Erindale Automotive borrowed $8,800 from the Bank of Montreal on a demand note on May 10. Interest on the loan, calculated on the daily balance, is charged to Erindale's current account (the separate interest method) on the 10th of each month. Erindale mad payment of $2,000 on July 20, a payment of $3,000 on October 1, and repaid the balance on December 1. The rate of interest on th loan on May 10 was 8% per annum. The rate was changed to 9.5% on August 1 and to 8.5% on October 1. What was the total inter cost for the loan? June 10 Calculate the interest charged on June 10. July 10

Erindale Automotive borrowed $8,800 from the Bank of Montreal on a demand note on May 10. Interest on the loan, calculated on the daily balance, is charged to Erindale's current account (the separate interest method) on the 10th of each month. Erindale mad payment of $2,000 on July 20, a payment of $3,000 on October 1, and repaid the balance on December 1. The rate of interest on th loan on May 10 was 8% per annum. The rate was changed to 9.5% on August 1 and to 8.5% on October 1. What was the total inter cost for the loan? June 10 Calculate the interest charged on June 10. July 10

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 22MC: A company collects an honored note with a maturity date of 24 months from establishment, a 10%...

Related questions

Question

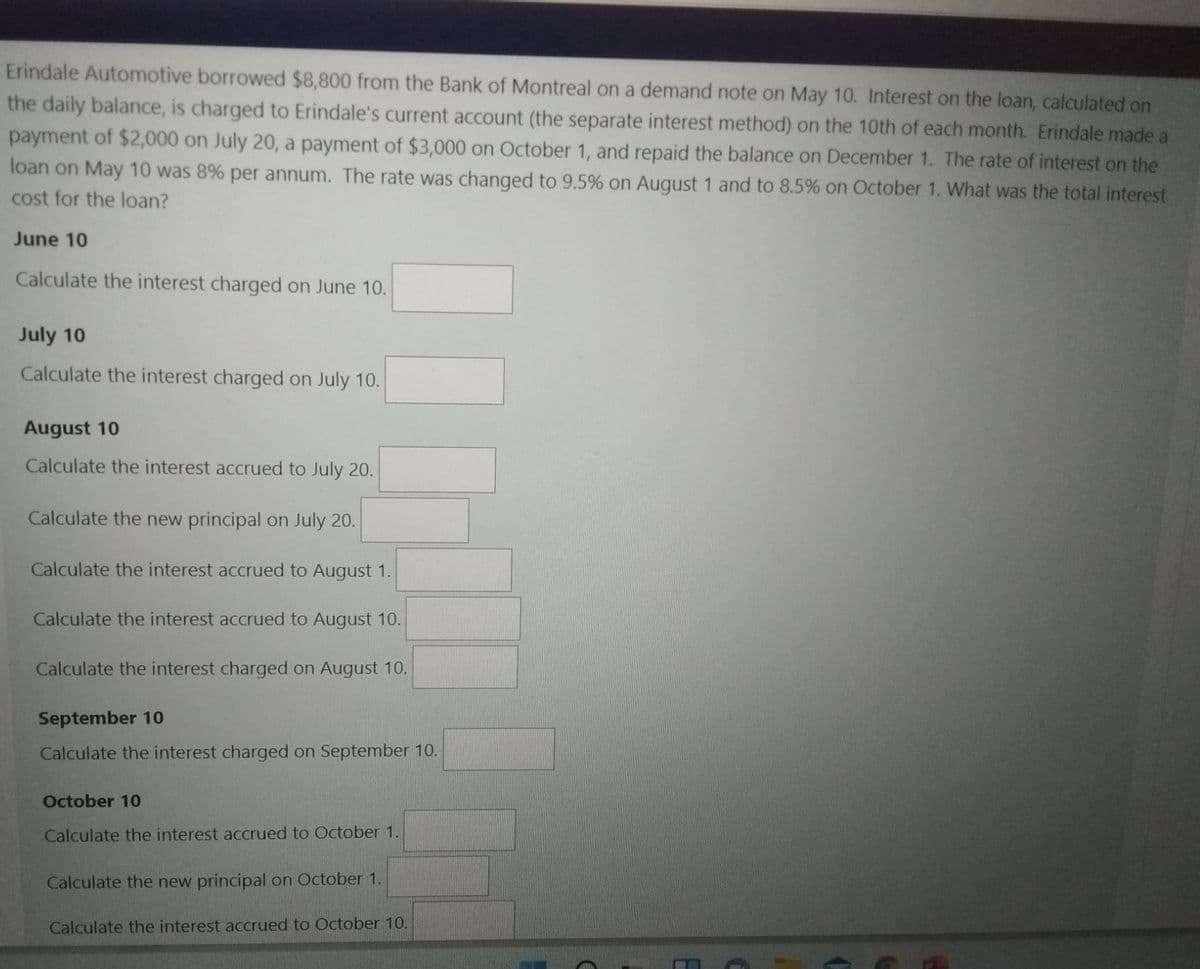

Transcribed Image Text:Erindale Automotive borrowed $8,800 from the Bank of Montreal on a demand note on May 10. Interest on the loan, calculated on

the daily balance, is charged to Erindale's current account (the separate interest method) on the 10th of each month. Erindale made a

payment of $2,000 on July 20, a payment of $3,000 on October 1, and repaid the balance on December 1. The rate of interest on the

loan on May 10 was 8% per annum. The rate was changed to 9.5% on August 1 and to 8.5% on October 1. What was the total interest

cost for the loan?

June 10

Calculate the interest charged on June 10.

July 10

Calculate the interest charged on July 10.

August 10

Calculate the interest accrued to July 20.

Calculate the new principal on July 20.

Calculate the interest accrued to August 1.

Calculate the interest accrued to August 10.

Calculate the interest charged on August 10.

September 10

Calculate the interest charged on September 10.

October 10

Calculate the interest accrued to October 1.

Calculate the new principal on October 1.

Calculate the interest accrued to October 10.

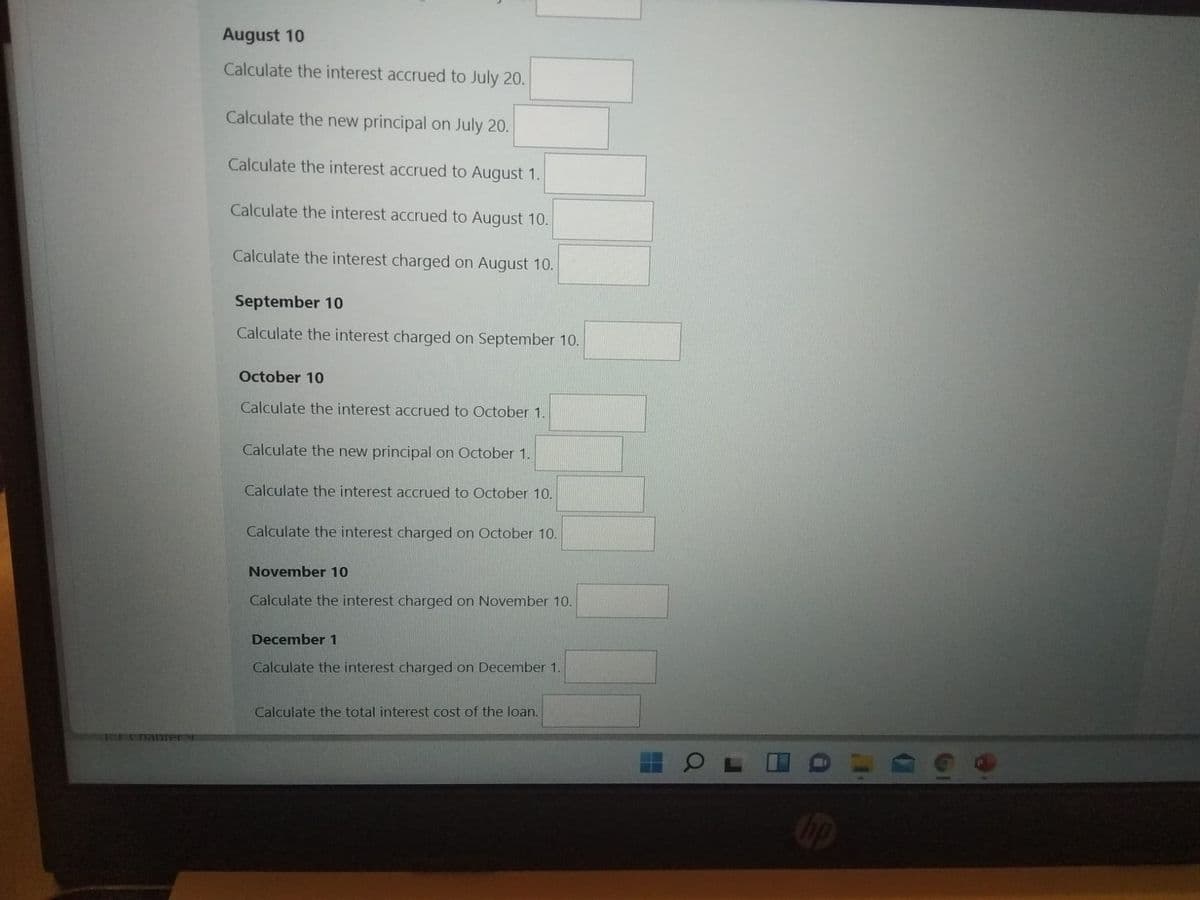

Transcribed Image Text:August 10

Calculate the interest accrued to July 20.

Calculate the new principal on July 20.

Calculate the interest accrued to August 1.

Calculate the interest accrued to August 10.

Calculate the interest charged on August 10.

September 10

Calculate the interest charged on September 10.

October 10

Calculate the interest accrued to October 1.

Calculate the new principal on October 1.

Calculate the interest accrued to October 10.

Calculate the interest charged on October 10.

November 10

Calculate the interest charged on November 10.

December 1

Calculate the interest charged on December 1.

Calculate the total interest cost of the loan.

11chabrery

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,