paid for in Jan ($10,000), and payment had been recorded as deferred revenue. - On Feb 24, the nonprofit made a mortgage…The Senior League, a not-for-profit welfare agency, redeemed a $100,000 bond that it had held as an investment of resources without donor restrictions. It also received an interest payment of $6,000. In its statement of cash flows, the league should report: A.) $106,000 as a cash flow from investing activities B.) $106,000 as a cash flow from operating activities C.) $100,000 as a cash flow from investing activities and $6,000 as a cash flow from financing activities D.) $100,000 as a cash flow from investing activities and $6,000 as a cash flow from operating activitiesWhich of the following journal entry is appropriate to recognize that a not-for-profit organization collected P200,000 of amounts pledged and wrote off P10,000 of amounts pledged as amounts uncollectible? a.Debit Pledges Receivable P200,000; Credit Cash P200,000. b.Debit Cash P200,000; Debit Allowance for uncollectible pledges P10,000; Credit Pledges Receivable P210,000. c.Debit Pledges Receivable P200,000; Credit Allowance for uncollectible pledges P10,000, Credit Cash P210,000. d.Debit Cash P200,000; Credit Pledges Receivable P200,000. e.Debit Cash P200,000; Debit Allowance for uncollectible pledges P10,000; Credit Unrestricted net assets-contributions P210,000.

- Prepare journal entries to record the transactions.1. Donor A gave a nonprofit a $55,000 cash gift in June, stipulating that the nonprofit could not use the gift until the next fiscal year.2. Donor B gave a nonprofit a $27,500 cash gift in July, telling the nonprofit the gift could be used only for research on a specific project.3. In response to a special fundraising campaign, whereby contributions could be used only for construction of a new warehouse, a large number of individualspromised to make cash contributions totaling $2,200,000 during the current fiscal year. The nonprofit believes it will actually collect 80 percent of the promised cash.4. Donor C gave a nonprofit several investments having a fair value of $3,300,000 in March. Donor C stipulated that the nonprofit must hold the gift in perpetuity,but it could use the income from the gift for any purpose the trustees considered appropriate. Between March and December, the investments produced income of $110,0005. Using the…In need help with preparing the following for journal entries, balance and statement sheets. I would like to know how close I'm to the right answers A donor made a $1,000,000 pledge, giving the foundation a legally enforceable 90-day note for the full amount. The same donor paid $500,000 of the amount pledged. The foundation purchased a building for $900,000, paying $90,000 in cash and giving a ten-year mortgage for the balance. The building has a 25-year useful life. The foundation charges a half-year’s depreciation for all assets in the year they are acquired. The foundation hired five employees. By year-end, these employees have earned $10,000 in salaries and wages for which they have not been paid. The foundation accounts for its activities in a single fund. Prepare journal entries to record the transactions, making the following alternative assumptions as to the fund’s measurement focus: Cash only Cash plus other current financial resources (cash plus short-term receivables…Carleton Agency, a VHWO, conducts two programs: Medical Services and Community Information Services. It had the following transactions during the year ended June 30, 2019.1. Received the following contributions:Unrestricted pledges . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $800,000Restricted cash. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 95,000Building fund pledges . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 50,000Endowment fund cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,0002. Collected the following pledges:Unrestricted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $450,000Building fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .…

- shak City creates a new internal service fund. To get the internal service fund started, the City's general fund loans $100,000 to the newly created internal service fund. What journal entry will be recorded in the general fund as a result of the transaction? None of these Debit cash $100,000; credit due to internal service fund $100,000 Debit due from internal service fund $100,000; credit cash $100,000 Debit transfers in/out $100,000; credit cash $100,000 Debit cash $100,000; credit transfers in/out $100,000A business donated rent-free office space to the organization that would normally rent for $35,200 a year. A fund drive raised $186,000 in cash and $102,000 in pledges that will be paid within one year. A state government grant of $152,000 was received for program operating costs related to public health education. Salaries and fringe benefits paid during the year amounted to $208,760. At year-end, an additional $16,200 of salaries and fringe benefits were accrued. A donor pledged $102,000 for construction of a new building, payable over five fiscal years, commencing in 2022. The discounted value of the pledge is expected to be $94,460. Office equipment was purchased for $12,200. The useful life of the equipment is estimated to be five years. Office furniture with a fair value of $9,800 was donated by a local office supply company. The furniture has an estimated useful life of 10 years. Furniture and equipment are considered net assets without donor restrictions by INVOLVE. Telephone…A business donated rent-free office space to the organization that would normally rent for $35,200 a year. A fund drive raised $186,000 in cash and $102,000 in pledges that will be paid within one year. A state government grant of $152,000 was received for program operating costs related to public health education. Salaries and fringe benefits paid during the year amounted to $208,760. At year-end, an additional $16,200 of salaries and fringe benefits were accrued. A donor pledged $102,000 for construction of a new building, payable over five fiscal years, commencing in 2022. The discounted value of the pledge is expected to be $94,460. Office equipment was purchased for $12,200. The useful life of the equipment is estimated to be five years. Office furniture with a fair value of $9,800 was donated by a local office supply company. The furniture has an estimated useful life of 10 years. Furniture and equipment are considered net assets without donor restrictions by INVOLVE. Telephone…