Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter3: Basic Accounting Systems: Accrual Basis

Section: Chapter Questions

Problem 3.6.4P: Adjustment process and financial statements Adjustment data for Ms. Ellen’s Laundry Inc. for the...

Related questions

Question

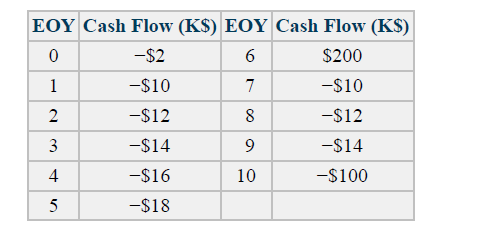

Jupiter is considering investing time and administrative expense on an effort that promises one large payoff in the future, followed by additional expenses over a 10-year horizon. The cash flow profile is shown in the table below. Jupiter’s MARR is 12%/year. Solve, a. What is the annual worth of this investment? b. What is the decision rule for judging the attractiveness of investments based on annual worth? c. Should Jupiter invest?

Transcribed Image Text:EOY Cash Flow (K$) EOY Cash Flow (K$)

-$2

$200

1

-$10

7

-$10

2

-$12

-$12

3

-$14

9

-$14

4

-$16

10

-$100

5

-$18

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning