Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter8: Basic Stock Valuation

Section: Chapter Questions

Problem 2P

Related questions

Question

100%

Hi can you help me with this problem

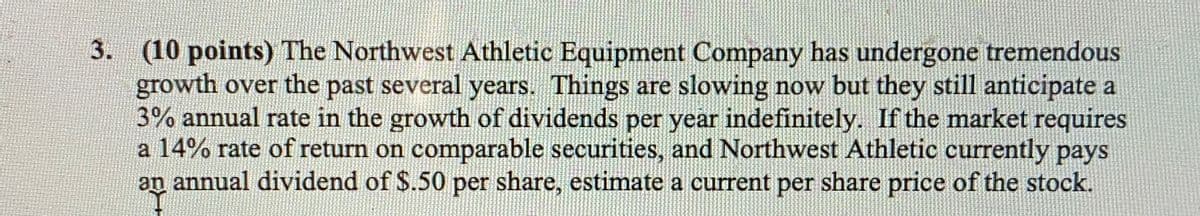

Transcribed Image Text:3. (10 points) The Northwest Athletic Equipment Company has undergone tremendous

growth over the past several years. Things are slowing now but they still anticipate a

3% annual rate in the growth of dividends per year indefinitely. If the market requires

a 14% rate of return on comparable securities, and Northwest Athletic currently pays

an annual dividend of $.50 per share, estimate a current per share price of the stock.

Expert Solution

Step 1

The constant growth model is a method for valuing the share price of a stock. It calculates the intrinsic value of a stock. It is also known as the Dividend Discount Model (DDM) or Gordon’s Growth Model (GGM).

It is an important tool in comparing various companies across industries while making an investment decision.

It is calculated as:

Calculate the expected dividend:

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning