epare the journal entries to record Ibrahim's withdrawal under each of the

Chapter21: Partnerships

Section: Chapter Questions

Problem 57P

Related questions

Question

Transcribed Image Text:SCO

PROFESSOR:

NAME:

SECTION:

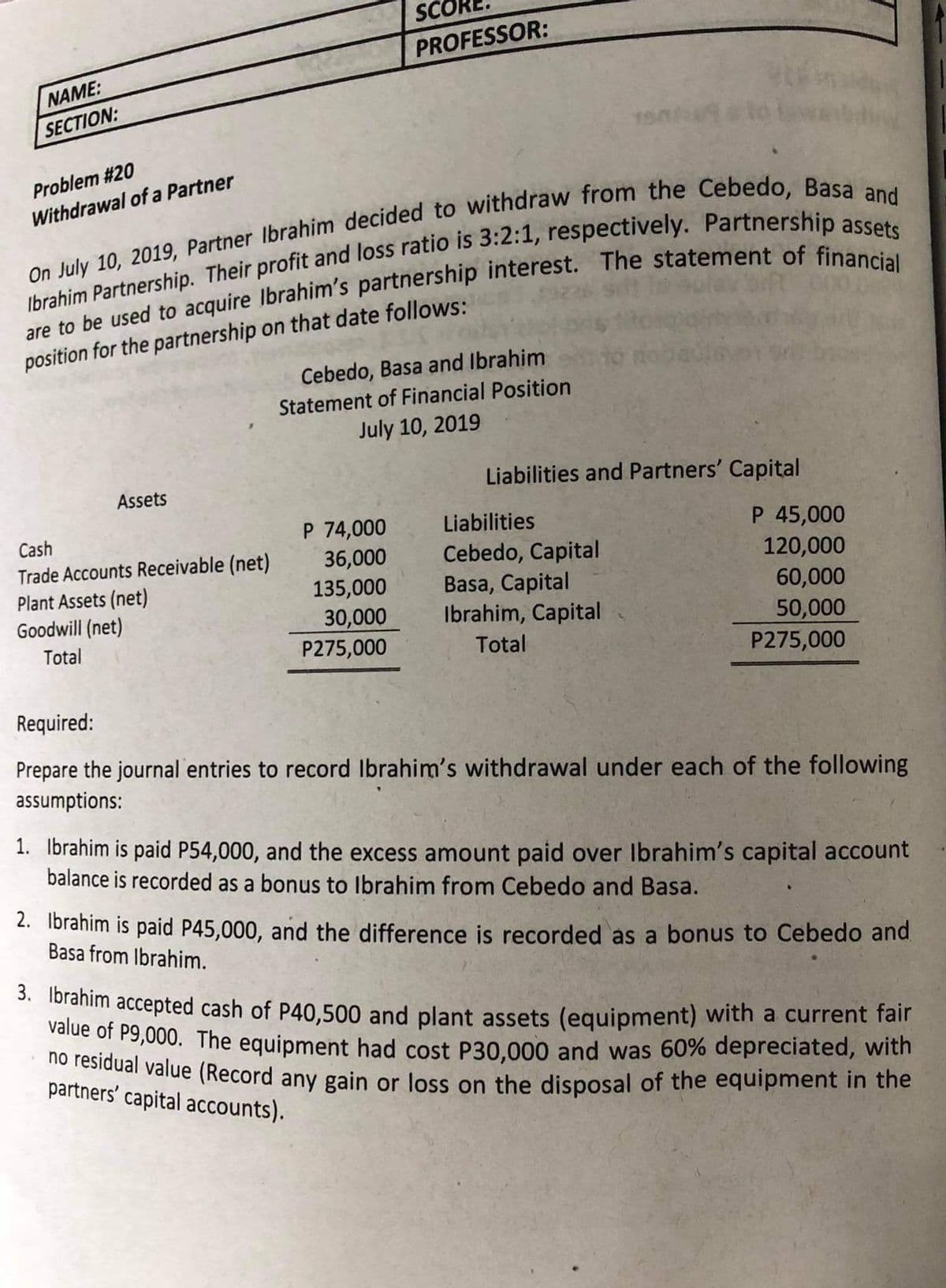

Problem #20

Withdrawal of a Partner

position for the partnership on that date follows:

Cebedo, Basa and Ibrahim

Statement of Financial Position

July 10, 2019

Liabilities and Partners' Capital

骨

Assets

P 74,000

36,000

135,000

30,000

P275,000

Liabilities

P 45,000

120,000

Cash

Trade Accounts Receivable (net)

Plant Assets (net)

Goodwill (net)

Cebedo, Capital

Basa, Capital

Ibrahim, Capital

60,000

50,000

P275,000

Total

Total

Required:

Prepare the journal entries to record Ibrahim's withdrawal under each of the following

assumptions:

1. Ibrahim is paid P54,000, and the excess amount paid over Ibrahim's capital account

balance is recorded as a bonus to Ibrahim from Cebedo and Basa.

2. Ibrahim is paid P45,000, and the difference is recorded as a bonus to Cebedo and

Basa from Ibrahim.

* 1oranim accepted cash of P40,500 and plant assets (equipment) with a current fair

value of P9,000. The equipment had cost P30.000 and was 60% depreciated, with

sidual value (Record any gain or loss on the disposal of the equipment in the

partners' capital accounts).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College