Enter the January 1 balances in T Also prepare T accounts for the following: Paid-In Capital from Sale of Stock Dividends Distributable; Stock Dividends; Cash Dividends. Journalize the entries to record the transactions, and post to the eight selected acc Brenare a retained earnings statement for the year ended December 31, 2016. f the December 31, 2016, balance s

Enter the January 1 balances in T Also prepare T accounts for the following: Paid-In Capital from Sale of Stock Dividends Distributable; Stock Dividends; Cash Dividends. Journalize the entries to record the transactions, and post to the eight selected acc Brenare a retained earnings statement for the year ended December 31, 2016. f the December 31, 2016, balance s

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter12: Corporations: Organization, Stock Transactions, And Dividends

Section: Chapter Questions

Problem 12.4APR: Entries for selected corporate transactions Morrow Enterprises Inc. manufactures bathroom fixtures....

Related questions

Question

100%

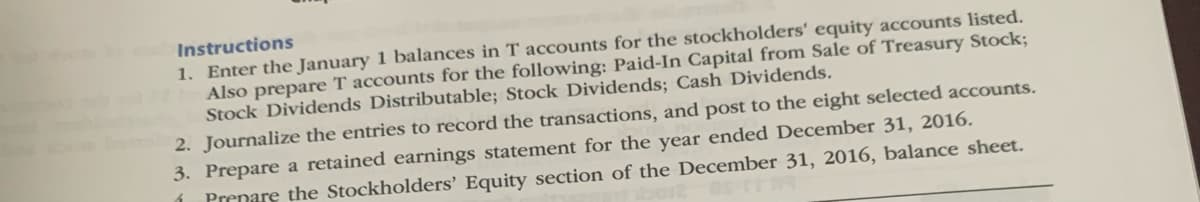

Transcribed Image Text:Instructions

1. Enter the January 1 balances in T accounts for the stockholders' equity accounts listed.

Also prepare T accounts for the following: Paid-In Capital from Sale of Treasury Stock;

Stock Dividends Distributable; Stock Dividends; Cash Dividends.

2. Journalize the entries to record the transactions, and post to the eight selected accounts.

3. Prepare a retained earnings statement for the year ended December 31, 2016.

Prenare the Stockholders’ Equity section of the December 31, 2016, balance sheet.

Transcribed Image Text:PR 11-4A

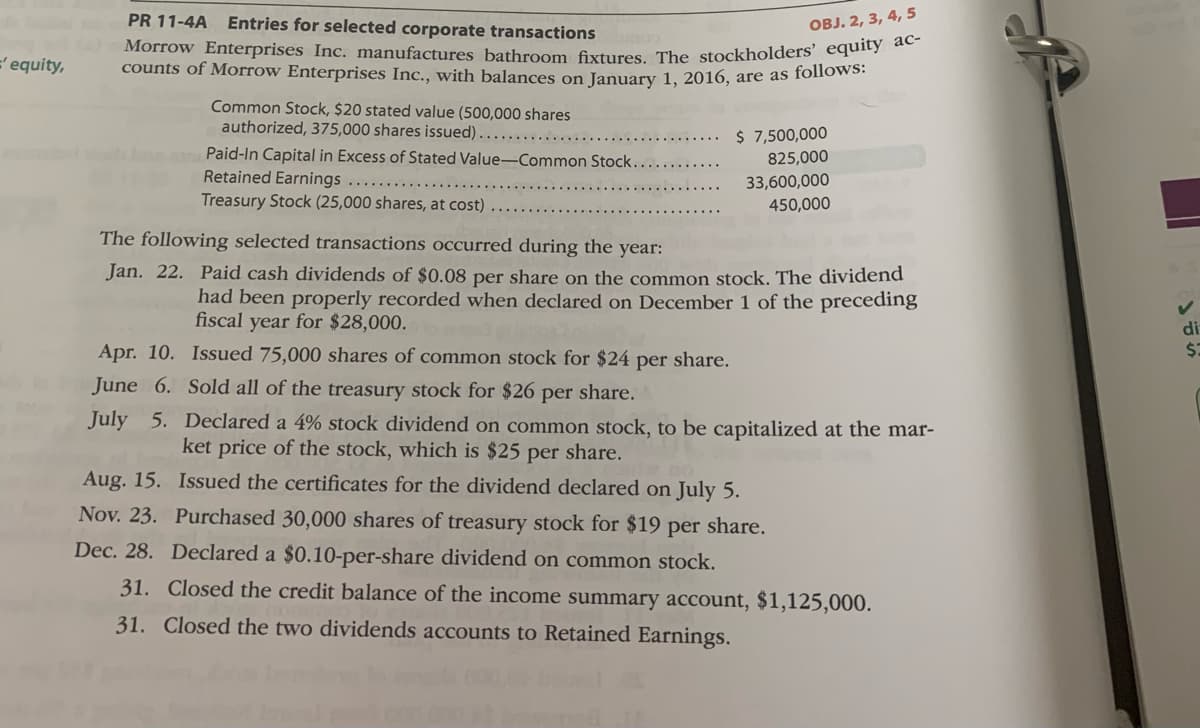

Entries for selected corporate transactions

оBJ. 2, 3, 4, 5

Morrow Enterprises Inc. manufactures bathroom fixtures. The stockholders' equity ae

counts of Morrow Enterprises Inc., with balances on January 1, 2016, are as foimower

E'equity,

Common Stock, $20 stated value (500,000 shares

authorized, 375,000 shares issued).

$ 7,500,000

825,000

Paid-In Capital in Excess of Stated Value-Common Stock.

Retained Earnings ....

Treasury Stock (25,000 shares, at cost)

33,600,000

450,000

The following selected transactions occurred during the year:

Jan. 22. Paid cash dividends of $0.08 per share on the common stock. The dividend

had been properly recorded when declared on December 1 of the preceding

fiscal year for $28,000.

Apr. 10. Issued 75,000 shares of common stock for $24 per share.

June 6. Sold all of the treasury stock for $26 per share.

July 5. Declared a 4% stock dividend on common stock, to be capitalized at the mar-

ket price of the stock, which is $25 per share.

Aug. 15. Issued the certificates for the dividend declared on July 5.

Nov. 23. Purchased 30,000 shares of treasury stock for $19 per share.

Dec. 28. Declared a $0.10-per-share dividend on common stock.

31. Closed the credit balance of the income summary account, $1,125,000.

31. Closed the two dividends accounts to Retained Earnings.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning