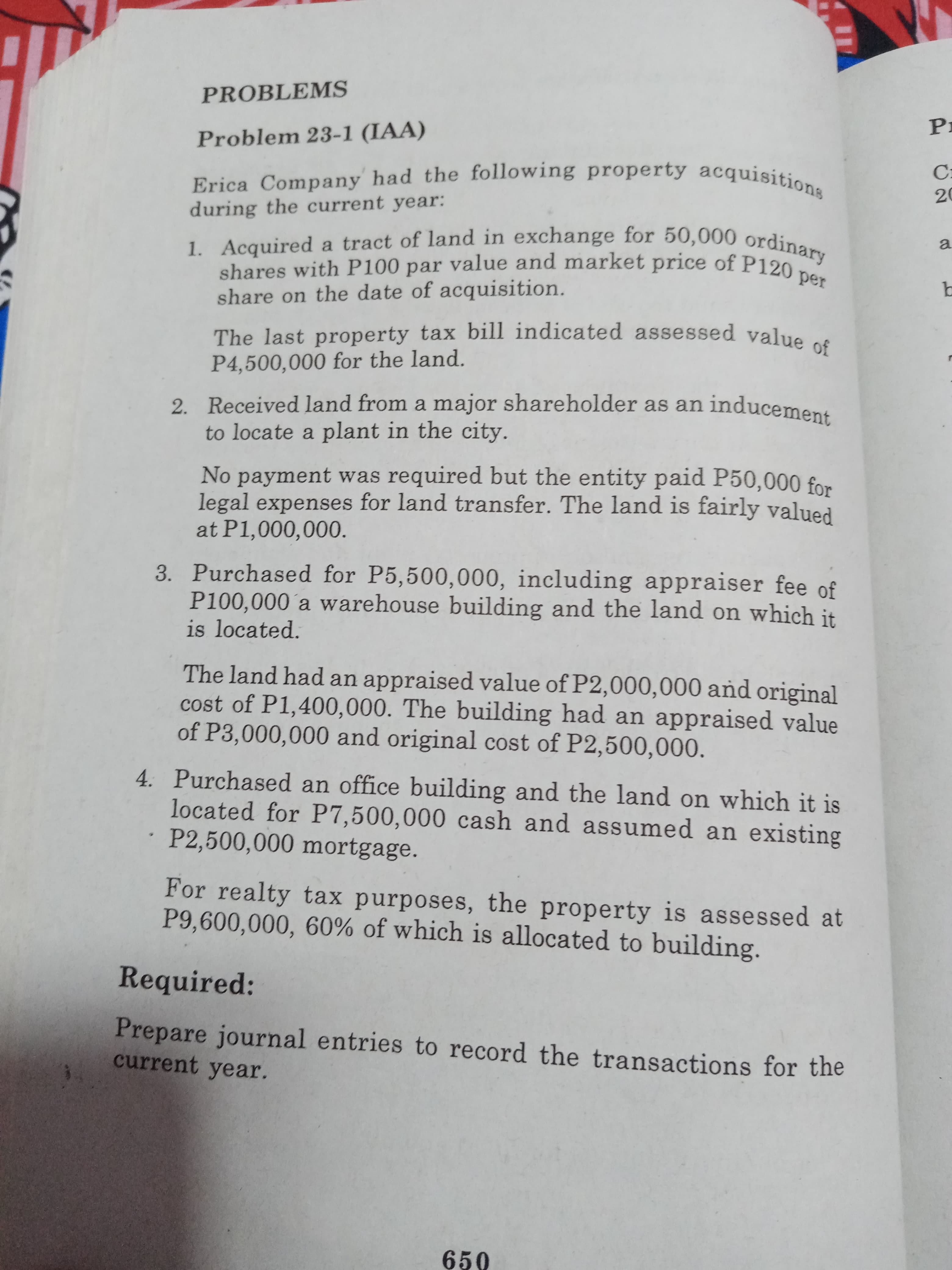

Erica Company had the following property acquisitions during the current year: 1. Acquired a tract of land in exchange for 50,000 ordinary shares with P100 par value and market price of P120 share on the date of acquisition. per The last property tax bill indicated assessed value of P4,500,000 for the land. 2. Received land from a major shareholder as an inducement to locate a plant in the city. No payment was required but the entity paid P50,000 for legal expenses for land transfer. The land is fairly valued at P1,000,000. 3. Purchased for P5,500,000, including appraiser fee of P100,000´a warehouse building and the land on which it is located. The land had an appraised value of P2,000,000 and original cost of P1,400,000. The building had an appraised value of P3,000,000 and original cost of P2,500,000.

Erica Company had the following property acquisitions during the current year: 1. Acquired a tract of land in exchange for 50,000 ordinary shares with P100 par value and market price of P120 share on the date of acquisition. per The last property tax bill indicated assessed value of P4,500,000 for the land. 2. Received land from a major shareholder as an inducement to locate a plant in the city. No payment was required but the entity paid P50,000 for legal expenses for land transfer. The land is fairly valued at P1,000,000. 3. Purchased for P5,500,000, including appraiser fee of P100,000´a warehouse building and the land on which it is located. The land had an appraised value of P2,000,000 and original cost of P1,400,000. The building had an appraised value of P3,000,000 and original cost of P2,500,000.

Chapter9: Acquisitions Of Property

Section: Chapter Questions

Problem 42P

Related questions

Question

100%

Transcribed Image Text:Erica Company had the following property acquisitions

during the current year:

1. Acquired a tract of land in exchange for 50,000 ordinary

shares with P100 par value and market price of P120

share on the date of acquisition.

per

The last property tax bill indicated assessed value of

P4,500,000 for the land.

2. Received land from a major shareholder as an inducement

to locate a plant in the city.

No payment was required but the entity paid P50,000 for

legal expenses for land transfer. The land is fairly valued

at P1,000,000.

3. Purchased for P5,500,000, including appraiser fee of

P100,000´a warehouse building and the land on which it

is located.

The land had an appraised value of P2,000,000 and original

cost of P1,400,000. The building had an appraised value

of P3,000,000 and original cost of P2,500,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you