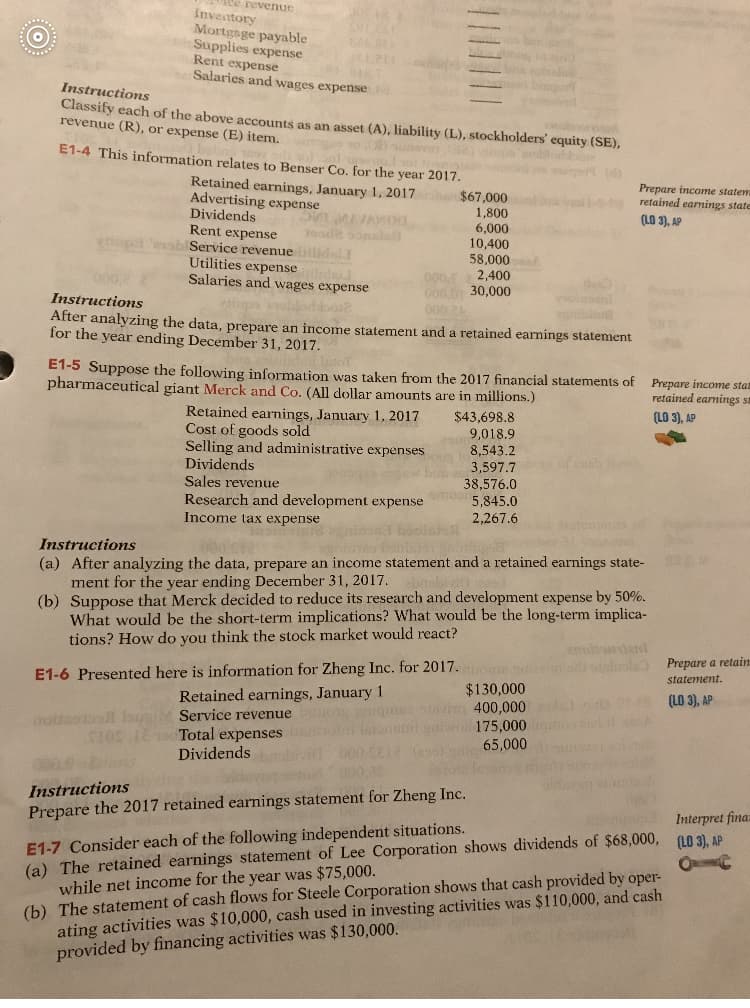

ee revenue In Mortgage payable Supplies expense Rent expense Salaries and wages expense Instructions Classify each of the above accounts as an asset (A), liability (L), stockholders' equity revenue (R), or expense (E) item. E1-4 This information relates to Benser Co. for the year 2017 SE) Retained earnings, January 1, 2017$67,000 Advertising expense Dividends Rent expense Service revenue Utilities expense Salaries and wages expense Prepare income statem retained earnings state LO 3), AP 1,800 6,000 10,400 58,000 2,400 30,000 Instructions After analyzing the data, prepare an income statement and a retained earnings statement for the year ending December 31, 2017 information was taken from the 2017 financial statements of Prepare income stat pharmaceutical giant Merck and Co. (All dollar amounts are in millions.) retained earnings st LO 3),AP Retained earnings, January 1, 2017 Cost of goods sold Selling and administrative expenses Dividends Sales revenue Research and development expense Income tax expense $43,698.8 9,018.9 8,543.2 3,597.7 38,576.0 5,845.0 2,267.6 Instructions (a) After analyzing the data, prepare an income statement and a retained earnings state- ment for the year ending December 31, 2017 Suppose that Merck decided to reduce its research and development expense by 50%. What would be the short-term implications? What would be the long-term implica- tions? How do you think the stock market would react? (b) a retain E1-6 Presented here is information for Zheng Inc. for 2017. Retained earnings, January 1 Service revenue Total expenses Dividends $130,000 400,000 175,000 65,000 (LO 3), AP Instructions Prepare the 2017 retained earnings statement for Zheng Inc. E1-7 Consider each of the following independent situations. (a) The retained earnings statement of Lee Corporation shows dividends of $68,000, Interpret fina (L0 3),AP while net income for the year was $75,000. ating activities was $10,000, cash used in investing activities was $110,000, and cash provided by financing activities was $130,000. (b) The statement of cash flows for Steele Corporation shows that cash provided by oper-

ee revenue In Mortgage payable Supplies expense Rent expense Salaries and wages expense Instructions Classify each of the above accounts as an asset (A), liability (L), stockholders' equity revenue (R), or expense (E) item. E1-4 This information relates to Benser Co. for the year 2017 SE) Retained earnings, January 1, 2017$67,000 Advertising expense Dividends Rent expense Service revenue Utilities expense Salaries and wages expense Prepare income statem retained earnings state LO 3), AP 1,800 6,000 10,400 58,000 2,400 30,000 Instructions After analyzing the data, prepare an income statement and a retained earnings statement for the year ending December 31, 2017 information was taken from the 2017 financial statements of Prepare income stat pharmaceutical giant Merck and Co. (All dollar amounts are in millions.) retained earnings st LO 3),AP Retained earnings, January 1, 2017 Cost of goods sold Selling and administrative expenses Dividends Sales revenue Research and development expense Income tax expense $43,698.8 9,018.9 8,543.2 3,597.7 38,576.0 5,845.0 2,267.6 Instructions (a) After analyzing the data, prepare an income statement and a retained earnings state- ment for the year ending December 31, 2017 Suppose that Merck decided to reduce its research and development expense by 50%. What would be the short-term implications? What would be the long-term implica- tions? How do you think the stock market would react? (b) a retain E1-6 Presented here is information for Zheng Inc. for 2017. Retained earnings, January 1 Service revenue Total expenses Dividends $130,000 400,000 175,000 65,000 (LO 3), AP Instructions Prepare the 2017 retained earnings statement for Zheng Inc. E1-7 Consider each of the following independent situations. (a) The retained earnings statement of Lee Corporation shows dividends of $68,000, Interpret fina (L0 3),AP while net income for the year was $75,000. ating activities was $10,000, cash used in investing activities was $110,000, and cash provided by financing activities was $130,000. (b) The statement of cash flows for Steele Corporation shows that cash provided by oper-

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

I don’t understand E1-6 please help.

Transcribed Image Text:ee

revenue

In

Mortgage payable

Supplies expense

Rent expense

Salaries and wages expense

Instructions

Classify each of the above accounts as an asset (A), liability (L), stockholders' equity

revenue (R), or expense (E) item.

E1-4 This information relates to Benser Co. for the year 2017

SE)

Retained earnings, January 1, 2017$67,000

Advertising expense

Dividends

Rent expense

Service revenue

Utilities expense

Salaries and wages expense

Prepare income statem

retained earnings state

LO 3), AP

1,800

6,000

10,400

58,000

2,400

30,000

Instructions

After analyzing the data, prepare an income statement and a retained earnings statement

for the year ending December 31, 2017

information was taken from the 2017 financial statements of Prepare income stat

pharmaceutical giant Merck and Co. (All dollar amounts are in millions.)

retained earnings st

LO 3),AP

Retained earnings, January 1, 2017

Cost of goods sold

Selling and administrative expenses

Dividends

Sales revenue

Research and development expense

Income tax expense

$43,698.8

9,018.9

8,543.2

3,597.7

38,576.0

5,845.0

2,267.6

Instructions

(a) After analyzing the data, prepare an income statement and a retained earnings state-

ment for the year ending December 31, 2017

Suppose that Merck decided to reduce its research and development expense by 50%.

What would be the short-term implications? What would be the long-term implica-

tions? How do you think the stock market would react?

(b)

a retain

E1-6 Presented here is information for Zheng Inc. for 2017.

Retained earnings, January 1

Service revenue

Total expenses

Dividends

$130,000

400,000

175,000

65,000

(LO 3), AP

Instructions

Prepare the 2017 retained earnings statement for Zheng Inc.

E1-7 Consider each of the following independent situations.

(a) The retained earnings statement of Lee Corporation shows dividends of $68,000,

Interpret fina

(L0 3),AP

while net income for the year was $75,000.

ating activities was $10,000, cash used in investing activities was $110,000, and cash

provided by financing activities was $130,000.

(b) The statement of cash flows for Steele Corporation shows that cash provided by oper-

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education