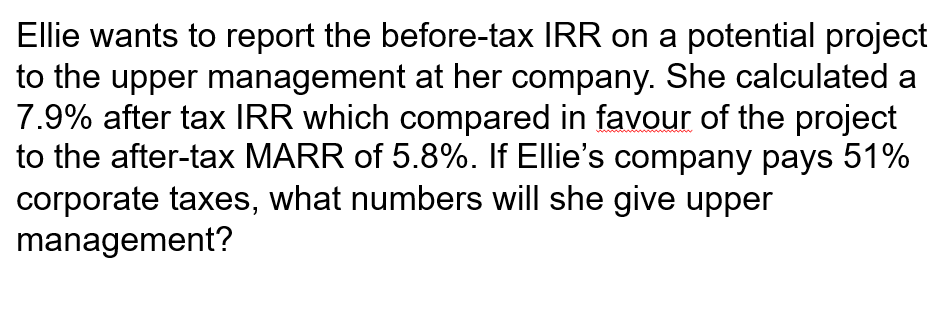

Ellie wants to report the before-tax IRR on a potential project to the upper management at her company. She calculated a 7.9% after tax IRR which compared in favour of the project to the after-tax MARR of 5.8%. If Ellie's company pays 51% corporate taxes, what numbers will she give upper management?

Q: SAMPLE PROBLEM A new concrete road has been constructed in line with the government's Build-Build-Bu...

A: Equivalent annual cost is the effective payment that a firm must generate each year at given interes...

Q: If an investment of P750,000 that matures in 15 years but with certain specification that P 500000 w...

A: We are required to find out the Return on its maturity and to choose which is the best option

Q: Many firms in the United States file for bankruptcy every year, yet they still continue operating. W...

A: Bankruptcy is a legal procedure that allows people or organizations to be free of their obligations ...

Q: Have 2000 $ interest rate 4% /year for 5 years what is the money you get in the end

A: Future value = Present value x (1 + r)n where, Present value = 2,000 Interest rate (r) = 0.04 Number...

Q: A 6.44% bond makes coupon payments on June 15 and December 15 and is trading with a yield-to-maturit...

A: To Find: Full price of Bond

Q: suppose a stock worth $50 today is equally likely to be worth $100 or $25 a year from today. What is...

A: Stock Worth = $50 Equally worth stock $100 or $25 Highest price = $100 Lowest price = $25 Probabili...

Q: The zero growth model of stock valuation; ...

A: The zero growth model is one of the options which is used to find the intrinsic value or the fair va...

Q: In buying a farm worth P 1,500,000 cash, the purchaser pays P 500,000 cash and agrees to pay the bal...

A: Payments are the modes of the cash outflow therefore, the person who pays the amount has to make it ...

Q: Whitney recently retired, and has $450,000 in savings. She wants to invest as much as possible in a ...

A: The total amount earned during the year is equal to the sum of interest earned on the different secu...

Q: 7. A price tag of P 1,200.00 is payable in 60 days but if paid within 30 days it will have 3% discou...

A: As per the time value of money theory, the value of money today is worth more than tomorrow.

Q: 21. Find the number of interest periods to achieve the conditions set forth. A= $6000; P =$1000; int...

A: Interest can be accumulated on a daily, weekly, monthly, or yearly basis. Standard compounding frequ...

Q: A company is planning to augment its production capacity through equipment additions that will cost ...

A: Additional cost (C) = $350000 Increase in income (x) = $250000 Increase in costs (y) = $150000 n = 5...

Q: The American debt as of today amounts to 12 trillion. This balloons with an interest rate of 0.16% y...

A: In order to calculate the monthly payment to be made by earning individuals, we are required to calc...

Q: If Marco invests $800 each year for 16 years at 9.5% interest, compounded quarterly, what is the dis...

A: Present Value of Ordinary Annuity refers to a concept which determines the value of cash flows at pr...

Q: What is a "call" provision? Why would bond issuers exercise this? Why would bond investors choose to...

A: Certain companies issue bonds with a 'call' provision.

Q: How much will be paid every three months for a loan that amounts to P1 400 500.00 if money is worth ...

A: The loan which is discharged by making installment payments consist of two components as interest mo...

Q: Dan is considering borrowing $500,000 to purchase a new condo. Based on that information, answer the...

A: Amortized Loan: Amortized loan is a type of loan in which the borrower would pay periodic payments ...

Q: Define the difference between a proprietorship and a partnership. What are the advantages and disadv...

A: The business entity can be established, managed, and operated using a variety of business structures...

Q: Life inHow would you determine the amount to purchase? Should it be based on your current financial ...

A: Life insurance is a very important insurance tool that each and every individual should take.

Q: Finance professionals make decisions that fall into three distinctive areas: corporate finance, capi...

A: Corporate finance deals with the capital structure of a company, funding, and it also consists of al...

Q: Consider the following cash flow profile, and assume MARR is 11 percent/year. ΕΟΥ NCF $-115 $19 2 $1...

A: a) According to Descartes' rule of signs, there are as many IRRs as there are sign changes in the ca...

Q: Compare the results of the three methods by quality of information for decision making. Using what y...

A: The question is related to Capital Budgeting. The Net Present Value is the exess of Present Value of...

Q: 1. Differentiate the two main subdivisions of the Philippine Financial System. 2. Discuss the elemen...

A: "Since you have asked multiple question we will be solving First question for you if you want any sp...

Q: Greta has risk aversion of A = 4 when applied to return on wealth over a one-year horizon. She is po...

A: Capital allocation is referred as the investing as well as distribution of the financial resources o...

Q: How much will be paid every three months for a loan that amounts to P1 400 500.00 if money is worth ...

A: Loan amount = P1,400,500 Interest rate = 518% = 418% = 5.125% Time period = 20

Q: Describe the five variables like Stock Price, Exercise Price, Risk-Free Rate, Volatility or Standard...

A: After a long research done by financial economicts in searching a workable option-pricing model. Bla...

Q: Bond Yields Parkway Void Co. issued 15-year bonds two years ago at a coupon rate of 5.4 percent. The...

A: yeild to maturity is return earned for period of holding

Q: D&R A3 4 -2 Question 4. Interest Rate Options – Pricing, Valuation, Payoff, and Hedging Tango Ba...

A: An annualized total return is the geometric average of the amount of money earned by an investment o...

Q: We are interested in making a bid for Privately Held Automotive Group (PAG). PAG is an up-and- oming...

A: Unlevered or asset beta When a company has only equity and no debt, its beta is known as unlevered o...

Q: You work in a company. You are offered the choice of two payments streams. A. $250 paid now. B. $150...

A: The interest rate that makes both option same will be the IRR of cash flows where cash outflow for y...

Q: A disadvantage of equity financing

A: Equity financing refers to raising finances in the form of selling equity shares of the concerned co...

Q: You own a successful business and you decided to sell the business for $950,000. However, the buyer ...

A: Note : Hi ! Thank you for the Question ,As Per the Honor Code , we are allowed to answer only the fi...

Q: Problem. Assume the following cash flow for 2 projects. Assuming that the cash flows are occurring a...

A: Payback period measures in how many years project's cash flow will take to recover its initial inves...

Q: 1 ) Solve the following quesitons in an Excels spreadsheet, and create a cash-flow table for each Bo...

A: Rate of return (ROR) It is the net return from an investment over a period, presented as a percentag...

Q: QUESTION 24 What are the three different ways that a statistical/financial report can show variances...

A: Financial statement are referred as the formal records of the financial position as well as activiti...

Q: Bond Yields Parkway Void Co. issued 15-year bonds two years ago at a coupon rate of 5.4 percent. The...

A: Yield to Maturity = [Coupon + ( ( Face value - Current price ) / time )] / ( Face value + Current pr...

Q: You are given a bond with a yield to maturity of 16%, Macaulay duration of 12 and a convexity of 52....

A: Given, The yield to maturity is 16% Macaulay duration is 12 Convexity is 52 % change in yield is 2%

Q: 1. T.J. Chan, an engineering consultant, decided to begin a business of his own. Chan has set up the...

A: Balance sheet A balance sheet is a financial statement that shows the financial condition of a compa...

Q: How do you turn an income statement int a forecasted return? And how is it helpful?

A: Return means earn additional on invested amount. Return is a positive factor in every investment. In...

Q: In a regression of the single-index model, the R-square is 66%, residual variance is 0.02, beta esti...

A: The regression analysis is a statistical procedure that allows us to find the linear association bet...

Q: when you retire 40 years from now you plan to make 10 annual withdrawals from your savings accounts ...

A: The present value is calculated by multiplying all future cash flows by present value factor using d...

Q: The additional return over the risk-free rate needed to compensate investors for assuming an average...

A: Basis the general principle that higher risk security do have the higher returns, it is known that s...

Q: which should you

A: answer A B cost 90000 90000 cash flow 35000 30000 years 4 5 required return 13% 13% ...

Q: A company borrowed $18,000 paying interest at 6% compounded semi-annually. If the loan is repaid by ...

A: For loans, outstanding balance refers to amount which is payable towards lender at a given point of ...

Q: Statement of Cash , select the false statement a.The cash received from the sale of goods is a cash ...

A: A statement of cash shows the different sources of cash (i.e. cash inflows) and the different uses o...

Q: Find the payment made by the ordinary annuity with the given present value. $91,119; monthly payment...

A:

Q: You decide to do some remodeling in the kitchen. Your parents agree to lend you the money, but you i...

A: Simple interest per month is calculated at: = Principal * rate of interest * 1/12

Q: 3. How large is the gap between Beta(Asset) and Beta(Leverage)? What is the impact of their differe...

A: Beta is a metric used by shareholders to correlate the uncertainty of a securities or portfolio to t...

Q: 3. An investor takes a long position on an FRA that is based on 90-day LIBOR and has 6 months till e...

A: A forward rate contract is a contract where the interest earned on the notional principal is exchang...

Q: How can financial literacy be improved?

A: Financial literacy refers to a wide range of critical financial skills and concepts. People who are ...

Step by step

Solved in 2 steps

- The manager of Pharoah is given a bonus based on net income before taxes. The net income after taxes is $75980 for FIFO and $64500 for LIFO. The tax rate is 30%. The bonus rate is 20%. How much higher is the manager's bonus if FIFO is adopted instead of LIFO?A company wants to set up a new office in a country where the corporate tax rate is: 15% of first $50,000 profits, 25% of next $25,000, 34% of next $25,000, and 39% of everything over $100,000. Executives estimate that they will have gross revenues of $500,000, total costs of $300,000, $30,000 in allowable tax deductions, and a one-time business start-up credit of $8000. What is taxable income for the first year, and how much should the company expect to pay in taxes?New Business is just being formed by 10 investors, each of whom will own 10% of the business. The firm is expected to earn $2,000,000 before taxes each year. The corporate tax rate is 34% and the personal tax rate for the firm's investors is 32%. The firm does not need to retain any earnings, so all of its after-tax income will be paid out as dividends to its investors. The investors will have to pay personal taxes on whatever they receive. How much additional spendable income will each investor have if the business is organized as a partnership rather than as a corporation? a. $46,240 b. $39,520 c. $4,000 d. $48,880 e. $43,520

- Sherry just received a big promotion at the corporation. Last year her salary was $100,000, but due to her promotion, she expects to earn $180,000 this year. She expects that she will be able to save about $60,000 of her pay raise and is interested in exploring ways to minimize her federal tax liability. List some of the tax-planning opportunities with respect to her salary.John is considering making a $7,000 investment in a venture that its promoter promises will generate immediate tax benefits for him. John, who does not anticipate itemizing his deductions, is in the 30% marginal income tax bracket. If the investment is of a type that produces a tax credit of 40% of the amount of the expenditure, by how much will John's tax liability decline because of the investment? a.) $2,400 b.) $0 c.) $2,100 d.) $2,800According to a professional analysis of one proposed federal tax cut (by the accounting firm Deloitte and Touche), the cut would have resulted in the following income tax savings: a single person with a household income of $41,000 would save $211 in taxes; a single person with a household income of $530,000 would save $12,838 in taxes; a married couple with two children and a household income of $41,000 would save $1208 in taxes; and a married couple with two children and a household income of $530,000 would save $13,442 in taxes. Find the absolute difference in savings between a single person earning $41,000 and a single person earning $530,000. Then express the savings as a percentage of earnings for each person. Find the absolute difference in savings between a married couple with two children earning $41,000 and a married couple with two children earning $530,000. Then express the savings as a percentage of earnings for each couple. Write a paragraph either defending or…

- Kristen, the president and sole shareholder of Egret Corporation, has earned a salary bonus of $30,000 for the current year. Because of the lower tax rates on qualifying dividends, Kristen is considering substituting a dividend for the bonus. Assume that the tax rates are 24% for Kristen and 21% for Egret Corporation. Question Content Area a. How much better off would Kristen be if she were paid a dividend rather than salary? If Kristen were paid a bonus, she would receive $fill in the blank bcbd0cf5affa04c_1 22,800 after taxes. If Kristen receives a dividend rather than salary, she would receive $fill in the blank bcbd0cf5affa04c_2 25,500 after taxes. Thus, she would be better off by receiving the dividend . Feedback Area Feedback Closely held corporations have considerable discretion regarding their dividend policies. In the past, the double tax result provided strong motivation to avoid the payment of dividends. Instead, the incentive was to bail out corporate profits in a…Assume that Provident Health System, a for-profit hospital, has $1 million in tax-able income for 2020, and its tax rate is 30 percent (combined federal and state tax rates). Given this information, what is the firm’s net income? Suppose the hospital pays out $300,000 in dividends. A shareholder, Carl Wu, receives $10,000. If Carl’s initially paid $100,000 for his shares and faces a tax rate on dividends of 15 percent, what is his after-tax dividend and after-tax rate of return on his investment. Suppose that Aditi Patel currently holds tax-exempt bonds of Good Samaritan Healthcare that pay 7 percent interest. She is in the 40 percent tax bracket. Her broker wants her to buy some Beverly Enterprises taxable bonds that will be issued next week. With all else the same, what rate must be set on the Beverly bonds to make Aditi interested in making a switch? Due date is midnight of day 7. Your submission can be made in WORD or EXCEL. Clearly show your work and provide a concise…An investor is considering investing in one of two firms (C and D). The WACC is 12% and the corporate income‐tax rate is 25% for both firms. Firm C’s equity totals $100 million and its net annual operating profit before taxes is $24 million. Firm D’s equity totals $200 million and its net annual operating profit before taxes is $36 million. Based on an EVA analysis, which firm is stronger economically?

- In 2007, two domestic corporations operating in the same industry report the following effective tax rates: Rally and More, Inc., 35%, and Dontall and Less, Inc., 20%. You believe Dontall is doing a better job with their tax planning due to the lower effective tax rates and, therefore, decide to invest $100,000 in Dontall. After a couple of years, you find out from a public announcement that Dontall has been under investigation by the IRS for using some aggressive tax planning strategies. You contact the CEO of Dontall who tells you it is nothing to worry about and that the CPAs (Anderson and Company CPAs) have this all under control. One year later, the stock takes a nosedive on a Wednesday morning after the press prints an article stating that the IRS has adjusted the taxable income of Dontall upward after an auditor found that some of the reported tax benefits and expenses were falsely reported. Even before the penalties, the newly assessed tax rate of Dontall is now greater than…In connection with the previous problem, suppose a certain governmentemployee earns a performance benefit = ₱2,340/month, 13 th Month Pay =₱15,780.43, and he has other benefits amounting to ₱6,000. How much of theadditional earnings will be taxed?A company, based in the Midwest, requires an 8.000% after tax rate of return. The state tax rate is 5% and the company is in the 21% federal tax bracket.Using the combined incremental tax rate equation on p. 433 of the textbook and the after-tax rate of return equation on p. 439, what is the estimate of the before-tax rate ofreturn required.Give rate of return in percent to 3 decimal places like 10.134% or 9.765%