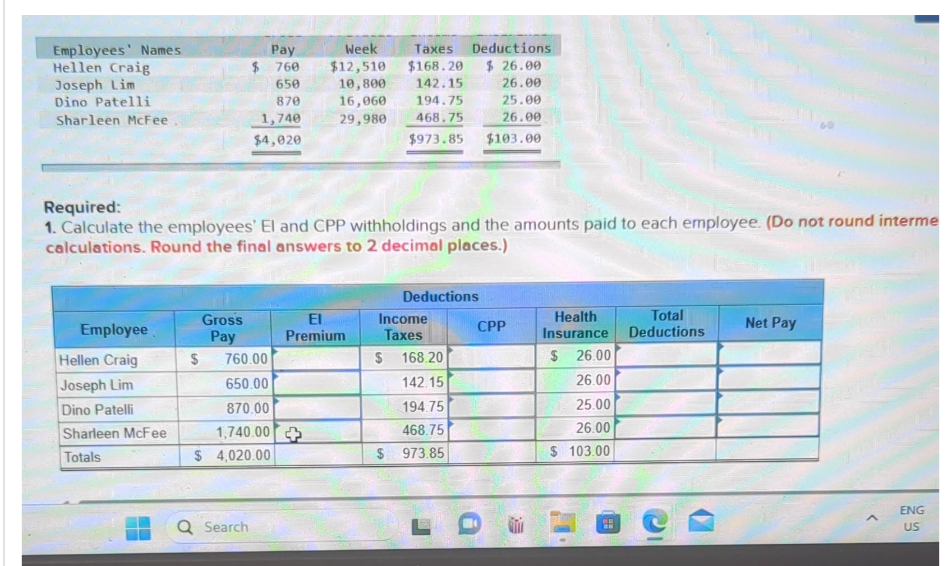

Employees' Names Hellen Craig Joseph Lim Dino Patelli Sharleen McFee. Employee Hellen Craig Joseph Lim Dino Patelli Pay $ 760 650 870 1,740 $4,020 Sharleen McFee Totals Required: 1. Calculate the employees' El and CPP withholdings and the amounts paid to each employee. (Do not round interme calculations. Round the final answers to 2 decimal places.) Week $12,510 10,800 Taxes Deductions $168.20 $26.00 142.15 16,060 194.75 29,980 468.75 Gross Pay S 760.00 650.00 870.00 1,740.00 $ 4,020.00 El Premium 26.09 25.00 26.00 $973.85 $103.00 Deductions Income Taxes $ 168.20 142.15 194.75 468.75 $ 973.85 CPP Health Insurance $ 26.00 26.00 25.00 26.00 $ 103.00 Total Deductions Net Pay

Employees' Names Hellen Craig Joseph Lim Dino Patelli Sharleen McFee. Employee Hellen Craig Joseph Lim Dino Patelli Pay $ 760 650 870 1,740 $4,020 Sharleen McFee Totals Required: 1. Calculate the employees' El and CPP withholdings and the amounts paid to each employee. (Do not round interme calculations. Round the final answers to 2 decimal places.) Week $12,510 10,800 Taxes Deductions $168.20 $26.00 142.15 16,060 194.75 29,980 468.75 Gross Pay S 760.00 650.00 870.00 1,740.00 $ 4,020.00 El Premium 26.09 25.00 26.00 $973.85 $103.00 Deductions Income Taxes $ 168.20 142.15 194.75 468.75 $ 973.85 CPP Health Insurance $ 26.00 26.00 25.00 26.00 $ 103.00 Total Deductions Net Pay

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 16MC: An employee earns $8,000 in the first pay period. The FICA Social Security Tax rate is 6.2%, and the...

Related questions

Topic Video

Question

Transcribed Image Text:Employees' Names

Hellen Craig

Joseph Lim

Dino Patelli

Sharleen McFee

Employee

Hellen Craig

Joseph Lim

Dino Patelli

Sharleen McFee

Totals

$

Gross

Pay

$

760

650

870

1,740

$4,020

Required:

1. Calculate the employees' El and CPP withholdings and the amounts paid to each employee. (Do not round interme

calculations. Round the final answers to 2 decimal places.)

Q Search

Pay

760.00

650.00

870.00

1,740.00

$ 4,020.00

Week

$12,510

10,800 142.15

16,060

Taxes Deductions

$168.20 $26.00

26.00

25.00

26.00

194.75

29,980 468.75

El

Premium

$973.85 $103.00

$

Deductions

Income

Taxes

168.20

142.15

194.75

468.75

$ 973.85

CPP

Health

Insurance

$

26.00

26.00

25.00

26.00

$ 103.00

BE

Total

Deductions

Net Pay

ENG

US

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT