enses argaret and John Murphy (age 66 and 68, respective ncurred the following expenses: nsurance premiums

Q: PowerTrain Sports Inc. manufactures and sells two styles of All Terrain Vehicles (ATVs), the Mountai...

A: The contribution margin ratio is calculated as contribution margin divided by sales revenue.

Q: The following pre-closing accounts and balances were drawn from the records of Carolina Company on D...

A: Retained Earnings is the sum of All profit or losses, Reserve created for business purpose. Retained...

Q: E13-1 Characteristics of a partnership [5–10 min] Theresa Thayer, a friend from university, asks you...

A: Partnership means where two or more person comes together to do some common business activity and ea...

Q: Ariana Corporation includes two coupons in each box of cereal box and 9 coupons are needed to be red...

A: In accounting for premiums and coupons, companies should charge the cost of premiums and coupons to ...

Q: Lily is excited because she is getting a company car. Her employer is purchasing a car for $35,000. ...

A: Operating expenses paid by the employer = 3800 Taxable benefit to the employee = operating expenses ...

Q: 5. Acme Corp. makes a vending machines for small companies. They have recently started selling their...

A: Break-Even Point is a situation where if Breakeven Units are sold, the Company will face a situation...

Q: 1. The interest cost component of the net defined benefit cost is determined using a. the settlement...

A: "Since you have asked multiple question we would be solving first question,If you want any specific ...

Q: 6. Costs allocation of service departments can be challenging because... I. The definition of suppor...

A: A service department is a cost center that provides services to the company's other departments. Sin...

Q: On January 1, 2015, Ernie and Bert both sole proprietors decided to form a partnership to expand bot...

A:

Q: Problem 7-5B Determine depreciation under three methods (LO7-4) [The following information applies t...

A: 2. Depreciation using double-declining method = (Original cost – Salvage value) /4 years x 2

Q: Make a General Ledger for the following selected transactions completed by the SPC Laundry Shop duri...

A: Introduction:- A journal entry is the act of recording or keeping track of any financial or non-fina...

Q: Review the following independent auditors’ report: To the Board of Directors and Shareholders Comp...

A: An audit report refers to the document which reflects upon the end results of the audit process cond...

Q: Shellie, a single individual, received her Bachelor's degree in 2020, and took a job with a salary o...

A: Income tax- Income tax refers to the tax that is levied on the earnings/ income of a person or organ...

Q: Which of the following taxes is not deductible as an itemized deduction? a.Sales tax in a state with...

A: Non Deductible Taxes under itemized deduction: 1. federal income tax 2. Federal, state or local esta...

Q: Compute the ending inventory using the dollar value LIF0 method for 2019, 2020, and 2021. Do not rou...

A: Inventory valuation refers to the methods used by the company to determine the value of its inventor...

Q: Problem 5-25 Interest (LO 5.8) Helen paid the following amounts of interest during the 2021 tax year...

A: Itemized deductions are those allowances and reductions which are qualified to be deducted from gros...

Q: n the role of the accounting system according to the agency theory

A: Agency theory is one of the common problem in the organization form of the system and that exist due...

Q: lassified as a finance lease or as an operating lease.

A: In case of a financial lease only, assets or liabilities are created. In case of operating lease agr...

Q: 1. Springer Inc. began 2021 with 10,000 shares of common stock outstanding with a par value of $10 p...

A: Shares of common stock Number of shares January 1 10000 shares outstanding 10000 March 1...

Q: What is the cash flow from assets for 2015 ($ in millions)? Select one: a. $3,100 b. $2,590 c. $1...

A: Cash flow (CF) from assets refers to the total cash generated by the company during a period from th...

Q: The Social Security Administration increased the taxable wage base from $127,200 to $128,400. The 6....

A: Solution:- a)Calculation of the percentage increase in the base as follows under:- Taxable base incr...

Q: In Year 1of its operations, Reliable Company has revenues of $600,000 and expenses of $400,000. Of t...

A: Revenue. $600000 less : expenses ($400000 - $70000 +$30000)...

Q: Determine the balance in PASTEL Company's finished goods inventory account at the end of August — us...

A: Cost of goods available for sale - Ending finished goods inventory = Cost of goods sold Ending finis...

Q: aker's Financial Planners purchased nine new computers for $910 each. It received a 20% discount bec...

A: solution concept credit term 5/10 n/30 means that if the payment is made within 10 days from the inv...

Q: mortgage. The partners plan to use the building to manufacture, distribute, and sell green and purpl...

A: As per given details please refer below Trial Balance and Workings :- Agreed guaranteed payments to ...

Q: Principal $60,000, Rate of interest 14%, Time 60 days.Date note made July 5, Date noted discontinued...

A: Solution: Principal amount of note = $60,000 Date of issue = July 5 Period = 60 days Maturity date =...

Q: ll business decisions have a on people. Oapplication O risk O effect recourse

A: Solution Concept Every business is operated on the society and it largely is affected by the society...

Q: O60 260 300 Land 300 120 130 Buildings (net) 1,200 220 280 Equipment 360 100 75 Accounts payable 480...

A: Consolidation means combination of assets and liabilities and other financial items of two or more c...

Q: Complete the following table (assume the overtime for each employee is a time-and-a-half rate after ...

A: Solution: Total time worked in the week = 12 + 8 + 10 + 8 + 6 + 3 = 47 hours Regular time = 40 hours...

Q: 4. Record the sale of the ovens at the end of the third year. (If no entry is required for a transac...

A: Depreciation means the loss in value of assets because of usage of assets , passage of time or chang...

Q: Abe Factor opened a new accounting practice called X-Factor Accounting and completed these activitie...

A: Solution Accounting equation = Assets = Liabilities + Capital.

Q: Ms. B, spouse of the decedent who died in a bus accident, received P2,500,000 broken down as follows...

A: P900,000 From a life insurance taken out by the decedent designating his wife as revocable beneficia...

Q: The Hilton's manufacturing company uses job order costing system. The company uses machine hours to ...

A:

Q: Which of the following charitable contributions is not tax deductible? a.Clothing donated to a quali...

A: Tax deductible deductions are those allowances and reductions that are deducted for the purpose of t...

Q: Requirement 1. Journalize the adjusting entries needed on December 31 for Watson Fishing Charters. A...

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in...

Q: Lancaster Company must make three adjusting entries on December 31, 20X1. a. Supplies used, $9,200 (...

A: The accounting process starts with the process of journalizing and posting to the ledger. After that...

Q: During February 1, 2018 Royal Company sold merchandise with a price of P100,000 towards Dew enterpri...

A: Solution Good in transit Refers to merchandise and other type of inventory that have left the shipp...

Q: What is the role of ethics in accounting and business?

A: Ethics means the principles that govern a person's behavior and activities. These are the morals tha...

Q: Jerry and Ann paid the following amounts during the current year: Interest on automobile loan $1,50...

A: Introduction:- Some of the itemized deductions are enumerated as below:-

Q: Red Rock Bakery purchases land, building, and equipment for a single purchase price of $500,000. How...

A: Allocation percentage = Estimated fair value of individual assets / Total estimated fair value of al...

Q: Aug. 9) Paid $125 cash for shipping charges related to the August 5 sale to Baird Corp. Aug. 10) Bai...

A: Impact on Income - Income = Revenue - Expenses All the Income earned are added to it and expense are...

Q: The following properties were identified upon the death of Mr. B: Car, registered in the name of his...

A: Merchandise consigned to Mr. B , House nad lot constituted as family home, taxicab, taxicab franchis...

Q: Choose ONE of the MAS studied in this unit from the list below, and answer the questions that follow...

A: given • Budgeting System

Q: Bond X and bond Y both are issued by the same company. Each of the bonds has a face value of $100,00...

A: The issue price of Bonds is equal to the present value of all coupon payments and maturity value dis...

Q: Year 1 Year 2 S01,000 $72.500 $18,500 Year 3 NOI S4,640 S08,426 DS $72.500 S2,500 Cash flow $72,140 ...

A: solution concept dividend rate It is known as the rate of dividend or dividend y...

Q: the cash interest paid is:

A: Bonds are issued by company to raise funds for running business. Bonds are issued either at par valu...

Q: The Social Security Administration increased the taxable wage base from $127,200 to $128,400. The 6....

A: Social Security Tax: The Social Security tax is a federal tax placed on both employers and workers i...

Q: 2. The cash settlement of all liabilities is referred to as realization. 1 1. Liquidation is the pro...

A: In case of interlinked question, as per bartleby guidelines answer first three only 1) When the co...

Q: What three roles can an accountant fill in relation to the AIS? Describe them.

A: Accounting information system is written as AIS. It is the system used by accountants, managers, aud...

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- LO2 Joyce Lee earns 30,000 a year. Her employer pays a matching Social Security tax of 6.2% on the first 118,500 in earnings, a Medicare tax of 1.45% on gross earnings, and a FUTA tax of 0.6% and a SUTA tax of 5.4%, both on the first 7,000 in earnings. What is the total cost of Joyce Lee to her employer? (a) 32,295 (b) 30,000 (c) 30,420 (d) 32,715Harvey Cook, 45, is a recently divorced father of two children, ages 10 and 7. He currently earns $95,000 a year as an operations manager for a utility company. The divorce settlement requires him to pay $1,500 a month in child support and $400 a month in alimony to his ex-wife. Harvey is now renting an apartment, and the divorce settlement left him with about $100,000 in savings and retirement benefits. His employer provides a $75,000 life insurance policy. Harvey’s ex-wife is currently the beneficiary listed on the policy. What advice would you give to Harvey? What factors should he consider in deciding whether to buy additional life insurance at this point in his life? If he does need additional life insurance, what type of policy or policies should he buy? Use Worksheet 8.1 to help answer these questions for Harvey.Use Figure 12.15 to complete the following problem. Roland Inc. employees monthly gross pay information and their W-4 Form withholding allowances follow. Rolands payroll deductions include FICA Social Security at 6.2%, FICA Medicare at 1.45%, FUTA at 0.6%, SUTA at 5.4%, federal income tax (based on withholdings table) of gross pay, state income tax at 3% of gross pay, and health insurance coverage premiums of $1,000 split 50% employees and 50% employer. Assume each employee files as single, gross income is the same amount each month, October is the first month of business operation for the company, and salaries have yet to be paid. Record the entry or entries for accumulated employee and employer payroll for the month of October; dated October 31.

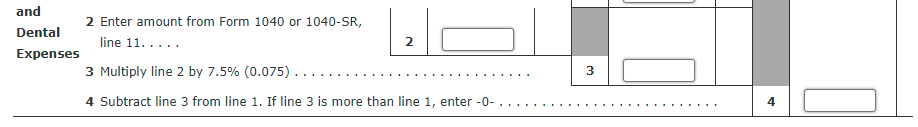

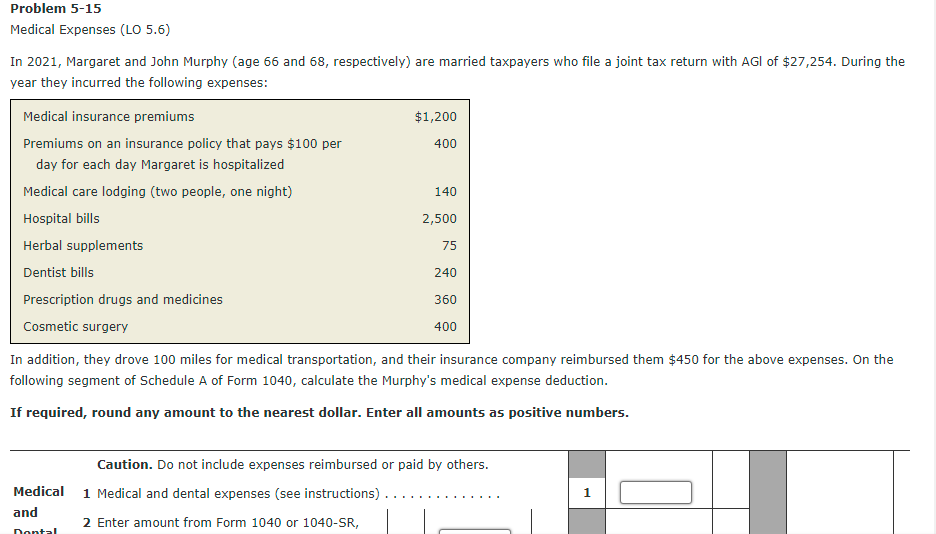

- LO.2 What is the taxpayers gross income in each of the following situations? a. Darrin received a salary of 50,000 from his employer, Green Construction. b. In July, Green gave Darrin an all-expense-paid trip to Las Vegas (value of 3,000) for exceeding his sales quota. c. Megan received 10,000 from her employer to help her pay medical expenses not covered by insurance. d. Blake received 15,000 from his deceased wifes employer to help him in his time of greatest need. e. Clint collected 50,000 as the beneficiary of a group term life insurance policy when his wife died. The premiums on the policy were paid by his deceased wifes employer.Medical Expenses (LO 5.6) In 2019, Margaret and John Murphy (age 66 and 68, respectively) are married taxpayers who file a joint tax return with AGl of $26,100. During the year they incurred the following expenses: Medical insurance premiums $1,300 Premiums on an insurance policy that pays $100 per day for each day Margaret is hospitalized 400 Medical care lodging (two people, one night) 65 Hospital bills 2,100 Doctor bills 850 Dentist bills 200 Prescription drugs and medicines 340 Psychiatric care 350 In addition, they drove 80 miles for medical transportation, and their insurance company reimbursed them $800 for the above expenses. On the following segment of Schedule A of Form 1040, calculate the Murphy's medical expense deduction. If required, round any amount to the nearest dollar. Enter all amounts as positive numbers.Problem 10-39 (LO. 2, 3, 4, 5, 6, 7) Linda, who files as a single taxpayer, had AGI of $280,000 for 2022. She incurred the following expenses and losses during the year: Medical expenses (before the 7.5%-of-AGI limitation) $33,000 State and local income taxes 4,800 State sales tax 1,300 Real estate taxes 6,000 Home mortgage interest 5,000 Automobile loan interest 750 Credit card interest 1,000 Charitable contributions 7,000 Casualty loss (before the 10%-of-AGI limitation but after the $100 floor; not in a Federally declared disaster area) 34,000 Unreimbursed employee business expenses 7,600 Calculate Linda's allowable itemized deductions for the year.$fill in the blank 1.

- Problem 10-25 (LO. 2) For calendar year 2020, Jean was a self-employed consultant with no employees. She had $80,000 of net profit from consulting and paid $7,000 in medical insurance premiums on her policy covering 2020. How much of these premiums may Jean deduct as a deduction for AGI? As an itemized deduction? If an amount is zero, enter "0". Self-employed persons can deduct fill in the blank 1 % of their medical insurance premiums as a deduction for AGI in 2020. Thus, Jean may deduct $fill in the blank 2 as a deduction AGI and she may deduct $fill in the blank 4 as an itemized deduction (subject to the AGI floor).Problem 5-3Individual Retirement Accounts (LO 5.3) Karen, 28 years old and a single taxpayer, has a salary of $35,000 and rental income of $33,000 for the 2021 calendar tax year. Karen is covered by a pension through her employer. AGI phase-out range for traditional IRA contributions for a single taxpayer who is an active plan participant is $66,000 – $76,000. Question Content Area a. What is the maximum amount that Karen may deduct for contributions to her traditional IRA for 2021?$fill in the blank abcab0f9afd1fe0_1 Question Content Area b. If Karen is a calendar year taxpayer and files her tax return on August 15, what is the last date on which she can make her contribution to the IRA and deduct it for 202Subject - Acounting Problem 7-6Earned Income Credit (LO 7.2) Diane is a single taxpayer who qualifies for the earned income credit. Diane has two qualifying children who are 3 and 5 years old. During 2022, Diane's wages are $19,800 and she receives dividend income of $1,200. Number of Qualifying Children Other than joint filers Joint filers Phaseout Begins Phaseout Ends Phaseout Begins Phaseout Ends None $11,610 $21,430 $17,560 $27,380 1 19,520 42,158 25,470 48,108 2 19,520 47,915 25,470 53,865 3 or more 19,520 51,464 25,470 57,414 Calculate Diane's earned income credit $ Would you kindly assist and explain:) I'm grateful for your help :)

- Problem 10-23 (LO. 2) Reba is a single taxpayer. Lawrence, Reba's 84-year-old dependent grandfather, lived with Reba until this year, when he moved to Lakeside Nursing Home because he needs specialized medical and nursing care. During the year, Reba made the following payments on behalf of Lawrence: Room at Lakeside $11,000 Meals for Lawrence at Lakeside 2,200 Doctor and nurse fees at Lakeside 1,700 Cable TV service for Lawrence's room at Lakeside 380 Total $15,280 Lakeside has medical staff in residence. Disregarding the AGI floor, how much, if any, of these expenses qualifies for a medical expense deduction by Reba?$fill in the blank 1Problem 6-50 (LO. 1, 3) Chee, single, age 40, had the following income and expenses during 2021: Income Salary $43,000 Rental of vacation home (rented 60 days, used personally 60 days, vacant 245 days) 4,000 Municipal bond interest 2,000 Dividend from General Electric 400 Expenses Interest on home mortgage 8,400 Interest on vacation home 4,758 Interest on loan used to buy municipal bonds 3,100 Property tax on home 2,200 Property tax on vacation home 1,098 State income tax 3,300 State sales tax 900 Charitable contributions 1,100 Tax return preparation fee 300 Utilities and maintenance on vacation home 2,600 Depreciation on rental portion of vacation home 3,500 Calculate Chee's net income from the vacation home, itemized deductions and taxable income for the year. If Chee has any options, choose the method that maximizes his deductions. In your computations, round any fractions to four decimal places. Then, round any amounts to the…Problem 7-6Earned Income Credit (LO 7.2) Diane is a single taxpayer who qualifies for the earned income credit. Diane has two qualifying children who are 3 and 5 years old. During 2023, Diane's wages are $21,000 and she receives dividend income of $1,200. Other Than Joint Filers Joint Filers QualifyingChildren Phase-outBegins Phase-outEnds Phase-outBegins Phase-outEnds None $9,800 $17,640 $16,370 $24,210 1 21,560 46,560 28,120 53,120 2 21,560 52,918 28,120 59,478 3 or more 21,560 56,838 28,120 63,398 Calculate Diane's earned income credit using the EIC table in Appendix B.