er part (d) and s

Q: Assume that Pope Enterprises held a S10.000, 10 percent six-month note signed by Mery Drevdon Decemb...

A: At the maturity date i.e. December 1, 2019, the maker i.e. Drew is responsible for the principal i.e...

Q: WHAT ARE THE SIGNIFICANT RISK YOU SHOULD CONSIDER UPON AUDITING CURRENT LIABILITIES AND HOW WOULD IT...

A: Current liabilities refers to the liabilities which will be due and payable by the organisation wit...

Q: a. Direct materials price variance (based on purchases) b. Direct materials efficiency variance c. D...

A: Every manufacturing unit has some estimated standard costs for the production based on the past reco...

Q: In the general information, the capital projects fund reports a $45,750 increase in its fund balance...

A: Solution :- Given, During 2020, the City of Coyote contracts to build a bus stop for schoolchildren ...

Q: Lucky Company's direct labor information for the month of February is as follows: Actual direct labo...

A: The variance is the difference between the actual data and standard output of the production.

Q: 9. How much is the utilities expense? * P2,400 debit P3,750 debit P3,750 credit P2,400 credit 10. Ho...

A: Answer - Part 9 - Correct Answer is Option A - P 2,400 Debit. If debits exceed credits, the accou...

Q: Under this concept, the entity would first use a fixed ratio of retained earnings and long-term debt...

A: Company have many method and Theory to arrange its finance. Following is the correct answer.

Q: According to the National Baseball Hall of Fame, at the end of 1979, the pitcher Nolan Ryan signed w...

A: Given that average CPI for 1980 was 82.383 Average CPI for 2020 was 258.838 Given that average earni...

Q: A company reports the following sales-related information. Sales, gross Sales discounts $ 260,000 Sa...

A: The question is related to Multi-Step Income Statement (Partial). A multi-step income statement is ...

Q: Summarized data for Walrus Co. for its first year of operations are: Sales (90,000 units) $4,500,00...

A: Income statement under Absorption costing Income statement under Variable costing

Q: In the context of choosing a share repurchase over declaring dividends, a share repurchase would

A: As per our guidelines, we are supposed to answer only one question in case of multiple questions pos...

Q: Jeff Boyer, of Rainking Company, designs and installs custom lawn and garden irrigation systems for ...

A: 1. Job costing is a cost accounting methodology which is used to allocate the cost to different jobs...

Q: Magic Realm, Incorporated, has developed a new fantasy board game. The company sold 52,200 games las...

A: Answer 1-a) Contribution Margin Income Statement Sales Revenue (52,200 units X $ 68 per unit...

Q: Prepare the necessary journal entries (include journal entry descriptions) for the selected transact...

A: 1. Interest received by Barns company on 12/1/20Y5 = $9,000 * 6% * 5/12 months = $225 2. Interest re...

Q: he following information applies to questions 24-26: he following items were obtained from the recor...

A: The balance sheet represents the financial position of the business with assets and liabilities on a...

Q: apartment building for sale. LL is to manage the joint arrangement hence, he will rec ponus of 10% o...

A: The answer is stated below:

Q: The Diversified Portfolio Corporation provides investment advice to customers. A condensed income st...

A: Cash flow statement refers to one of the key financial statements which is formed, prepared and pres...

Q: Use the following question to answer next 10 Questions. Comprehensive Problem Dell Company is sell...

A: Here student asked for Multi sub part question we will solve first three sub part question for you. ...

Q: 1. ABC Corporation pays dividends of P10 per share every year. If the growth rate of the equity is e...

A: Here asked for multi question we will solve only one question for you. If you need additional kindl...

Q: Tech Co. and Robotics Co. are joint operators in the development of Super OS, a mobile phone operati...

A: Lets understand the basic. Joint operation is an arrangement in which two or more parties contribute...

Q: Use this problem for the next two questions: On January 1, year 1, ABC Corporation purchased 80% of ...

A: Non-controlling interest, which also goes by the term ‘minority interest’, is a position of holding/...

Q: Lia plans to buy a house for Php 157,950. She wants to make a down payment of Php 24, 937 and to tak...

A: Mortgage- A mortgage is a sort of loan used to buy or maintain tangible assets such as a home, build...

Q: 9. Preference shares has preference over ordinary shares relative to a) Dividends and voting rights ...

A: Since you have asked multiple questions, we will solve the first question for you. If you want any s...

Q: On January 2, year 1, ABC Company purchased 75% of XYZ's outstanding common stock. On that date, the...

A: The question is related to the Consolidation. The details are as under ABC Company Share in XYZ = ...

Q: To compute for the annual interest payments of a loan, the principal amount is multiplied by: a. Mar...

A: Nominal Rate of a loan is the rate by which interest is paid on the loan. Market Rate and Effective ...

Q: chief accounting

A: From the given statement, the answer is explained as,

Q: Alice issued $50,000 of 4%, 5-year term bonds on 12-31-18 when the market rate for similar bonds was...

A: The effect of bond on the cash flow statement is as follows:- (a) Issue of bond- Inflow of cash (b) ...

Q: Emma’s balance sheet showed an accounts receivable balance of $75 000 at the beginning of the year a...

A: We are required to calculate cash collection from debtor. For calculating that, we need to use below...

Q: What is the expected result of a zero-interest-bearing note that is sold today for less than face va...

A: Solution: Zero interest bearing note are note that contains no interest and same is issued at a disc...

Q: Jeniffer Fly Shop applies overhead at a rate of $5.50 per direct labor hour. At the end of the month...

A: Formula: Manufacturing overhead = Direct labor hours x Per direct labor hour

Q: A bond does not pay out regular interest. This means that * a. This is a bad investment. b. It is u...

A: A bond is a written instrument or document issued by the company acknowledging the borrowing. The te...

Q: Doll Company is selling sounds and lights equipment. The company's fiscal year ends on March 31. The...

A: The money a company owes its vendors for inventory-related commodities, such as business supplies or...

Q: The "Allowance for sales discounts" account may be used under Select the correct response: O Net met...

A: Solution: Allowance for sales discount is used when sales discount is accounted for using estimates ...

Q: Doll Company is selling sounds and lights equipment. The company's fiscal year ends on March 31. The...

A: Bond Amortization Amortization of bond which are include with whether it is treated in the interest ...

Q: eBook Problem Walk-Through Madsen Motors's bonds have 8 years remaining to maturity. Interest is pai...

A: Lets understand the basics. When yield to maturity is more than the coupon rate of interest then bon...

Q: Which statements are true? 1. [S1] Preference shares are considered a hybrid type of financing beca...

A: Preference shares are those shares which have preferred right on dividend before equity shares while...

Q: You are provided with the following information regarding events that occurred at Moore Corporation ...

A: Transactions (a) Depreciation Expense was $80000 (b) Interest Payable accoun...

Q: 10. These are issued shares, which are in the hands of the shareholders a) Issued Share Capital b) O...

A: Share capital refers to the amount or capital raised by a company by issuing its shares on which the...

Q: The purchases and disbursements cycle usually begins when Group of answer choices A user department ...

A: A disbursement seems to be the transfer of funds from one account to another, whether for a purchase...

Q: ngs, Inc., makes two sizes of box springs: twin and double. The direct material for the twin is $25 ...

A: In this question, we have to find out the unit cost to manufacture each unit

Q: b. Debt-to-equity ratio.

A: Times interest earn ratio also known as Interest Coverage ratio.

Q: hite purchased land with a current market value of $144,000, a building with a market value of $18,0...

A: Total market value of land, building nd equipment = $144, 000 + 18000 + 18000 =$180, 000

Q: On January 1, 2022, ABC Company signed a 5-year non-cancelable lease for a building. This is also th...

A: Discounting all lease payments, guaranteed residual value and estimated restoration cost: Year An...

Q: Required information [The following information applies to the questions displayed below.] Allied Me...

A: Solution:- Preparation of the journal entries to record the following transactions for Allied assumi...

Q: Mrs. Kimberly deposited P 300, 000 in an account earning 8% compounded every 6 months. On the 2th ye...

A: Compound interest: Compound interest denotes an interest computed on the total initial deposits and ...

Q: EXERCISES: 1. XYZ Corporation's most recent balance sheet and income statement appear below: XYZ Cor...

A: Hi student Since there are multiple subparts, we will answer only first three subparts.

Q: On January 1, 2020, ABC Company granted to employees a share-based payment with cash and share alter...

A: Share premium will be recorded on the basis of the price of issuance date. Since shares are issued o...

Q: Scoresby Incorporated tracks the number of units purchased and sold throughout each year but applies...

A: Inventory costing can be define as the process in which management of a company valued their invento...

Q: Dow Deep Mining Co acquired mineral rights for $56,000,000. The mineral deposit is estimated at 70,0...

A: Formula: Depletion rate per ton = Total mineral rights acquired cost / Estimated Tons

Q: On January 1, year 1, ABC Corporation purchased 80% of XYZ Corporation's P10 par common stock for P9...

A: The question is related to Business Combination. The details are as under ABC Corporation Share = 8...

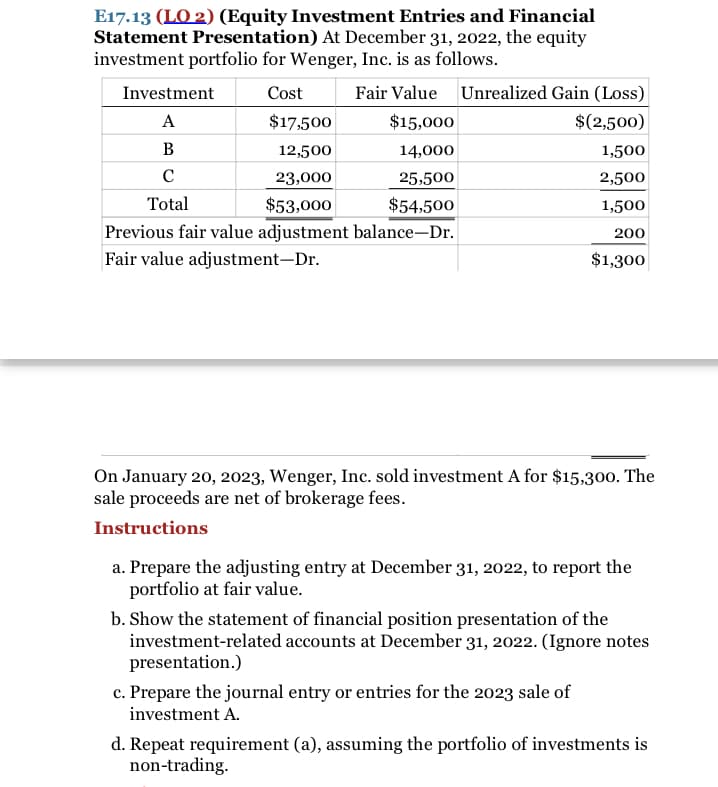

E17-13. Please answer part (d) and show all workings clearly.

Step by step

Solved in 2 steps

- - How much is the unrealized gain on equity investment reported in the 2022 other comprehensive income? A. P2,230,000 B. P1,880,000 C. P950,000 D. P350,000Paul Company presented the following information pertaining to its investments in equity securities. FVPL FVOCICost P1,000,000 P1,000,000Market value December 31, 2020 1,050,000 980,000 December 31, 2019 950,000 920,000 2.What amount should Paul report as unrealized gains/losses in the shareholders' equity of its December 31, 2020 statement of financial position?Paul Company presented the following information pertaining to its investments in equity securities. FVPL FVOCICost P1,000,000 P1,000,000Market value December 31, 2020 1,050,000 980,000 December 31, 2019 950,000 920,0001. What amount should Paul Company report as unrealized gain on its 2020 profit or loss? a. P160,000 b. P110,000 c. P100,000 d. P 50,000 2.What amount should Paul report as unrealized gains/losses in the shareholders' equity of its December 31, 2020 statement of financial position? a. P60,000 credit b. P20,000 debit c. P80,000 debit d. P20,000 credit

- - What is the unrealized gain (loss) reported in profit or loss for the year 2021?A. P31,000B. (P31,000)C. P43,000D. (P43,000) - How much was the gain or loss on the sale of CD shares? A. P1,100 gain B. P2,000 gain C. P15,000 loss D. P15,900 lossRed Company had the following portfolio of equity securities to other comprehensive income at December 31, 2018:Security Cost Market ValueA 400,000 390,000B 700,000 660,000Total 1,100,000 1,050,000If Red Company would have to sell the securities transaction cost will be incurred as follows; P20,000 and P30,000 for security A and B, respectively. In Red's December 31, 2018 statement of financial position, how much should be reported as the carrying value of the portfolio? a. 1,050,000 b. 1,060,000 c. 1,100,000 d. 1,110,000Can you explain the information below market value added (MVA) analysis and interpretation of results below. Market Value of Equity:$133,341,000,000.00 Plus: Market Value of Debt:$13,677,000.00 Equals: Market Value of Firm:$133,354,677,000.00 Minus: Total Invested Capital:($1,944,100.00) Equals: MVA$133,356,621,100.00

- 22. During 2022, Haggard Company purchased marketable equity securities for P 1,850,000 to be held as trading investments. In 2022, the entity appropriately reported an unrealized loss of P 200,000 in the income statement. There was no change during 2022 in the composition of the portfolio of trading securities. Pertinent data on December 31, 2023 are: Security Cost Market value Inc (Dec) A 600,000 700,000 100,000 B 450,000 400,000 (50,000) C 800,000 900,000 100,000 Net Increase 150,000 What amount of unrealized gain on these securities should be included in the 2021 income statement?During 2021, Anthony Company purchased debt securities as a long-term investment and classified them as trading. All securities were purchased at par value. Pertinent data are as follows: The net holding gain or loss included in Anthonys income statement for the year should be: a. 0 b. 3,000 gain c. 9,000 loss d. 12,000 lossWalsh, Inc. began business on January 1, 2002, and at December 31, 2002, Walsh had the following investment portfolios of equity securities: FVPL FVOCI Aggregate cost ₱150,000 ₱225,000 Aggregate fair value 120,000 185,000 None of the declines is judged to be other than temporary. Unrealized losses at December 31, 2002, should be recorded with corresponding charges against Profit or loss Equity Profit or loss Equity 70,000 0 30,000 40,000 40,000 30,000 0 70,000

- PAPASAKAYA Corporation began operations on January 11, 2020. At December 31, 2020, PAPASAKAYA had the following investment portfolios of equity securities: In its 2020 income statement, what amount should PAPASAKAYA report as unrealized gain (loss) on equity securities?Assume the following data for U&P Company: Debt (D) = $100 million; Equity (E) = $300 million; rD = 6%; rE = 12%; and TC = 30%. Calculate the after-tax weighted average cost of capital (WACC): Multiple Choice A) 10.5% B) 10.05% C) 15% D) 9.45%The company capital structure consist of debt 340000 @ 4.05%, common stock 40% of preferred stock @ 9.09% and preferred stock 400000 @ 19.50%, calculate company’s weighted average cost of capital. Select one: a. 12.50% b. 11.79% c. 14.98% d. None of the option e. 13.15%