entered into a contract beginning January 1, 2025.

Q: Selected accounts of Blue Spruce Limited at December 31, 2023, follow: Finished Goods Inventory…

A: Statements of financial position includes the list of an organization's assets, liabilities, and…

Q: Hahn Company uses a job-order costing system. Its plantwide predetermined overhead rate uses direct…

A: Plantwide predetermined overhead rate is determined to calculate the overhead applied to the job.…

Q: It has been suggested that published accounting statements should attempt to be relevant,…

A: Relevance Relevance in accounting refers to the usefulness of the reported information. Relevant…

Q: Question 1: Assume the following information pertaining to Star Company: Prime costs $…

A: Manufacturing costs: Manufacturing costs are the costs which are directly associated with products.…

Q: Match the appropriate parts of tax for the following purchase. You purchase a new pair of shoes for…

A: Tennessee State Sales Tax The sale of goods and services inside the state of Tennessee is subject to…

Q: Required information [The following information applies to the questions displayed below.] Carlberg…

A: The average cost per unit is calculated as total cost divided by number of units produced. The…

Q: ssets $50,000 $25,000 $10,000 Retained Earnings $15,000 Suppose in year two the company plans to…

A: The accounting equation states that assets equals to sum of liabilities and shareholders equity. The…

Q: 2. Costa farms borrowed $6,100 6 years ago to purchase a new automated fertilizer. They have made no…

A: The concept of time value of money will be used in this case. We are provided with present value,…

Q: Current Attempt in Progress Sweet Company has the following securities in its portfolio on December…

A:

Q: [The following information applies to the questions displayed below.] Green Wave Company plans to…

A: T-accounts are the ledger accounts which are prepared for the purpose of determining the…

Q: Carlberg Company has two manufacturing departments, Assembly and Painting. The Assembly department…

A: Ghhgggggg

Q: at is the amount of bonus given by D to the existing partners?

A: Partnership is the firm which is run by two or more partners on the basis of partnership agreement,…

Q: On January 1, 2019, Pepin Company adopts a compensatory share option plan for its 50 executives. The…

A: SOLUTION:- 1. 2019 2020 2021 Estimated (Actual) Compensation Cost 119000 119000…

Q: Corporation owns $1,300,000 of Branch Pharmaceuticals bonds and classifies its investment as…

A: In accounting for equity there is comprehensive income which shows change in overall equity…

Q: Jamie Lee is reviewing her finances one month later. She has provided the actual amounts paid below.…

A: An income statement shows a company revenues, expenses, and profitability over a period of time.

Q: iz K This question: 1 point(s) possible A. $9,660 B. $6,280 OC. $3,380 OD. $2,900 Submit quiz At the…

A: Accounting equation Assets = liabilities + equity Which means the assets which are owned by a…

Q: At the end of the prior annual reporting period, Barnard Corporation's balance sheet showed the…

A: The statement of shareholders' equity include the amount for the accounts that belongs to the…

Q: Assume that IBM leased equipment that was carried at a cost of $163,000 to Ivanhoe Company. The term…

A: Journal entries is a tool for recording business transactions into accounting records.

Q: Sandy and Dave formed a law partnership, agreeing to split the income 50:50. The partnership had net…

A: Answer Given that profit sharing ratio of sandy and Dave is 50 : 50 ( equal share ) During the year…

Q: Luthan Company uses a predetermined overhead rate of $23.80 per direct labor-hou This predetermined…

A: The manufacturing overhead Applied is included in the manufacturing cost of product. The overhead is…

Q: Jimmy has fallen on hard times recently. Last year he borrowed $343,000 and added an additional…

A: Answer The real estate is worth $277,800 and Jimmy has $47,200 in other assets but no other…

Q: The balance sheet account balances of the Dominic Inn at the end of 20X3 are as follows: $ 10,000…

A: A company's assets, liabilities, equity capital, total debt, and other items as of a specific point…

Q: Douglass Minerals mines ore and then processes it into other products. At the end of the mining…

A: Answer: Please fallow the answer below: Requirement A; Calculation of Net Realizable value of…

Q: The following is a December 31, 2024, post-closing trial balance for Almway Corporation. Debits $…

A: Balance sheet is prepared by the business entities so that the investors and other stakeholders…

Q: How would the first P100,000 of available assets be distributed?

A: Total External liabilities are 70000 and partner's loan is 20000. Out of realization of 100000,…

Q: Your client, Albert Hall Leasing Company, is preparing a contract to lease a machine to Souvenirs…

A: Lease is an agreement between the owner of the property or asset and other party who wants to use…

Q: Presented below are two independent situations related to future taxable and deductible amounts…

A: In relation to an asset or a liability, certain differences arise when the value recorded in the…

Q: (CO C) Suzanne transfers a building with an adjusted basis of $60,000 and a fair market value of…

A: Solution: 1. The gain is $60,000 2. The basis would be the fair value of $120,000

Q: What is a job order cost system? Describe a situation in which you would use job order cost…

A: Costing systems adopted by manufacturing entities differ according to their nature of operations. It…

Q: Maya company has seen slow but steady growth over the past 10 years. Maya company started small, and…

A: The internal controls framework for the effective initially evaluates the maturity of your overall…

Q: 7. On January 1, 2024, the Marjlee Company began construction of an office building to be used as…

A: Lets understand the basics. As per IAS 23 "Borrowing costs", interest expense incurred for the…

Q: Harris has the following data (VAT exclusive): Taxable sales are P 1,200,000 Exempted sales are P…

A: ANSWER:- VAT payable = P101,818.19. Explanation:- Value Added Tax (VAT) is a tax imposed on the…

Q: # Assume that Global Cleaning Service performed cleaning services for a department store on account…

A: This transaction increases Global Cleaning Service's assets by $180, because the company will…

Q: Darlene Inc. purchased 23,600 common shares (20%) of Carlyle Ltd. on January 1, Year 4, for…

A: Investment accounts include those assets, funds, and securities which are used for fulfilling some…

Q: Required information [The following information applies to the questions displayed below.) This…

A: Honor code- “Since you have posted a question with multiple sub-parts, we will provide the solution…

Q: . It has been suggested that published accounting statements should attempt to be relevant,…

A: ANSWER: The demand for accounting information by investors, lenders, creditors, and others leads…

Q: List three (3) of the five (5) internal control components stated by the Committee of Sponsoring…

A: 1. Control Environment: Establishes the tone of an organization, influencing the control…

Q: Debtors were shown in balance sheet at Rs 80,000. Debtors were realised at a discount of 7%. The…

A: INTRODUCTION: The revenue recognition principle or the realization idea in accounting is a mechanism…

Q: Jeremy (unmarried) earned $100,300 in salary and $6,300 in interest income during the year. Jeremy's…

A: A tax refund is a reimbursement to taxpayers who have overpaid their taxes, often due to having…

Q: Crane's Market recorded the following events involving a recent purchase of merchandise: Received…

A: Lets understand the basics. Seller in order to attract early payments give discount terms. They term…

Q: Herring Wholesale Company has a defined benefit pension plan. On January 1, 2021, the following…

A: Solution: 1. Calculation of Amortized to 2021 pension expenses: Net Gain (Excess of Previous gains…

Q: The lender charges three points to get the mortgage. How much do the points cost you?

A: Solution Calculated the points cost Cost of one unit Home = $200000 Less:25% Down…

Q: The following are independent situations. Situation 1: Ivanhoe Cosmetics acquired 10% of the 215,000…

A: For situation 1: The investment need to be recorded at Fair value method as it is given that…

Q: Bailey Company manufacturers and sells one product for $39 per unit. The company maintains no…

A: Disclaimer : “Since you have posted a question with multiple sub-parts, we will solve first three…

Q: F is employed by a public corporation. In year 1, F was granted a stock option to acquire 4,000…

A: In almost every nation on earth, governments impose taxes as mandatory fees on people or things.…

Q: 16 Given the following, prepare a cost of goods manufactured schedule and partial income statement.…

A: The purpose of an income statement is to provide information about the business entities' annual…

Q: Darlene Inc. purchased 23,600 common shares (20%) of Carlyle Ltd. on January 1, Year 4, for…

A: Investment accounts include assets, funds, and securities that are used for specific financial…

Q: On June 1, 2020, Waterway Industries loaned Carla Vista $504000 on a 11% note, payable in five…

A: Calculation of Waterway's interest receivable on loan to Carla Vista. Interest receivable =…

Q: The Allwardt Trust is a simple trust that correctly uses the calendar year for tax purposes. Its…

A: ANSWER: The Allwardt Trust is a simple trust that correctly uses the calendar year for tax purposes.…

Q: Bailey Company manufacturers and sells one product for $39 per unit. The company maintains no…

A: The various costs incurred during the production are classified as variable and fixed cost. The…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Net present value method for a service company Coast-to-Coast Inc. is considering the purchase of an additional delivery vehicle for 70,000 on January 1, 20Y1. The truck is expected to have a five-year life with an expected residual value of 15,000 at the end of five years. The expected additional revenues from the added delivery capacity are anticipated to be 65,000 per year for each of the next five years. A driver will cost 40,000 in 20Y1, with an expected annual salary increase of 2,000 for each year thereafter. The annual operating costs for the truck are estimated to be 6,000 per year. a. Determine the expected annual net cash flows from the delivery truck investment for 20Y120Y5. b. Compute the net present value of the investment, assuming that the minimum desired rate of return is 12%. Use the present value table appearing in Exhibit 2 of this chapter. c. Is the additional truck a good investment based on your analysis? Explain.Calculate the following: The first year of depreciation on a residential rental building costing $250,000 purchased June 2,2019. $_____________ The second year (2020) of depreciation on a computer costing $5,000 purchased in May 2019, using the half-year convention and accelerated depreciation considering any bonus depreciation taken. $______________ The first year of depreciation on a computer costing $2,800 purchased in May 2019, using the half-year convention and straight-line depreciation with no bonus depreciation. $______________ The third year of depreciation on business furniture costing $10,000 purchased in March 2017, using the half-year convention and accelerated depreciation but no bonus depreciation. $______________On March 1, 2022, AGGREGATES Company enters a contract to build a hotel which is estimated to cost P31,200,000. The company recognizes construction revenue over time. Data on this project for 2022-2024 follow: Contract Billings Costs incurred Est'd Costs to complete 2022 10,500,000 5,460,000 20,540,000 2023 12,500,000 9,984,000 13,156,000 2024 14,440,000 15,756,000 - The contract contains a penalty clause that penalizes the company a reduction of P70,000 from the contract price for every week of delay. In 2024, the contract was delayed for 8 weeks. What is the gross profit for 2024?A. 1,164,000 C. 1,724,000B. 1,466,400 D. 1,824,000

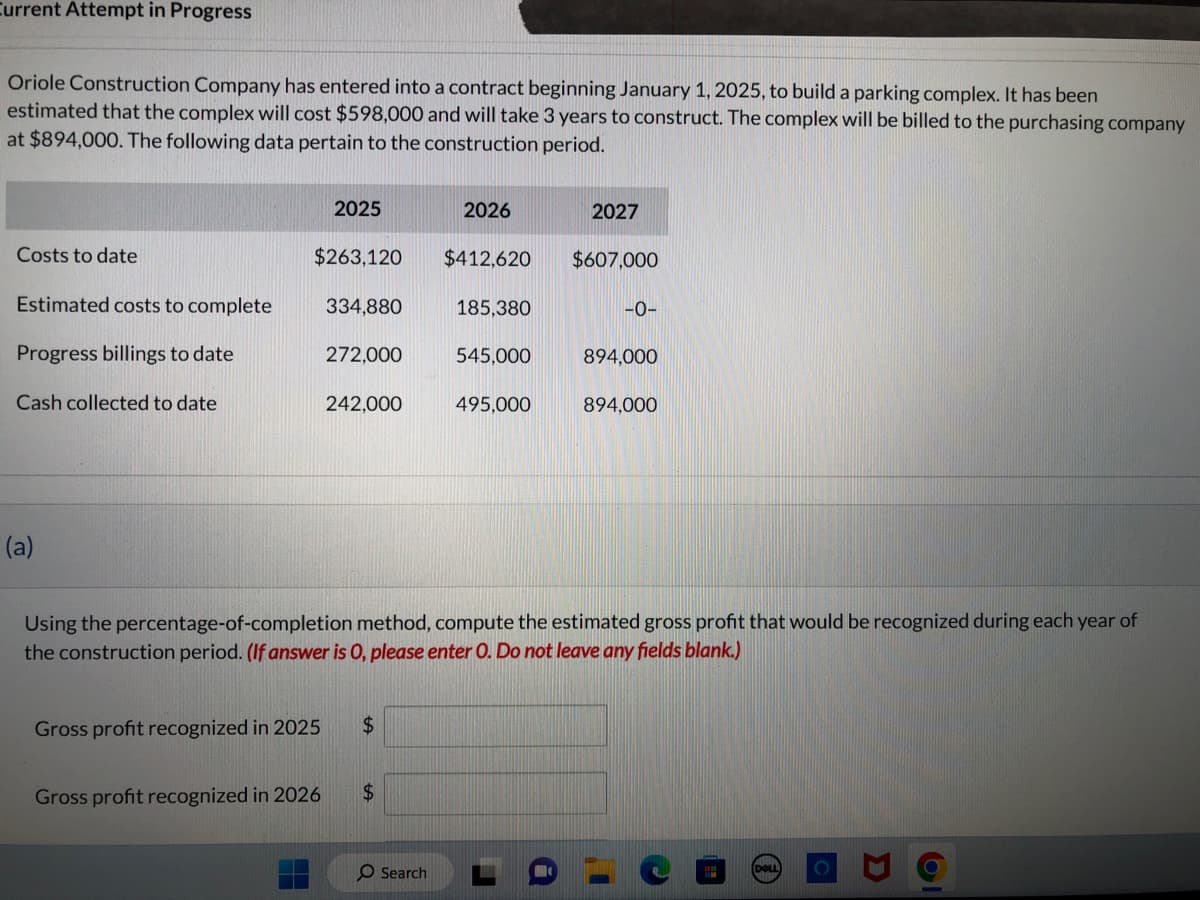

- Shanahan Construction Company has entered into a contract beginning January 1, 2020, to build a parking complex. It has been estimated that the complex will cost $609,000 and will take 3 years to construct. The complex will be billed to the purchasing company at $896,000. The following data pertain to the construction period. 2020 2021 2022 Costs to date $266,640 $412,080 $617,000 Estimated costs to complete 339,360 193,9200 –0– Progress billings to date 270,000 545,000 896,000 Cash collected to date 240,000 495,000 896,000 A/ Using the percentage-of-completion method, compute the estimated gross profit that would be recognized during each year of the construction period. Gross profit recognized in 2020: Gross profit recognized in 2021: Gross profit recognized in 2022: B/ Using the completed-contract method, compute the estimated gross profit that would be recognized during each year of the construction period. Gross profit recognized in 2020: Gross profit recognized in 2021: Gross…1.On March 1, 2022, AGGREGATES Company enters a contract to build a hotel which is estimated to cost P31,200,000. The company recognizes construction revenue over time. Data on this project for 2022-2024 follow:Contract BillingsCosts incurredEst’d Costs to Complete2022 10,500,000 5,460,000 20,540,0002023 12,500,000 9,984,000 13,156,0002024 14,440,000 15,756,000 -The contract contains a penalty clause that penalizes the company a reduction of P70,000 from the contract price for every week of delay. In 2024, the contract was delayed for 8 weeksWhat is the gross profit for 2024?A. 1,164,000 C. 1,724,000B. 1,466,400 D. 1,824,000 2.MOC Construction Company started work on three job sites during the current year. Any costs incurred are expected to be recoverable. Data relating to the three jobs are given below:Site Contract PriceCost IncurredEstimated Costs to CompleteBillings on ContractCollections on Billings1 5,000,000 3,750,000 - 5,000,000 5,000,0002 7,000,000 1,000,000 4,000,000 900,000…Paul Constructions has entered into a contract beginning January 1, 2020, to build a pool. It has been estimated that the pool will cost P300,000, and will take three years to construct. The pool will be billed to the purchasing at P450,000. The following data pertain to the construction period. 2020 135,000 165,000 2021 210,000 90,000 2022 0 Cost to date: Estimated cost to complete. Progress billing to date. Cash collected to date 135.000 120.000 275.000 250,000 450,000 450.000 During 2020, Costs incurred include P15,000 standard materials stored at the site to be used in 2022 to complete the project. Using the percentage of completion method, compute the recognize gross profit for 2022: a. 52,500 b. 45,000 c. 97.500 d. 150,000 2. The CIP net of Progress billing is a. 27.500 current liability b. 32,500 current asset c. 167,500 current asset. d. 102,500 current liability

- Shanahan Construction Company has entered into a contract beginning January 1, 2020, to build a parking complex. It has been estimated that the complex will cost $600,000 and will take 3 years to construct. The complex will be billed to the purchasing company at $900,000. The following data pertain to the construction period. 2020 2021 2022 Costs to date $270,000 $450,000 $610,000 Estimated costs to complete 330,000 150,000 –0– Progress billings to date 270,000 550,000 900,000 Cash collected to date 240,000 500,000 900,000 Instructions a. Using the percentage-of-completion method, compute the estimated gross profit that would be recognized during each year of the construction period. b. Using the completed-contract method, compute the estimated gross profit that would be recognized during each year of the construction period.On March 1, 2022, ABC Co. was contracted to construct a building for a customer at a total contract price of P16,500,000. The building was estimated to be completed in 2024. The following data were made available: 2022 2023 2024 Contract costs incurred P6,400,000 P5,200,000 P2,900,000 Estimated costs to complete 6,400,000 2,900,000 - Progress billings each year 6,400,000 7,000,000 3,100,000 How much is the realized gross profit for 2023?Casio Co. recognizes construction revenue and expenses using the percentage-of-completion method. During 2023, a single long-term project was begun, which continued through 2025. Information on the project follows: 2023 $100,000 2024 $300,000 12/31 Accounts Receivable balance 125,000 162,000 Construction expenses for year Gross Profit recognized in year Billings during year 52,000 100,000 100,000 420,000 The 12/31/24 CIP balance is: Select one: a.$139,000 b.$452,000 c.$187,000 d.$152,000 e.$439,000

- In 2024, Cupid Construction Company (CCC) began work on a two-year fixed price contract project. CCC recognizes revenue over time according to percentage of completion for this contract, and provides the following information (dollars in millions): Accounts receivable, 12/31/2024 (from construction progress billings) $ 37.5 Actual construction costs incurred in 2024 $ 135 Cash collected on project during 2024 $ 105 Construction in progress, 12/31/2024 $ 207 Estimated percentage of completion during 2024 60% What were the construction billings by CCC during 2024?On February 1, 2020, Mar Contractors agreed to construct a building at a contract price of $15,400,000. Mar initially estimated total construction costs would be $12,000,000 and the project would be finished in 2023. Information relating to the costs and billings for this contract during 2020-2022 is as follows: Total costs incurred during the year Estimated costs to complete Customer billings to date Collections to date 2020 4,500,000 7,500,000 6,600,000 6,000,000 2021 5,300,000 4,200,000 12,000,000 10,500,000 2022 4,000,000 1,800,000 13,800,000 13,500,000 a. Using the percentage-of-completion method, prepare schedules to compute the profit or loss to be recognized as a result of this contract and all the necessary journal entries for the years ended December 31, 2020, 2021, and 2022. b. Using the cost-recovery method, prepare schedules to compute the profit or loss to be recognized as a result of this contract all the necessary journal entries to record the costs,…