Ellen has maxed out her credit card at Si1,500 and vows not to make any other credit card purchases. Her credit card company charges 1.9% interest per month, and the minimum monthly payment is all interest due plus 2% of the principal balance. How much of the balance can Ellen pay down if she pays the minimum payment only for 5 months? Round the answer to the nearest cent. After 5 months, Ellen would have paid off S

Ellen has maxed out her credit card at Si1,500 and vows not to make any other credit card purchases. Her credit card company charges 1.9% interest per month, and the minimum monthly payment is all interest due plus 2% of the principal balance. How much of the balance can Ellen pay down if she pays the minimum payment only for 5 months? Round the answer to the nearest cent. After 5 months, Ellen would have paid off S

Chapter9: Sequences, Probability And Counting Theory

Section9.4: Series And Their Notations

Problem 57SE: Karl has two years to save $10000 to buy a used car when he graduates. To the nearest dollar, what...

Related questions

Question

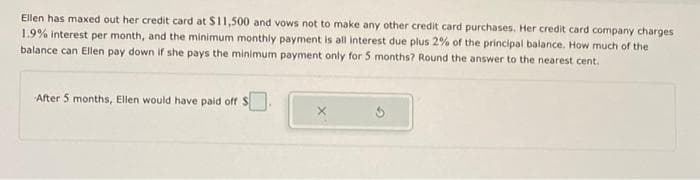

Transcribed Image Text:Ellen has maxed out her credit card at $11,500 and vows not to make any other credit card purchases. Her credit card company charges

1.9% interest per month, and the minimum monthly payment is all interest due plus 2% of the principal balance. How much of the

balance can Ellen pay down if she pays the minimum payment only for 5 months? Round the answer to the nearest cent.

After 5 months, Ellen would have paid off S

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you