ement of revenues, ex

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Prepare a

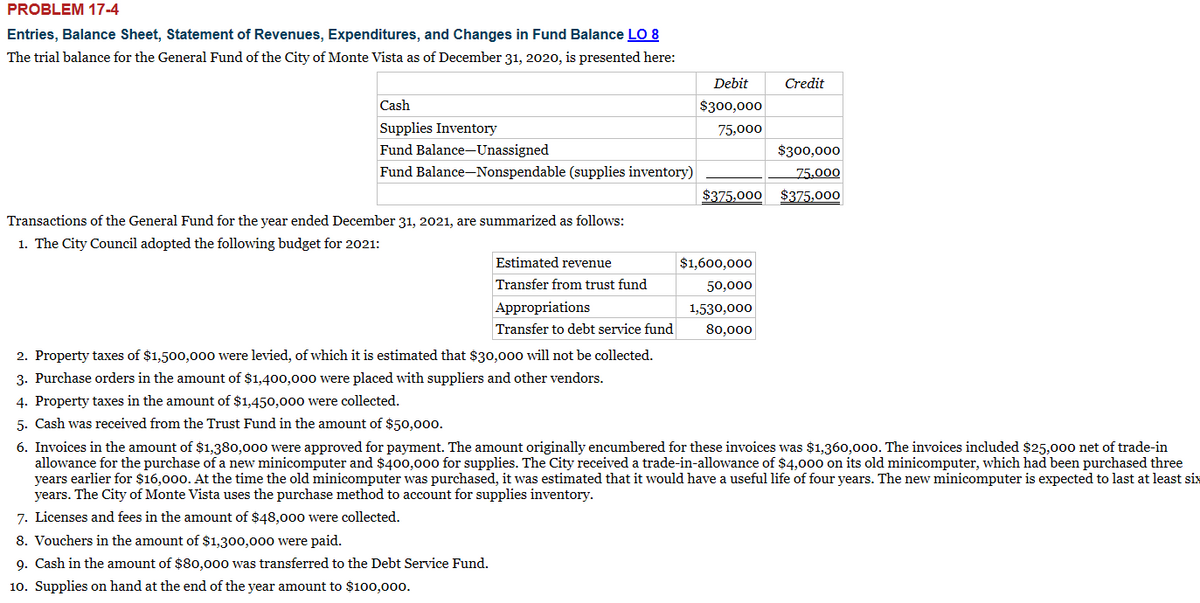

Transcribed Image Text:PROBLEM 17-4

Entries, Balance Sheet, Statement of Revenues, Expenditures, and Changes in Fund Balance LO 8

The trial balance for the General Fund of the City of Monte Vista as of December 31, 2020, is presented here:

Debit

Credit

Cash

$300,000

Supplies Inventory

75,000

Fund Balance-Unassigned

$300,000

Fund Balance-Nonspendable (supplies inventory)

75.000

$375,000

$375,000

Transactions of the General Fund for the year ended December 31, 2021, are summarized as follows:

1. The City Council adopted the following budget for 2021:

Estimated revenue

$1,600,000

Transfer from trust fund

50,000

Appropriations

1,530,000

Transfer to debt service fund

80,000

2. Property taxes of $1,500,000 were levied, of which it is estimated that $30,000 will not be collected.

3. Purchase orders in the amount of $1,400,000 were placed with suppliers and other vendors.

4. Property taxes in the amount of $1,450,000 were collected.

5. Cash was received from the Trust Fund in the amount of $50,000.

6. Invoices in the amount of $1,380,000 were approved for payment. The amount originally encumbered for these invoices was $1,360,000. The invoices included $25,000 net of trade-in

allowance for the purchase of a new minicomputer and $400,000 for supplies. The City received a trade-in-allowance of $4,000 on its old minicomputer, which had been purchased three

years earlier for $16,000. At the time the old minicomputer was purchased, it was estimated that it would have a useful life of four years. The new minicomputer is expected to last at least six

years. The City of Monte Vista uses the purchase method to account for supplies inventory.

7. Licenses and fees in the amount of $48,00o were collected.

8. Vouchers in the amount of $1,300,000 were paid.

9. Cash in the amount of $80,000 was transferred to the Debt Service Fund.

10. Supplies on hand at the end of the year amount to $100,00o.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education