erence between financial income and taxable income?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter18: Accounting For Income Taxes

Section: Chapter Questions

Problem 7C

Related questions

Question

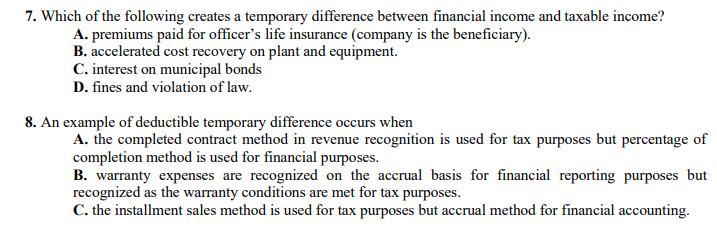

Transcribed Image Text:7. Which of the following creates a temporary difference between financial income and taxable income?

A. premiums paid for officer's life insurance (company is the beneficiary).

B. accelerated cost recovery on plant and equipment.

C. interest on municipal bonds

D. fines and violation of law.

8. An example of deductible temporary difference occurs when

A. the completed contract method in revenue recognition is used for tax purposes but percentage of

completion method is used for financial purposes.

B. warranty expenses are recognized on the accrual basis for financial reporting purposes but

recognized as the warranty conditions are met for tax purposes.

C. the installment sales method is used for tax purposes but accrual method for financial accounting.

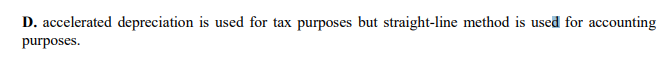

Transcribed Image Text:D. accelerated depreciation is used for tax purposes but straight-line method is used for accounting

purposes.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning