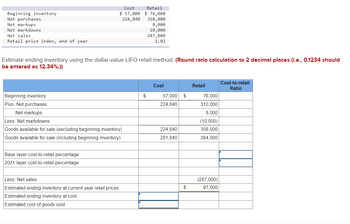

On January 1, 2021, Sanderson Variety Store adopted the dollar-value LIFO retail inventory method. Accounting records provided the following information: Cost Retail Beginning inventory $ 57,000 $ 76,000 Net purchases 224,840 310,000 Net markups 8,000 Net markdowns 10,000 Net sales 287,000 Retail price index, end of year 1.02 Estimate ending inventory using the dollar-value LIFO retail method. (Round ratio calculation to 2 decimal places (i.e., 0.1234 should be entered as 12.34%.)) Cost Retail Cost-to-retail Ratio Beginning inventory $57,000 $76,000 Plus: Net purchases 224,840 310,000 Net markups 8,000 Less: Net markdowns (10,000) Goods available for sale (excluding beginning inventory) 224,840 308,000 Goods available for sale (including beginning inventory) 281,840 384,000 Base layer cost-to-retail percentage 75.00%selected answer correct 2021 layer cost-to-retail percentage 73.00%selected answer correct Less: Net sales (287,000) Estimated ending inventory at current year retail prices $97,000 Estimated ending inventory at cost ? Estimated cost of goods sold ?

On January 1, 2021, Sanderson Variety Store adopted the dollar-value LIFO retail inventory method. Accounting records provided the following information: Cost Retail Beginning inventory $ 57,000 $ 76,000 Net purchases 224,840 310,000 Net markups 8,000 Net markdowns 10,000 Net sales 287,000 Retail price index, end of year 1.02 Estimate ending inventory using the dollar-value LIFO retail method. (Round ratio calculation to 2 decimal places (i.e., 0.1234 should be entered as 12.34%.)) Cost Retail Cost-to-retail Ratio Beginning inventory $57,000 $76,000 Plus: Net purchases 224,840 310,000 Net markups 8,000 Less: Net markdowns (10,000) Goods available for sale (excluding beginning inventory) 224,840 308,000 Goods available for sale (including beginning inventory) 281,840 384,000 Base layer cost-to-retail percentage 75.00%selected answer correct 2021 layer cost-to-retail percentage 73.00%selected answer correct Less: Net sales (287,000) Estimated ending inventory at current year retail prices $97,000 Estimated ending inventory at cost ? Estimated cost of goods sold ?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter7: Inventories: Cost Measurement And Flow Assumptions

Section: Chapter Questions

Problem 11RE: Jessie Stores uses the periodic system of calculating inventory. The following information is...

Related questions

Question

On January 1, 2021, Sanderson Variety Store adopted the dollar-value LIFO retail inventory method. Accounting records provided the following information:

| Cost | Retail | |||||

| Beginning inventory | $ | 57,000 | $ | 76,000 | ||

| Net purchases | 224,840 | 310,000 | ||||

| Net markups | 8,000 | |||||

| Net markdowns | 10,000 | |||||

| Net sales | 287,000 | |||||

| Retail price index, end of year | 1.02 | |||||

Estimate ending inventory using the dollar-value LIFO retail method. (Round ratio calculation to 2 decimal places (i.e., 0.1234 should be entered as 12.34%.))

| Cost | Retail | Cost-to-retail Ratio | |

| Beginning inventory | $57,000 | $76,000 | |

| Plus: Net purchases | 224,840 | 310,000 | |

| Net markups | 8,000 | ||

| Less: Net markdowns | (10,000) | ||

| Goods available for sale (excluding beginning inventory) | 224,840 | 308,000 | |

| Goods available for sale (including beginning inventory) | 281,840 | 384,000 | |

| Base layer cost-to-retail percentage | 75.00%selected answer correct | ||

| 2021 layer cost-to-retail percentage | 73.00%selected answer correct | ||

| Less: Net sales | (287,000) | ||

| Estimated ending inventory at current year retail prices | $97,000 | ||

| Estimated ending inventory at cost | ? | ||

| Estimated cost of goods sold | ? |

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Transcribed Image Text:Beginning inventory

Net purchases

Net markups

Net markdowns

Net sales

Retail price index, end of year

Estimate ending inventory using the dollar-value LIFO retail method. (Round ratio calculation to 2 decimal places (i.e., 0.1234 should

be entered as 12.34%.))

Cost

Retail

$57,000 $ 76,000

224,840 310,000

8,000

10,000

287,000

1.02

Beginning inventory

Plus: Net purchases

Net markups

Less: Net markdowns

Goods available for sale (excluding beginning inventory)

Goods available for sale (including beginning inventory)

Base layer cost-to-retail percentage

2021 layer cost-to-retail percentage

Less: Net sales

Estimated ending inventory at current year retail prices

Estimated ending inventory at cost

Estimated cost of goods sold

$

Cost

57,000 $

224,840

224,840

281,840

Retail

76,000

310,000

8,000

(10,000)

308,000

384,000

(287,000)

97,000

Cost-to-retail

Ratio

Solution

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning