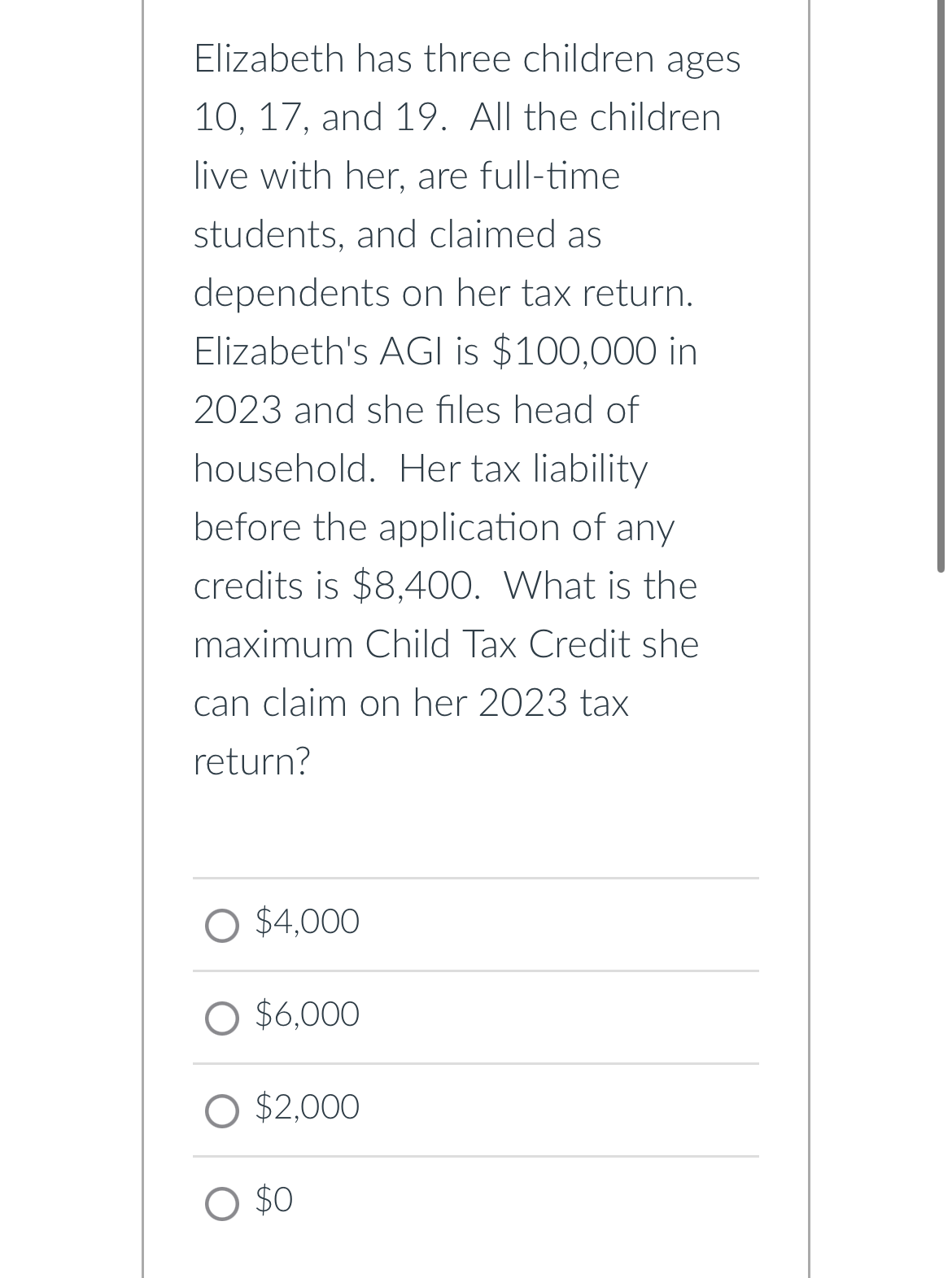

Elizabeth has three children ages 10, 17, and 19. All the children Ilive with her, are full-time students, and claimed as dependents on her tax return. Elizabeth's AGI is $100,000 in 2023 and she files head of household. Her tax liability before the application of any credits is $8,400. What is the maximum Child Tax Credit she can claim on her 2023 tax return?

Elizabeth has three children ages 10, 17, and 19. All the children Ilive with her, are full-time students, and claimed as dependents on her tax return. Elizabeth's AGI is $100,000 in 2023 and she files head of household. Her tax liability before the application of any credits is $8,400. What is the maximum Child Tax Credit she can claim on her 2023 tax return?

Chapter3: Tax Formula And Tax Determination : An Overview Of Property Transactions

Section: Chapter Questions

Problem 11CPA

Related questions

Question

Transcribed Image Text:Elizabeth has three children ages

10, 17, and 19. All the children

live with her, are full-time

students, and claimed as

dependents on her tax return.

Elizabeth's AGI is $100,000 in

2023 and she files head of

household. Her tax liability

before the application of any

credits is $8,400. What is the

maximum Child Tax Credit she

can claim on her 2023 tax

return?

$4.000

O $6,000

$2,000

$0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT