Q: mine the IRR of this project. Is it acceptable? b.Assuming that the cash inflows continue to be…

A:

Q: A company is considering two projects. The discount rate is 10 percent, and the projects' cash flows…

A: IRR is the rate at which NPV is zero

Q: Your company is considering two mutually exclusive projects. Project A has an initial cost of…

A: Net Present Value: It is the present worth of the firm project cashflows. It is computed by reducing…

Q: An analyst has gathered the following information about two projects, each with a 12% required rate…

A: Capital budgeting decisions are a kind of long-term decision that the management of a company has to…

Q: Kenny, Inc. has identified the following two mutually exclusive projects. Project A -$25,000 20,000…

A: Capital budgeting indicates the evaluation of the profitability of possible investments and projects…

Q: Please calculate the payback period, IRR, MIRR, NPV, and PI for the following two mutually exclusive…

A: Capital budgeting is the process by which investors determine the value of a potential investment…

Q: A company is considering two projects. The discount rate is 10 percent, and the projects' cash flows…

A: Net present value (NPV) is the difference between the present value of cash inflows and cash…

Q: A firm with a cost of capital of 15% is evaluating two independent projects utilizing the internal…

A: The rate at which the investor is expected to grow annual on its investment refers as IRR (Internal…

Q: The Janet Corporation is considering two mutually exclusive projects. The free cash flows associated…

A: Since more than three parts are asked at a time. The answer for first three questions is only…

Q: Elysian Fields, Inc., uses a maximum payback period of 6 years and currently must choose between two…

A: A method of capital budgeting that helps to evaluate the time period a project requires to cover its…

Q: Kaleb Konstruction, Inc., has the following mutually exclusive projects available. The company has…

A: Payback period is the amount of time required to recover initial investment. Payback period =Initial…

Q: A small company has P20,000 in surplus capital that it wishes to invest in new revenue producing…

A: The question is based on the concept of capital budgeting with capital limitations. Internal rate of…

Q: Your company must choose one of two mutually exclusive projects. Project A costs$2,000 today and has…

A: Hello. Since you have posted multiple questions and not specified which question needs to be solved,…

Q: A company is considering two projects. The discount rate is 10 percent, and the projects' cash flows…

A: IRR is the rate at which NPV is zero

Q: onsider the following project. Costs: $100,000, at time t = 0. $45,000, at time t = 4. Income: Three…

A: The question is based on the concept of calculating the future value of cash flows in a project at…

Q: 1. Kenny, Inc. has identified the following two mutually exclusive projects. Project A -$25,000…

A: Net present value is the technique used in capital budgeting to evaluate the acceptability of the…

Q: Hello, can you please answer this problem with excel and formulas, thank you! Kaleb Konstruction,…

A: a) The payback period alludes to what extent it takes for a speculator to hit breakeven to recoup…

Q: The Janet Corporation is considering two mutually exclusive projects. The free cash flows associated…

A: Given:

Q: George Company is evaluating two mutually exclusive projects with 3-year lives. Each project…

A: Capital budgeting process can be defined as a tool of evaluating the profitability and feasibility…

Q: George Company is evaluating two mutually exclusive projects with 3-year nves. Each project requires…

A: Disclaimer: “Since you have posted a question with multiple sub-parts, we will solve first three…

Q: Elysian Fields, Inc., uses a maximum payback period of 6 years and currently must choose between two…

A: Computation:

Q: Project P has a cost of $1,000 and cash flows of $300 per year for three years plus another $1,000…

A: A method of capital budgeting that helps to evaluate the time period a project requires to cover its…

Q: Find internal rate of return of a project with an initial cost of $43,000, expected net cash inflows…

A: Working of the IRR of the Project is shown below: Hence, the IRR is 14.90%.

Q: Project S has a cost of $10,000 and is expected to produce benefits (cash flows) of $3,000 per year…

A: Net Present Value: The net present value can be calculated by subtracting the present value of all…

Q: Your division is considering two projects. The discount rate is 10 percent, and the projects’ after-…

A: “Hey, since you have posted a question with multiple sub-parts, we will answer first three sub parts…

Q: You are considering the following two mutually exclusive projects. The required return on each…

A: NPV can be calculated by following function in excel =NPV(rate,value1,[value2],…) + Initial…

Q: An investment of P10,000 can be made in project that will produce a uniform annual revenue of P6310…

A: The question is related to Annual Cost Method. In this method, interest on the original…

Q: Consider the following projects, X and Y where the firm can only choose one. Project X costs $1500…

A: Here, WACC is 11% Cost of Project X is $1,500 Cash Flows of Project X are as follows: Year Cash…

Q: Three mutually exclusive design alternatives are being considered. The estimated cash flows for each…

A: The capital budgeting is a technique that helps to analyze the profitability of the project.

Q: If you apply the IRR decision rule, which investment will you choose? Why?

A: Internal rate of return is the rate at which the net present value of cash flows of the project…

Q: 1-Project K costs $75,000, its expected cash inflows are $15,000 per year for 10 years, and its WACC…

A: Part 1:Payback period refers to the time period required for an investment to recover its initial…

Q: A company is considering two projects. The discount rate is 10 percent, and the projects' cash flows…

A: Net present value (NPV) is the difference between the present value of cash inflows and cash…

Q: Project P has a cost of $1,000 and cash flows of $300 per year for three years plus another $1,000…

A: Time required of an investment to cover the investor’s expectation without considering time value…

Q: Three mutually exclusive design alternatives are being considered. The estimated cash flows for each…

A: MARR = 20℅ Cash flows: Year Project A Project B Project C Reference 0 -28000 -55000 -40000…

Q: 1. Determine which of the two (2) inveatment projecta your supervisor ahould choose, given a…

A: Given information : Year Project 1 Project 2 1 100000 75000 2 100000 75000 3 100000 75000…

Q: Find internal rate of return of a project with an initial cost of $43,000, expected net cash inflows…

A: Capital budgeting approaches are the techniques that the management of the company adopts to…

Q: Consider the following projects, X and Y where the firm can only choose one. Project X costs $1500…

A: Timeline of project refers to arrangement of all transaction related to a project in chronological…

Q: A project is expected to cost $30,000, with the capital due immediately. Four annual cash flows are…

A: Capital budgeting techniques are quantitative approaches that a company adopts while evaluating…

Q: Giant Equipment Ltd. is considering two projects to invest next year. Both projects have the…

A:

Q: u) Project P rcquires an mvcsiment of $95,000 and is expecled lo pro of $20,000 per year for 8…

A: (a): Payback = initial investment/annual cash flow

Q: Two mutually exclusive investment alternatives for implementing an office automation plan in an…

A: Net present value is the technique used in capital budgeting to evaluate the acceptability of the…

Q: Delta Gamma Inc. is considering two investment projects, each of which requires an up-front…

A: "Since you have posted a question with multiple sub-parts, we have solved the first three for you.…

Q: XYZ is considering a project that would last for 3 years and have a cost of capital of 18.20…

A: Year 0 1 2 3 Revenue $ - $ 12,500.00 $ 10,400.00 $…

Q: Proposal A Proposal B Benefits per year Benefits per year Probability $18,000 | Conservative=0.25…

A:

Q: Please calculate the payback period, IRR, MIRR, NPV, and PI for the following two mutually exclusive…

A: Formulas:

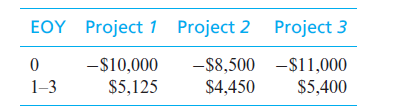

Consider the three mutually exclusive projects that follow. The firm’s MARR

is 10% per year. Solve, a. Calculate each project’s PW. b. Determine the

Step by step

Solved in 4 steps with 2 images

- Q - Akshu Cantrell Cash Flow: Year 5, Cash Flow $12,000 Year 4, Cash Flow $12,000Year 3, Cash Flow $11,000 Year 2, Cash Flow $11,000 Year 1, Cash Flow $10,500 Fuller Cash Flow: Year 5, Cash Flow $15,000 year 4, Cash Flow $14,000Year 3, Cash Flow $12,500 Year 2, Cash Flow $13,500 Year 1, Cash Flow $12,000 A home remodeling company is considering investing in two different house flips, Cantrell and Fuller. The company would like your help in determining which flip they should invest in. Assume the company uses a discount rate of 9 percent to analyze its projects. Use the Tableau Dashboard to assist in your analysis. Required: Calculate the net present value (NPV) of each house flip. Based on the NPV, which house(s) should the company pursue? Now assume the company has a limited amount to invest and must decide between Cantrell and Fuller. Which house should they select based on the NPV analysis?39.ABC sold land that cost $ 10,000 for $ 12,000. ABC will report: Select one: a. Net operating cash flow of $ 2,000. b. Net cash flow from financing of $ 2,000. c. Net cash flow from financing of $ 12,000. d. Net investment cash flow of $ 12,000.ACCOUNTS PAYABLE P60,000 ACCOUNTS RECEIVABLE P10,000 BUILDING ? CASH P30,000 EQUIPMENT P70,000 ARLYN VILLANUEVA, CAPITAL ? LAND P70,000 IF THE BALANCE OF THE VILLANUEVA, CAPITAL ACCOUNT WAS P210,000, WHAT WOULD BE THE BALANCE OF THE BUILDING ACCOUNT? P250,000 P40,000 P90,000 210,000

- Dec. 31, 20Y9. Dec.31, 20Y8 Cash $155,000 $150,000 Accounts Receivable $450,000 $400,000 Inventories $770,000 $750,000 Investments 0 $100,000 Land $500,000 0 Equipment $1,400,000 $1,200,000 Accumulated Depreciation Equipment ($600,000) ($500,000) Total Assets $2, 675,000 $ 2,100,000 Dec. 31, 20Y9 Dec.31, 20Y8 Accounts Payable $340,000 $300,000 Accrued Expense Payable $45,000 $50,000 Dividends Payable $30,000 $ 25,000 Common Stock $4 par $700,000 $ 600,000 Paid in Capital in excess of par-Common Stock $200,000 $175,000 Retained Earnings $ 1, 360,000 $ 950,000 Total Liabilities & Stockholders Equity $ 2, 675,000. $ 2, 100,000 Additional data obtained from an examination of the accounts in the ledger for 20Y7 are as follows: The investments were sold for…part 3 4 solution needed Year Net cashflows 0 -575,000 1 £125,000 2 £248,000 3 £176,000 4 £146,000Ma4. 1. Cash reserves on the Tri-State Medical Equipment Corporation's balance sheet presently amount to $111,200. When Tri-State pays cash for 20% of the purchase price of a new delivery truck, the cash payment will: 1) increase the company's cash reserves. 2) decrease cash on the balance sheet. 3) require an entry on the Statement of Retained Earnings. 4) require an entry to the Reserve for Depreciation on the income statement. 2. If an organization has operating income of $120,000, net income of $150,000, total revenue of $2,000,000, total assets of $1,000,000, and a net worth of $500,000, return on assets is: 1) 6.0%. 2) 7.5%. 3) 12.0%. 4) 15.0%. 5) 30.0%.

- QUESTION 2 (20) INFORMATION:Vista Limited intends purchasing a new machine and has a choice between the following two machines:Equipment A Equipment BInitial cost R220 000 R240 000Expected useful life 5 years 5 yearsScrap value Nil NilExpected net cash inflows: R REnd of:Year 1 55 000 70 000Year 2 60 000 70 000Year 3 62 000 70 000Year 4 60 000 70 000Year 5 70 000 70 000The company estimates that its cost of capital is 12%.Required:2.1 Calculate the Payback Period of both equipment. (Answers must be expressed in years, months and days). (4)2.2 Calculate the Accounting Rate of Return (on initial investment) for both equipment A and B. (Answers must be expressed to 2 decimal places). (5)2.3 Calculate the Net Present Value of each equipment. (Round off amounts to the nearest Rand. (6)2.4 Calculate the Internal Rate of Return of Equipment B. (5)Question 1 On March 1, ABC Co. began construction of a small building. The following expenditures were incurred for construction: Date Expenditures 3/1/2022 $ 300,0004/1/2022 400,0005/1/2022 620,000 6/1/2022 1,020,0007/31/2022 310,000 The building was completed and occupied on August 1. To help pay for construction $400,000 was borrowed on March 1 on a 12% three-year note payable. The only other debt outstanding during the year was a $200,000, 10% note issued two years ago. (a). Calculate the weighted-average accumulated expenditures. (Hint: using the following four-column schedule to calculate) Date Expenditures Capitalization Period Weighted-Average Accumulated Expenditures…XYZ Company Balance Sheet December 31, 20X2 Dec. 31, 20X2 Dec. 31, 20X1 Inc./Dec. Cash 25,000 22,000 3,000 Accounts Receivable 30,000 10,000 20,000 Inventories 23,000 19,000 4,000 Investments 15,000 40,000 (25,000) Land 60,000 0 60,000 Equipment 88,000 54,000 34,000 Accumulated depreciation--Equipment (8,000) (5,000) 3,000 233,000 140,000 Accounts payable 16,000 18,000 (2,000) Accrued expenses 20,000 3,000 17,000 Dividends payable 25,000 14,000 11,000 Common stock 120,000 80,000 40,000 Paid-in capital in excess of par 20,000 15,000 5,000 Retained earnings 32,000 10,000 22,000 233,000 140,000 a. The investments were sold for $24,000 cash. b. Equipment and land were acquired for cash. c. There…

- Question 2 20X6: Jane produced the following trial balance as at 30 June 20x6 $000 $000 Land at cost 2,160 Building at cost 1,080 Plant and equipment at cost 1,728 Intangible assets 810 Accumulated depreciation-30.6.20x5 Building 432 Plant and equipment 504 Interim dividend paid 108 Receivable and payable 585 Cash and bank balance 41.4 Inventory as at 30.6.20x6 586.8 Taxation 14.4 Deferred tax 37.8 Distribution cost 529.2 Administrative expenses 946.8 Retained earning b/f 891 Sales revenue 9480.6 Cost of sales 5909.4 Ordinary share of 50p each 2160 Share premium account 432 The following information is available: 1) A revaluation of the Land and Buildings on | July 20X5 resulted in an increase of £3,240,000 in the Land and £972,000 in the Buildings. This has not yet…Question 2 20X6: Jane produced the following trial balance as at 30 June 20x6 $000 $000 Land at cost 2,160 Building at cost 1,080 Plant and equipment at cost 1,728 Intangible assets 810 Accumulated depreciation-30.6.20x5 Building 432 Plant and equipment 504 Interim dividend paid 108 Receivable and payable 585 Cash and bank balance 41.4 Inventory as at 30.6.20x6 586.8 Taxation 14.4 Deferred tax 37.8 Distribution cost 529.2 Administrative expenses 946.8 Retained earning b/f 891 Sales revenue 9480.6 Cost of sales 5909.4 Ordinary share of 50p each 2160 Share premium account 432 The following information is available: 1) A revaluation of the Land and Buildings on | July 20X5 resulted in an increase of £3,240,000 in the Land and £972,000 in the Buildings. This has not yet…Exercise 9-03 a On March 1, 2022, Sandhill Co. acquired real estate, on which it planned to construct a small office building, by paying $85,000 in cash. An old warehouse on the property was demolished at a cost of $9,200; the salvaged materials were sold for $1,900. Additional expenditures before construction began included $1,400 attorney’s fee for work concerning the land purchase, $5,000 real estate broker’s fee, $8,900 architect’s fee, and $15,000 to put in driveways and a parking lot.(a) Determine the amount to be reported as the cost of the land. Cost of land $Enter a dollar amount