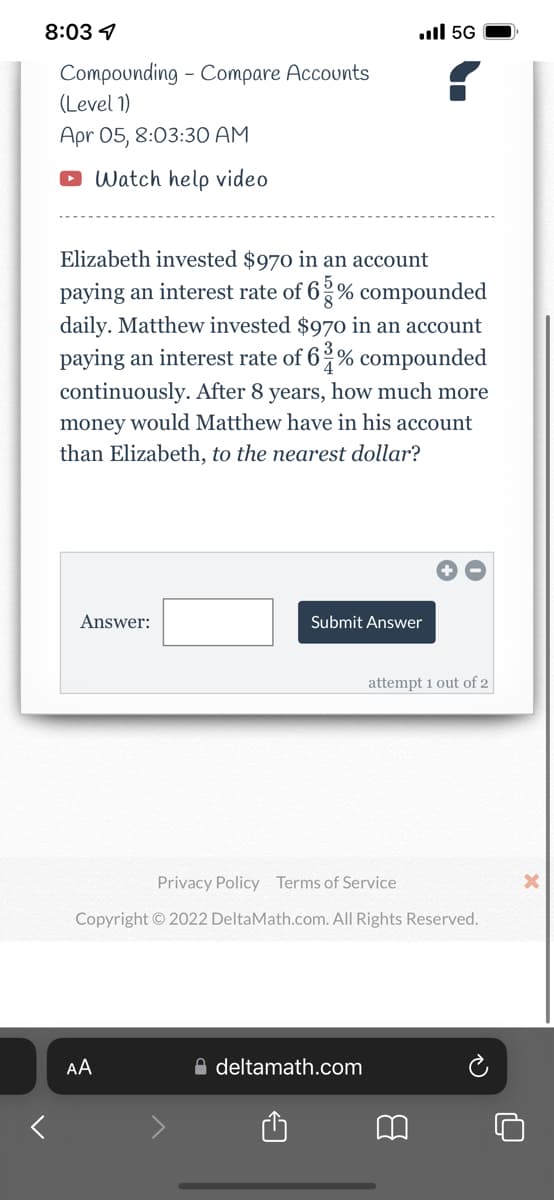

Elizabeth invested $970 in an account paying an interest rate of 62% compounded daily. Matthew invested $970 in an account paying an interest rate of 6 % compounded continuously. After 8 years, how much more money would Matthew have in his account than Elizabeth, to the nearest dollar?

Elizabeth invested $970 in an account paying an interest rate of 62% compounded daily. Matthew invested $970 in an account paying an interest rate of 6 % compounded continuously. After 8 years, how much more money would Matthew have in his account than Elizabeth, to the nearest dollar?

Algebra & Trigonometry with Analytic Geometry

13th Edition

ISBN:9781133382119

Author:Swokowski

Publisher:Swokowski

Chapter5: Inverse, Exponential, And Logarithmic Functions

Section5.3: The Natural Exponential Function

Problem 38E

Related questions

Question

Transcribed Image Text:8:03 1

ull 5G

Compounding - Compare Accounts

(Level 1)

Apr 05, 8:03:30 AM

O Watch help video

Elizabeth invested $970 in an account

paying an interest rate of 6 % compounded

daily. Matthew invested $970 in an account

paying an interest rate of 6 % compounded

continuously. After 8 years, how much more

money would Matthew have in his account

than Elizabeth, to the nearest dollar?

Answer:

Submit Answer

attempt 1 out of 2

Privacy Policy Terms of Service

Copyright © 2022 DeltaMath.com. All Rights Reserved.

AA

A deltamath.com

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Recommended textbooks for you

Algebra & Trigonometry with Analytic Geometry

Algebra

ISBN:

9781133382119

Author:

Swokowski

Publisher:

Cengage

College Algebra

Algebra

ISBN:

9781305115545

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning

Algebra & Trigonometry with Analytic Geometry

Algebra

ISBN:

9781133382119

Author:

Swokowski

Publisher:

Cengage

College Algebra

Algebra

ISBN:

9781305115545

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning