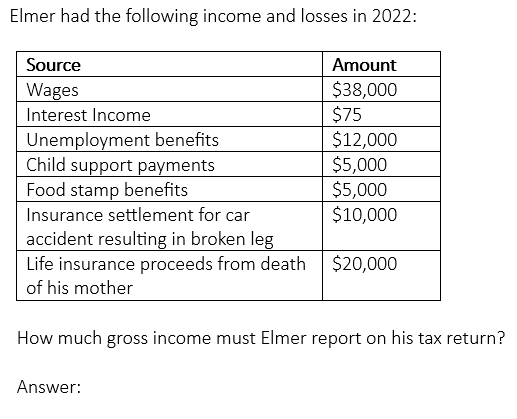

Elmer had the following income and losses in 2022: Source Wages Interest Income Unemployment benefits Child support payments Food stamp benefits Amount $38,000 $75 $12,000 $5,000 $5,000 $10,000 $20,000 Insurance settlement for car accident resulting in broken leg Life insurance proceeds from death of his mother How much gross income must Elmer report on his tax return? Answer:

Elmer had the following income and losses in 2022: Source Wages Interest Income Unemployment benefits Child support payments Food stamp benefits Amount $38,000 $75 $12,000 $5,000 $5,000 $10,000 $20,000 Insurance settlement for car accident resulting in broken leg Life insurance proceeds from death of his mother How much gross income must Elmer report on his tax return? Answer:

Chapter5: Gross Income: Exclusions

Section: Chapter Questions

Problem 22CE: Ellie purchases an insurance policy on her life and names her brother, Jason, as the beneficiary....

Related questions

Question

Transcribed Image Text:Elmer had the following income and losses in 2022:

Source

Wages

Interest Income

Unemployment benefits

Child support payments

Food stamp benefits

Amount

$38,000

$75

$12,000

$5,000

$5,000

$10,000

$20,000

Insurance settlement for car

accident resulting in broken leg

Life insurance proceeds from death

of his mother

How much gross income must Elmer report on his tax return?

Answer:

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT