es to private 1,680,000 90,00 tities

Q: On January 1, 2020, Blue Company purchased P500,000 8% bonds for P475,126 (including broker's commis...

A: Bonds are priced by discounting future cash flows. Future cash flows include coupons and par value o...

Q: Markie is employed by Holy Cross as an ambulance driver with a salary of Php. 20,000 a month. In add...

A: Answer: Given Monthly salary = P 20,000 Meal= P 4500 Living quarters = P 2000

Q: Required a. Assume that you are the supervisor of Department I. Choose the allocation base that woul...

A: Solution Formula for allocation Overhead allocation rate =total overhead/ allocation base Total over...

Q: Hours Process Job 301 Job 302 Job 303 Improvement Couro 23 14 d Clancy 2 14 17 14 Cano 13 17 10

A: Job costing seems to be an accounting strategy that allows you to keep control of the costs of diffe...

Q: ABC employs a job-order costing system, with overhead calculated based on direct worker hours. Manag...

A: Manufacturing cost means the cost which is incurred in factory or related with production of goods. ...

Q: ncoln Industries has a line of credit at Bank Two that requires it to pay 11% interest on its borrow...

A: Solution Given Amount borrowed $800000 compensating balance required 15% stated inte...

Q: Product per Unit per Unit Snowboards $330 $180 Skis $400 $210 Poles $40 $20

A: The weighted average contribution margin seems to be the average sum that a collection of goods or s...

Q: 13-31

A: note: We’ll answer the first question since the exact one wasn’t specified. Please submit a new ques...

Q: The partnership of Cruz, Amistoso, and Galicia decided to liquidate their partnership on May 31, 201...

A: The partnership firm of Cruz, Amistoso, and Galicia Computation of statement of partnership equity ...

Q: Chapter 10: Assessing and Responding to Fraud Risks Assessing the risk of fraud in a financial sta...

A: Brainstorming seems to be a way of generating solutions and exchanging information for the purpose o...

Q: Prepare the journal entry to record the sale of 1,700 units that cost $9 per unit and sold for $15 p...

A: Sales = 1700*$15 = $25,500 Cost of goods sold = 1700*$9 = $15,300

Q: Briefly explain any 2 similarities between job order and process costing

A: Solution:- job order costing:- It is one of the costing method, which is used when costs and product...

Q: The inventory sheets as at 31/12/2021 put the value of inventory at GHS129,500. Allowance for doubtf...

A: Statement of financial Position as at 31st December, 2021 Liabilities Amount Assets Amou...

Q: Question 10 Consider the following statements: 1. A mission statement addresses the question 'What d...

A: Solution Note Dear student as per the Q&A guideline we are required to answer the first question...

Q: When Shortman Haberdashery, Inc., merged with Meyers Men’s Suits, Inc., Shortman’s employees were sw...

A: An expense is the cost of operations incurred to generate revenue. Examples of expenses include paym...

Q: Prepare a selling and administrative expense budget for the year.

A:

Q: Divisional income statements for the year 2020 for the two divisions of a company appear below. ...

A: Computation of ROI and answer for above question are as follows

Q: 17. How long will it take any sum to double itself with an 11% interest rate compounded continuously...

A: Since you have asked multiple questions, we will slove the first question for you.If you want any sp...

Q: Prepare journal entries, including adjustments to record the above transactions assuming the company...

A: Journal entry under both system as well as calculation of cost of goods sold are as follows.

Q: Rent, building 49,000 Rea pute the predetermined overhead rate for the year. pare a schedule of cost...

A: Cost of goods sold The Calculation of cost of goods sold include beginning balance of raw material p...

Q: Ruby Beauty Cosmetic Finished goods inventory Details, ending P20,000.00, cost of goods manufactured...

A: Beginning inventory = P11,000 Cost of goods manufactured = P230,000 Ending inventory = P20,000

Q: Beginning inventory, purchases, and sales for Item Copper are as follows: Mar. 1 Inventory 450 units...

A: Introduction: FIFO Method: FIFO stands for First in First out. Which means First received inventory...

Q: Problem 4. On December 31, 2022, the stockholders' equity section of the balance

A: A non cumulative and non participating preference shareholder does not get ...

Q: (2) Compute the company's cash flow on total assets ratio for its fiscal year 2021. Cash Flow on Tot...

A:

Q: On July 1, 2021, Focus Company purchased 30,000 shares of Eagle Company's 100,000 outstanding ordina...

A: The profit made from assets including property and investment securities is known as investment inco...

Q: There were 2,600 units in ending work in process inventory that were 100% complete with regard to ma...

A: Equivalent units for conversion = 2600*20% = 520 units

Q: Yoshi Company completed the following transactions and events involving its delivery trucks. Year ...

A: Depreciation expense for year 1 ( cost - salvage value)/ Estimated useful life ($23,500-$200...

Q: 1. Investment of cash in the business 2. Purchase of computer equipment for cash 3. Billed a custome...

A: Solution Concept Accounting equation is expressed as Asset = liabilities + equity

Q: Perez Manufacturing Company uses two departments to make its products. Department I is a cutting dep...

A: Overhead allocation means to allocate the overhead using the appropriate cost drivers.

Q: Information related to Pukalani Limited is presented below for its first month of operations. Credit...

A: The final balance = Credit balance - Debit balance The Final balance is calculated on January 31 . T...

Q: Number Cost of Units per Unit Beginning inventory 130 $71 Purchased goods during the period 240 80 S...

A: Answer 1) Calculation of number of units available for Sale Number of units available for Sale = Num...

Q: Assertions are expressed or implied representations by management that are reflected in the financia...

A: Explanation of above audit procedure with proper justification are as follows

Q: On July 1, 2021 ABC issued bonds dated March 1, 2021 and for their principal (maturity value) of 100...

A: Interest Expense=Face Value of Bond×Interest Rate

Q: Beau Dawson and Willow McDonald formed a partnership, investing $276,000 and $92,000, respectively. ...

A: "Since you have posted a question with multiple sub parts, we will solve first three sub parts for y...

Q: D. 11,000 units are produced? Total variable costs $ 572,000 For E. and F., what is the total manufa...

A: We are given break up of average cost per unit at 15000 units of production level for various cost e...

Q: Based on the knowledge of depreciation being recorded on a journal entry as a manufacturing overhead...

A: Depreciation refers to the permanent diminution in the worth of tangible assets. This could be due t...

Q: Aug. 1. Purchased office supplies on account, $1,760

A: Office supplies include consumables as well as equipment that are often used in workplaces by corpor...

Q: Case: Verification Department of a Credit Company is in-charged in verifying and approving loans. Th...

A: Department performance refers to the measure to evaluate the efficiencies and productivity of all th...

Q: Question no. 01: A. According to the Turkish tax legislation, there are two main types of tax status...

A: Mathematical model is representation of mathematical figures, language and concepts. It uses equatio...

Q: Mine Company produced 1,000 units of a product at a selling price of P95.00 each. Direct materials P...

A: Variable cost are change with the production level . Calculation of total variable cost are as follo...

Q: Summarized data for Walrus Co. for its first year of operations are: Sales (110,000 units) $6,600,00...

A: Variable Costing - In this costing method, variable costs are considered while preparing the cost of...

Q: AA Ltd creates a product that passes through two departments prior to completion: the mixing departm...

A: In process costing, output of one process is input for next process. If units have not been complet...

Q: 2021?

A: Financial assets at fair value through profit or loss, including cost of P500,000 of YSA Inc. 2,500,...

Q: A resident citizen has the following data on income and expenses in 2018: Gross compens...

A: Instead of tracking all of your expenses to determine your net expense, you can simply claim that 40...

Q: Jordan Sporting Goods Corporation makes two types of racquets, tennis and badminton. The company use...

A: Activity-based costing is a method of allocation of overheads among/between products or services. It...

Q: A company has 1,400 units in ending work in process that are 20% complete after transferring out 11,...

A: Inventory- he term inventory refers to the raw resources used in creation as well as the commodities...

Q: Account Debit Credit No. Balances Balances Cash 11 6,530 Accounts Receivable 12 2,100 Prepaid Expens...

A: Total liabilities indicate the total due to the business entity. It includes current liabilities and...

Q: Problem 5. Musuan Agro-Industrial Corporation has an authorized share capital of P2,000,000 with a p...

A: Stockholder Equity- Stockholder Equity refers to the organization's current equity ownership as show...

Q: Beau Dawson and Willow McDonald formed a partnership, investing $276,000 and $92,000, respectively. ...

A: Partnership Account - A partnership is a mutual agreement enter into two or more entities for the pu...

Q: On March 1, 2021, your company sold $80,000 of 9%, 8-year bonds when the market rate was 7%. These b...

A: Bond is an investment security which is issued by large corporation and government organization to r...

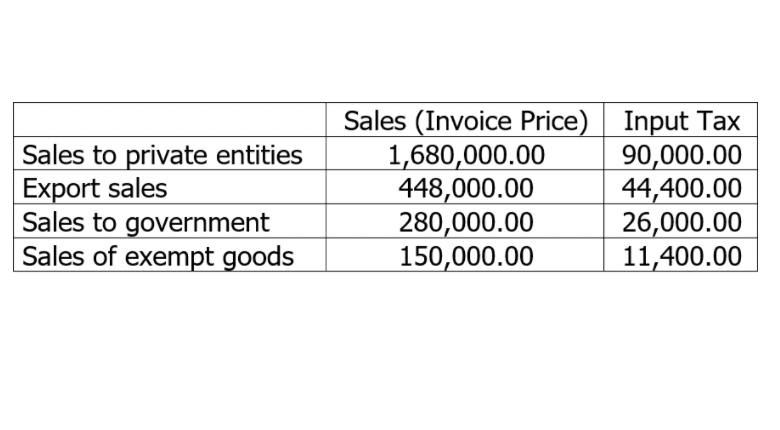

A VAT taxpayer had the following sales in december 2020 and with their correponding input VAT from purchases directly attributable to each sale. Compute the VAT.

Step by step

Solved in 2 steps

- identify deferred tax assets/liabilioties in the following figure Total Current Assets - - - - Total Assets 1057734 1014060 979868 976502 Cash & Due from Banks 96610 81786 73246 65619 Other Earning Assets, Total 144765 123145 118007 118805 Net Loans 759118 742473 737033 727002 Property/Plant/Equipment, Total - Net 5468 5602 5205 2383 Property/Plant/Equipment, Total - Gross - - - - Accumulated Depreciation, Total - - - - Goodwill, Net 5269 5284 5997 5974 Intangibles, Net 1674 1660 1732 1991 Long Term Investments 2865 3034 3054 3001 Other Long Term Assets, Total 4139 3830 3098 18226 Other Assets, Total 37826 47246 32496 33501 Total Current Liabilities - - - - Total Liabilities 982736 942052 908766 906908 Accounts Payable 9826 13188 9998 10285 Payable/Accrued - - - - Accrued Expenses - - - - Total Deposits 750843 701551 666300 640311 Other Bearing Liabilities, Total - - - 32 Total Short Term Borrowings 26633 16877 20346 19099…Multiple-choice question Compute for the Income tax Given: Taxpayer is a proprietary educational institution. Taxable period is 2021. Financial data: Related Activities Unrelated Activities Gross Income P 15,000,000 P 25,000,000 Expenses 5,000,000 11,000,000 Net 10,000,000 14,000,000 A. P140,000 B. P240,000 C. P3,500,000 D. P6,000,000Question The following are the balances extracted from the public Accounts on the consolidated fund from the year ended 31 December 2016. GHS000 Direct Tax 1044460 compensation of employee 808672 Goods and Services 404336 Non-financial Assets 134779 Indirect tax 939556 Grants 28110 Interest Expenses 398138 Social benefits 238882 Other Expenses 159255 Other revenue…

- Qalvin Corporation, a MSME, reported the following gross income and expenses in 2022: Philippines Abroad Total Gross income P400,000 P300,000 P700,000 Deductions 200,000 150,000 350,000 Taxable income P200,000 P150,000 P350,000 Compute the income tax due if Qalvin is a Government-owned and Controlled Corporation. (depends if it need the tabel)The following transactions incurred by a National Government Agency during the period of FY 2021: Received Notice of Cash Allocation (NCA) amounting to P10,000,000. Earned total revenue of P2,500,000 from billings and collections of unbilled income. Issued Notice of Transfer Allocation (NTA) amounting to P2,000,000. Incurred total expenses of P8,000,000. Remitted total taxes withheld of P1,500,000 to the BIR through Tax Remittance Advice (TRA). The unused NCA balance is P1,000,000 at the end of the period. How much is the net financial assistance or subsidy for the period in the statement of financial performance?LAB is a Philippine Economic Zone Authority Registered enterprise in the Philippines, taxable period is 2021 Related activities Unrelated activities gross income php 45,000,000 php 15,000,000 expenses 20,000,000 6,000,000 net 25,000,000 9,000,000 Compute for the tax on the income. choices P1,700,000 P2,250,000 P3,000,000 P4,500,000

- J, VAT registered taxpayer, had the following data on importation in 2022:Invoice cost (exchange rate $1: P46), $56,500Custom duties, 12%Freight, P200,000Insurance, P280,000Other charges before release from customs house, P70,000Facilitation fee, P100,000Freight from customs house to warehouse (net of VAT), P120,000The imported goods were sold for P6,650,000 (inclusive of VAT) 10 days after itsdelivery to the warehouse.How much is the VAT Payable?Assume the following transactions with the corresponding invoice cost, inclusive of Value Added Tax, if applicable: Apol, non-vat taxpayer, sells to LJ, vat taxpayer P89,600LJ, vat taxpayer, sells to Chris, vat taxpayer P134,400Chris, vat taxpayer, sells to Abi P201,600Abi, nonvat taxpayer, exported the goods in Canada P300,000 Required: Determine the following:A Vat payable of ApolB Vat payable of LJC Vat payable of ChrisD Vat payable of Abi30. The “Subsidy from National Government” account is credited when recording a Receipt of NCA Reversion of unused NCA Constructive remittance of customs duties or taxes withheld through TRA a and c

- Taxpayer: Domestic Corporation (SME) It year of operation: 2017 Taxable period: 2021 Year 2017 2018 2019 2020 2021 2022 Gross Income 7,000,000 8,000,000 8,000,000 5,000,000 7,000,000 7,000,000 Deductions 8,000,000 7,500,000 6,000,000 6,000,000 5,900,000 6,000,000 Net (1,000,000) 500,000 2,000,000 (1,000,000) 1,100,000 1,000,000 Compute the corporate income tax should be paid in 2022?ABC Corporation has the following sales during the 1ª quarter of 2021: Sale to private entities subject to 12% Php1,000,000 Sale to private entities subject to 0% 1,000,000 Sale exempt from VAT 1.000.000 Sale to government 1,000.000 The following input taxes were passed on by ABC Corps VAT suppliers: Input tax on taxable goods 50.000 Input tax on zero-rated sale 30,000 Input tax on sale of exempt goods 20,000 Input tax on sale to government 40,000 Input tax on depreciable capital goods not attributable to any specific activity 40,000 Total available input tax due for the quarter is:Company sold to Y Company goods worth 10,000.00, exclusive of any applicable tax. If X Company is a VAT registered taxpayer and Y Company is a non-VAT registered taxpayer, the journal entry of Y Company would include debit Purchases, 11,200.00credit Cash, 10,000.00debIt Purchases, 10,000.00credit VAT payable, 1,200.00