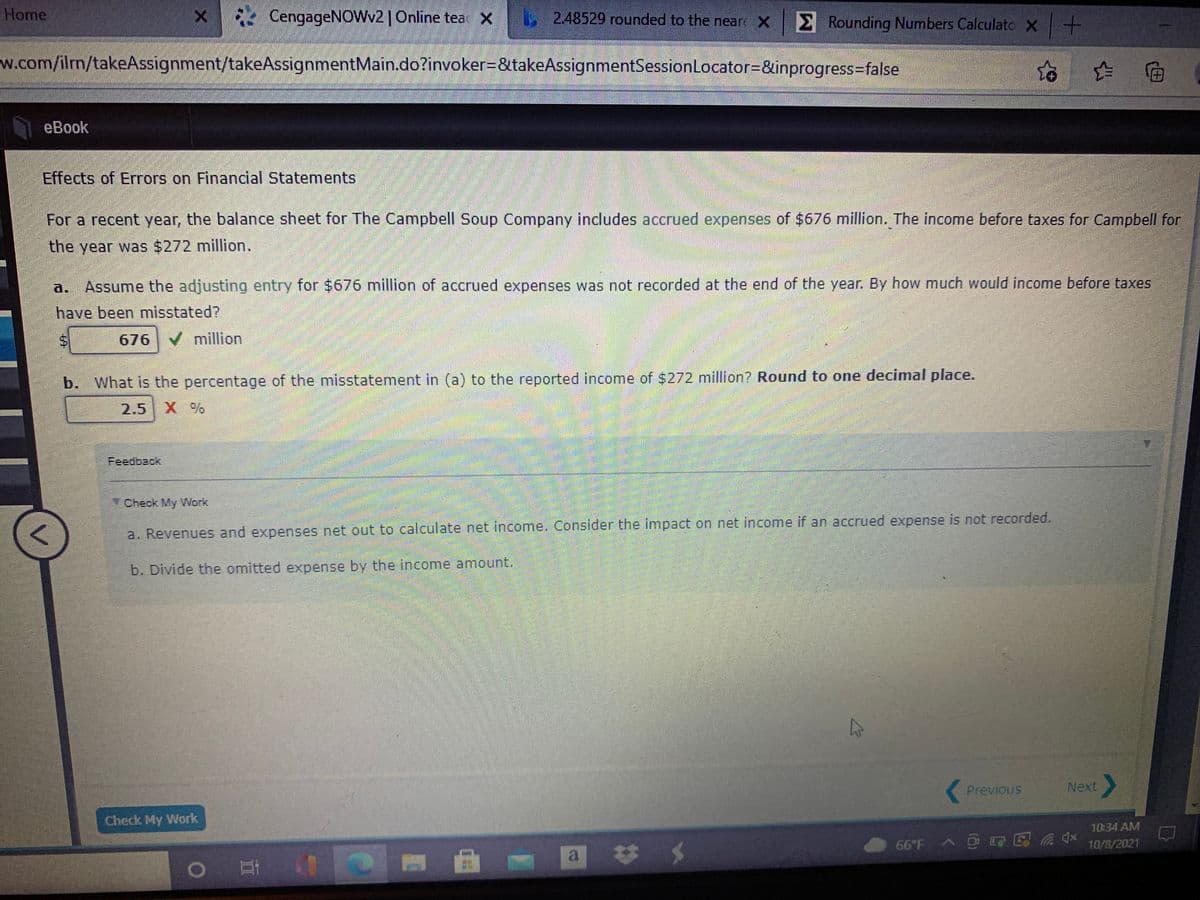

Effects of Errors on Financial Statements For a recent year, the balance sheet for The Campbell Soup Company includes accrued expenses of $676 million. The income before taxes for Campbell for the year was $272 million. a. Assume the adjusting entry for $676 million of accrued expenses was not recorded at the end of the year. By how much would income before taxes have been misstated? 676 V million b. What is the percentage of the misstatement in (a) to the reported income of $272 million? Round to one decimal place. 2.5 X % Feedback Check My Work a. Revenues and expenses net out to calculate net income. Consider the impact on net income if an accrued expense is not recorded. b. Divide the omitted expense by the income amount.

Effects of Errors on Financial Statements For a recent year, the balance sheet for The Campbell Soup Company includes accrued expenses of $676 million. The income before taxes for Campbell for the year was $272 million. a. Assume the adjusting entry for $676 million of accrued expenses was not recorded at the end of the year. By how much would income before taxes have been misstated? 676 V million b. What is the percentage of the misstatement in (a) to the reported income of $272 million? Round to one decimal place. 2.5 X % Feedback Check My Work a. Revenues and expenses net out to calculate net income. Consider the impact on net income if an accrued expense is not recorded. b. Divide the omitted expense by the income amount.

Chapter10: Financial Statements And Reports

Section: Chapter Questions

Problem 3.3C

Related questions

Question

Question B is what I'm struggling with. I'm trying to take the 676 and divide it by 272 then round it.

Transcribed Image Text:Home

E4 CengageNOWv2|Online tea x

L248529 rounded to the neare X Rounding Numbers Calculato X+

w.com/iln/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress%3false

eBook

Effects of Errors on Financial Statements

For a recent year, the balance sheet for The Campbell Soup Company includes accrued expenses of $676 million. The income before taxes for Campbell for

the year was $272 million.

a.

Assume the adjusting entry for $676 million of accrued expenses was not recorded at the end of the year. By how much would income before taxes

have been misstated?

676 V million

b. What is the percentage of the misstatement in (a) to the reported income of $272 million? Round to one decimal place.

2.5

Feedback

Check My Work

a. Revenues and expenses net out to calculate net income. Consider the impact on net income if an accrued expense is not recorded.

b. Divide the omitted expense by the income amount.

Previous

Next

Check My Work

10:34 AM

10/8/2021

a

23

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you