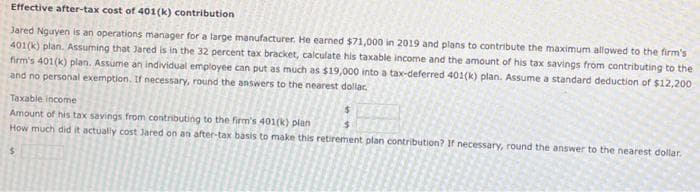

Effective after-tax cost of 401(k) contribution Jared Nguyen is an operations manager for a large manufacturer. He earned $71,000 in 2019 and plans to contribute the maximum allowed to the firm's 401(k) plan. Assuming that Jared is in the 32 percent tax bracket, calculate his taxable income and the amount of his tax savings from contributing to the firm's 401(k) plan. Assume an individual employee can put as much as $19,000 into a tax-deferred 401(k) plan. Assume a standard deduction of $12,200 and no personal exemption. If necessary, round the answers to the nearest dollar. $ Taxable income Amount of his tax savings from contributing to the firm's 401(k) plan How much did it actually cost Jared on an after-tax basis to make this retirement plan contribution? If necessary, round the answer to the nearest dollar. $

Effective after-tax cost of 401(k) contribution Jared Nguyen is an operations manager for a large manufacturer. He earned $71,000 in 2019 and plans to contribute the maximum allowed to the firm's 401(k) plan. Assuming that Jared is in the 32 percent tax bracket, calculate his taxable income and the amount of his tax savings from contributing to the firm's 401(k) plan. Assume an individual employee can put as much as $19,000 into a tax-deferred 401(k) plan. Assume a standard deduction of $12,200 and no personal exemption. If necessary, round the answers to the nearest dollar. $ Taxable income Amount of his tax savings from contributing to the firm's 401(k) plan How much did it actually cost Jared on an after-tax basis to make this retirement plan contribution? If necessary, round the answer to the nearest dollar. $

Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter14: Planning For Retirement

Section: Chapter Questions

Problem 7FPE

Related questions

Question

Transcribed Image Text:Effective after-tax cost of 401(k) contribution

Jared Nguyen is an operations manager for a large manufacturer. He earned $71,000 in 2019 and plans to contribute the maximum allowed to the firm's

401(k) plan. Assuming that Jared is in the 32 percent tax bracket, calculate his taxable income and the amount of his tax savings from contributing to the

firm's 401(k) plan. Assume an individual employee can put as much as $19,000 into a tax-deferred 401(k) plan. Assume a standard deduction of $12,200

and no personal exemption. If necessary, round the answers to the nearest dollar.

Taxable income

Amount of his tax savings from contributing to the firm's 401(k) plan

How much did it actually cost Jared on an after-tax basis to make this retirement plan contribution? If necessary, round the answer to the nearest dollar.

$

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT