en percent. P195,000 interest is receivable every end of six months for five years. Determine the buying price of the bond. Problem 2. Refer to problem number one. If Mala Inse Corp. sells the bonds after holding it for two years, how much should Mala Inse sell the bonds at P5,000 above the said bond price? Golution: ANSWER O PROBLEM:

en percent. P195,000 interest is receivable every end of six months for five years. Determine the buying price of the bond. Problem 2. Refer to problem number one. If Mala Inse Corp. sells the bonds after holding it for two years, how much should Mala Inse sell the bonds at P5,000 above the said bond price? Golution: ANSWER O PROBLEM:

Chapter6: Bonds (debt) - Characteristics And Valuation

Section: Chapter Questions

Problem 8PROB

Related questions

Question

PLEASE SKIP IF YOU ALREADY DID THIS OTHERWISE DOWNVOTE. THANK YOU. I WILL UPVOTE

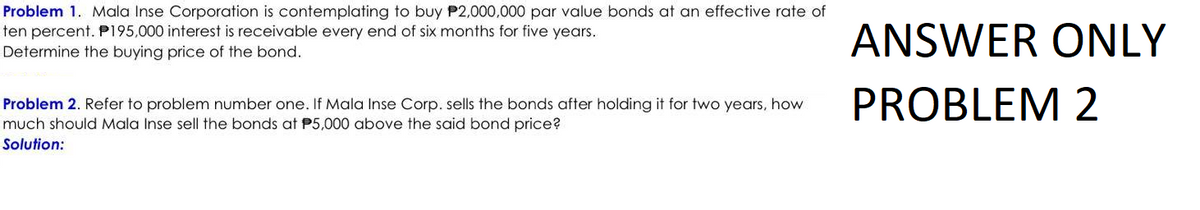

Transcribed Image Text:Problem 1. Mala Inse Corporation is contemplating to buy P2,000,000 par value bonds at an effective rate of

ten percent. P195,000 interest is receivable every end of six months for five years.

Determine the buying price of the bond.

Problem 2. Refer to problem number one. If Mala Inse Corp. sells the bonds after holding it for two years, how

much should Mala Inse sell the bonds at P5,000 above the said bond price?

Solution:

ANSWER ONLY

PROBLEM 2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning