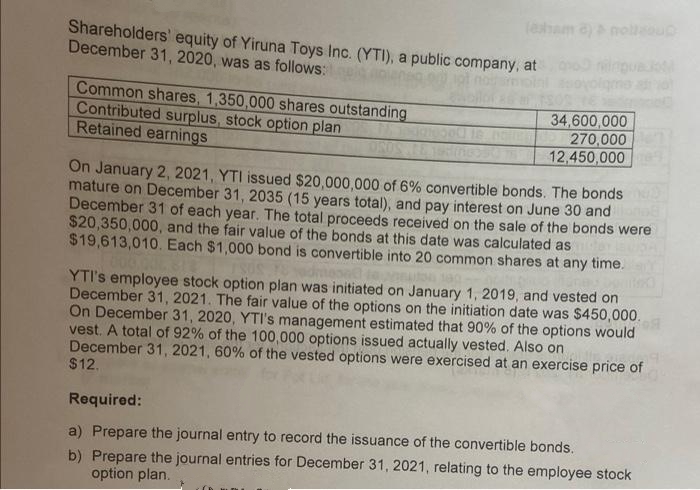

(ehama) nollsoup Shareholders' equity of Yiruna Toys Inc. (YTI), a public company, at December 31, 2020, was as follows: Common shares, 1,350,000 shares outstanding Contributed surplus, stock option plan Retained earnings 34,600,000 270,000 12,450,000 On January 2, 2021, YTI issued $20,000,000 of 6% convertible bonds. The bonds mature on December 31, 2035 (15 years total), and pay interest on June 30 and December 31 of each year. The total proceeds received on the sale of the bonds were $20,350,000, and the fair value of the bonds at this date was calculated as $19,613,010. Each $1,000 bond is convertible into 20 common shares at any time. YTI's employee stock option plan was initiated on January 1, 2019, and vested on December 31, 2021. The fair value of the options on the initiation date was $450,000. On December 31, 2020, YTI's management estimated that 90% of the options would vest. A total of 92% of the 100,000 options issued actually vested. Also on December 31, 2021, 60% of the vested options were exercised at an exercise price of $12. Required: a) Prepare the journal entry to record the issuance of the convertible bonds. b) Prepare the journal entries for December 31, 2021, relating to the employee stock option plan. >

(ehama) nollsoup Shareholders' equity of Yiruna Toys Inc. (YTI), a public company, at December 31, 2020, was as follows: Common shares, 1,350,000 shares outstanding Contributed surplus, stock option plan Retained earnings 34,600,000 270,000 12,450,000 On January 2, 2021, YTI issued $20,000,000 of 6% convertible bonds. The bonds mature on December 31, 2035 (15 years total), and pay interest on June 30 and December 31 of each year. The total proceeds received on the sale of the bonds were $20,350,000, and the fair value of the bonds at this date was calculated as $19,613,010. Each $1,000 bond is convertible into 20 common shares at any time. YTI's employee stock option plan was initiated on January 1, 2019, and vested on December 31, 2021. The fair value of the options on the initiation date was $450,000. On December 31, 2020, YTI's management estimated that 90% of the options would vest. A total of 92% of the 100,000 options issued actually vested. Also on December 31, 2021, 60% of the vested options were exercised at an exercise price of $12. Required: a) Prepare the journal entry to record the issuance of the convertible bonds. b) Prepare the journal entries for December 31, 2021, relating to the employee stock option plan. >

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 10MC

Related questions

Question

5

Transcribed Image Text:(esham 8) & nollsou

Shareholders' equity of Yiruna Toys Inc. (YTI), a public company, at

December 31, 2020, was as follows:

Common shares, 1,350,000 shares outstanding

Contributed surplus, stock option plan

Retained earnings

34,600,000

270,000

12,450,000

On January 2, 2021, YTI issued $20,000,000 of 6% convertible bonds. The bonds

mature on December 31, 2035 (15 years total), and pay interest on June 30 and

December 31 of each year. The total proceeds received on the sale of the bonds were

$20,350,000, and the fair value of the bonds at this date was calculated as

$19,613,010. Each $1,000 bond is convertible into 20 common shares at any time.

YTI's employee stock option plan was initiated on January 1, 2019, and vested on

December 31, 2021. The fair value of the options on the initiation date was $450,000.

On December 31, 2020, YTI's management estimated that 90% of the options would

vest. A total of 92% of the 100,000 options issued actually vested. Also on

December 31, 2021, 60% of the vested options were exercised at an exercise price of

$12.

Required:

a) Prepare the journal entry to record the issuance of the convertible bonds.

b) Prepare the journal entries for December 31, 2021, relating to the employee stock

option plan.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning