estimated warranty liability

Q: Define revenue bonds

A: Answer: A revenue bond is also regarded as a municipal bond that is sponsored by specific individual…

Q: Define Notes payable.

A: Notes payable is a liability item in the balance sheet of an organization.

Q: Explain the reporting of long-term liabilities, such as bonds payable and notes payable.

A: Liabilities - Liabilities are the obligation on the organization to be repayable in a year or more…

Q: total liabilities

A: A liability is an obligation that required outflow of economic benefits inorder to settle the same…

Q: What are warranty payments? Please explain.

A: A Warranty is a basically a handwritten promise made by the seller to the buyer on paper that if the…

Q: Why are warranty liabilities usually recognized on the balance sheet as liabilities even when they…

A: A warranty liability is a liability account that reports the estimated amount that a company will…

Q: Describe a note receivable, the computation of its maturity date, and the recording of its…

A: The cumulative sums owed to a client for products or services sold are trade receivables that are…

Q: extended warranties

A: We know that as per IAS 37( Provisions, Contingent Liabilities, and Contingent Assets ) A provision…

Q: Describe Liabilities from Advance Collections.

A: Liabilities: The claims creditors have over assets or resources of a company are referred to as…

Q: How should discount on bonds payable be reported on the financial statements? Premium on bonds…

A: Concept: A premium on bonds occurs if, the bonds are issued at a high price than the face value. On…

Q: 9. Which of the following best describes the accounting for assurance-type warranty costs? * a.…

A: Warranty means where the company is undertaking to make good the loss which has been incurred due to…

Q: List of Current Liabilities

A: Current liabilities are those liabilities of an entity which are payable in one year or entity’s…

Q: What type of account is Discount on Bonds Payable, and what is its normal balance?a. Adjusting…

A:

Q: Define Short-Term Interest-Bearing Notes.

A: Short-term interest-bearing note: The short-term interest-bearing note is a note on which interest…

Q: 2. Which of the following best describes the accounting for assurance-type warranty costs?

A: An assurance-type warranty provides an assurance to repair or replace the defective product.

Q: Distinguish between the accounting treatment of a manufacturer’s warranty and an extended warranty.…

A: WarrantyWarranty is assurance provided to a customer by a seller. It is provided against the…

Q: Define Quality-assurance warranty.

A:

Q: What are Account for notes payable and interest expense.

A: Notes Payable- It is a type of document or instrument which is issued to creditors for a specific…

Q: Distinguish between an interest-bearing note and a non-interest-bearing note. How are the proceeds…

A: A commercial paper that contains an express and absolute promise by the maker to…

Q: Describe the types of warranty.

A: Warranty: Estimated liability is an exact dollar amount of debt or obligation which is valued at a…

Q: Define and explain short-term and long-term accounts receivable.

A: Accounts receivable forms a part of assets of the entity and represent the amount due from the…

Q: . How is the present value of a non-interest-bearing note computed?

A:

Q: Define Warranty Modeling?

A: It is necessary to ascertain entire lifecycle cost of a product, and this includes the costs related…

Q: Define Accrued Interest Payable.

A:

Q: A typical provision is: a. bonds payable. b. cash. c. a warranty liability. d. accounts…

A: Provision: An economic obligation created and maintained to cover the future liability is termed as…

Q: When should the liability associated with a product warranty be recorded? Discuss.

A: Warranty: It is an agreement made by the company to provide guarantee against the defects in the…

Q: Define the term warranty expense.

A:

Q: Rebate on bills discounted is A liability Actual income Income received in advance An accrued income

A: Statement of financial position or balance sheet is one of a financial statement which helps…

Q: What is the formula to compute interest on a note receivable?

A: Note receivable: Note receivable refers to a written promise for the amounts to be received within a…

Q: If problem is silent as to the terms of a Warranty Payable, will it be presented in the current…

A: Warranty Payable:-It is a liability for the company which means the company has to pay for repair…

Q: Define the following items: Unearned revenue Inventory Notes payable

A: Hi student Since there are multiple subparts, we will answer only first three subparts. If you want…

Q: Define Extended warranties.

A: Warranty Warranty is assurance provided to a customer by a seller. It is provided against the…

Q: What types of short-term credit are classified as accrued liabilities?

A: An accrued liability means the expense of the business incurred during a specific period but has yet…

Q: When should the liability associated with a product warranty be recorded?

A:

Q: notes payable and interest expense.?

A: The Role of accounting is to provide information to investors, creditors, management and…

Q: What are current and noncurrent accounts among the following: - Deposit Liabilities - Bills…

A: Current liabilities are those Liabilities which are to be repaid within one year.. Any Liabilities…

Q: Define debt service requirements

A: Debt service requirement is very much essential for a company if it wants to maintain a good credit…

Q: Define the term warranty.

A: A warranty is a type of guarantee that a manufacturer or similar party makes with regard to the…

Q: Classifying Liability-Related Accounts into Balance Sheet or Income StatementIndicate the proper…

A: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question and…

Q: Which of the following is classified as nonmonetary? a. Warranty liability b. Accrued expense c.…

A: The question is multiple choice question Required Choose the Correct Option.

Q: Distinguish between a mortgage and a note

A: Note is a legal document, signed by the borrower to the creditor, agreeing to repay the money. When…

Q: What accounts are used to record a contingent warranty liability that is probable and estimable…

A: Warranty is a form of assurance being provided by the seller to the buyer that if there will be any…

Q: Discount on Bonds Payable account

A: Discount on Bonds Payable account is deducted from outstanding liability of Bonds Payable in order…

Step by step

Solved in 4 steps

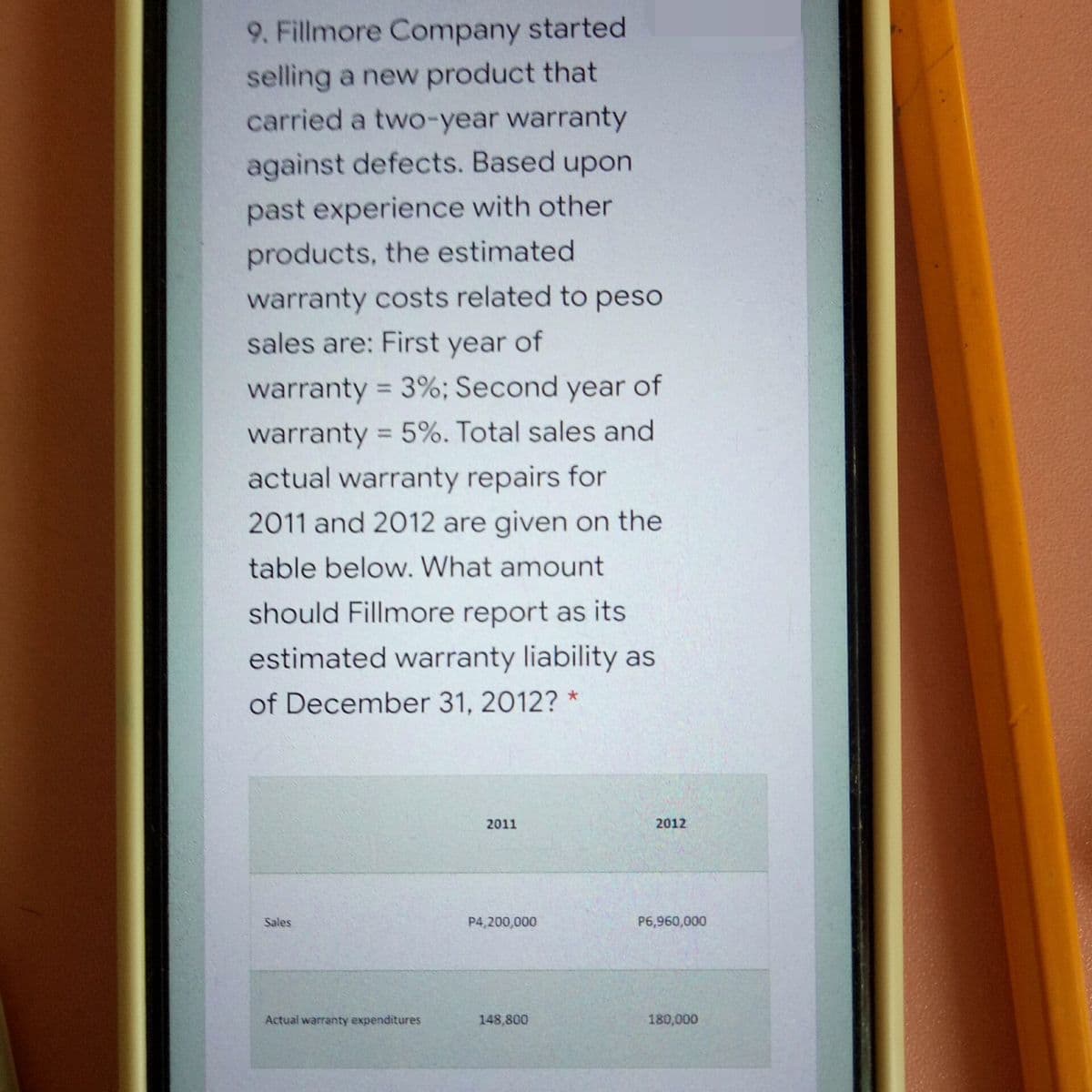

- Veneer Company started selling a new product that carried a two-year warranty against defect. Based upon pastexperience with other products, the estimated warranty costs related to peso sales are computed as follows:first year of warranty 3%second year of warranty 5%Total sales and actual warranty repairs for 2019 and 2020 are given below:2019 2020Sales P420,000 P696,000Actual warranty expenditures 14,880 18,000What amount should Veneer report as its estimated warranty liability as of December 31, 2020?Prepare all entries related to the above transactions of Veneer Company.Cupola Awning Corporation introduced a new line of commercial awnings in 2018 that carry a two-year warrantyagainst manufacturer’s defects. Based on their experience with previous product introductions, warranty costsare expected to approximate 3% of sales. Sales and actual warranty expenditures for the first year of selling theproduct were:Sales Actual Warranty Expenditures$5,000,000 $37,500Required:1. Does this situation represent a loss contingency? Why or why not? How should Cupola account for it?2. Prepare journal entries that summarize sales of the awnings (assume all credit sales) and any aspects of thewarranty that should be recorded during 2018.3. What amount should Cupola report as a liability at December 31, 2018?During 2018, Stable Company introduced a new line of product that carry a three-year warranty against manufacturer’s defects. Based on industry experience, warranty costs are estimated at 2% of sales in the year of sale, 3% in the year after sale, and 4% in the second year after sale. Sales and actual warranty expenditures for the first three-year period were as follows: Sales Actual Warranty Expenditures 2018 P 400,000 P 6,000 2019 1,000,000 40,000 2020 1,400,000 90,000 P2,800,000 P136,000 What amount should Stable report as estimated warranty liability at December 31, 2020? What amount of warranty expense should be reported for 2019?

- During 2021, JJJ Co. introduced a new line of machines that carry a three-year warranty against manufacturer’s defects. Based on industry experience, warranty costs are estimated at 2% of sales in the year of sale, 3% in the year after sale, and 4% in the second year after sale. Sales and actual warranty expenditures for the first three-year period were as follows:Sales / Actual Warranty / Expenditures2021 / 600,000 / 9,0002022 / 1,500,000 / 65,0002023 / 2,100,000 / 135,000What amount should JJJ report as a liability at December 31, 2023?In 20X1, Stevens Corp. began a new product line of wearable technology that carries a 24-month warranty against manufacturer defects. Based on industry experience, Stevens expects warranty costs to be an amount equal to approximately 9% of total sales dollars. During 20X1, new sales of this technology totaled $3,000,000. The costs incurred to satisfy warranty claims in 20X1 was $90,000. Required: Answer the following two questions. Question #1: What should Stevens report as the "Warranty Expense" balance on its 20X1 income statement?Answer: Question #2: What should Stevens report as the "Warranty Liability" balance on its balance sheet at 12/31/X1?AnswerDuring 2011, Rex Company introduced a new product carrying a two-year warranty against defects. The estimated warranty costs related to peso sales are 2% within 12 months following sale and 4% in the second 12 months following sale. Sales are P6,000,000for 2011 and P10,000,000 for 2012. Actual warranty expenditures are P90,000 for 2011 and P300,000 for 2012. On December 31, 2012, what is the estimated warranty liability? a. 570,000 b. 100,000 c. 450,000 d. 0

- In 2018, Carver Electronics Co. began selling a new computer that carried a two-year warranty against defects. Based on the manufacturer’s recommendations, Carver projects estimated warranty costs (as a percentage of dollar sales) as follows: First year of warranty…………………………………………………………….. 4% Second year of warranty………………………………………………………… 7% Sales and actual warranty repairs for 2018 and 2019 are as follows: 2019 2018 Sales $850,000 $700,000 Actual warranty repairs 30,750 18,500 1. Give the necessary journal entries to record the liability at the end of 2018 and 2019, assuming that there were no collections of previously reserved balances. 2. Analyze the warranty liability account as of the year ended December 31, 2019, to see if the actual repairs approximate the estimate. Should Carver revise the manufacturer’s warranty estimate? (Assume sales and repairs occur evenly throughout the year).In 2020, KD Corporation began selling a new line of products that carry a two-year warranty against defects.Based upon past experience with other products, the estimated warranty costs related to peso sales are as follows:First year of warranty 2%Second year of warranty 5%Sales and actual warranty expenditures for 2020 and 2021 are presented below: 2020 2021Sales P900,000 P1,200,000Actual warranty expenditures 30,000 60,000What is the estimated warranty liability at the end of 2021?a. P87,000 b. P24,000 c. P57,000 d. P147,000During 2019, Lawton Company introduced a new line of machines thatcarry a 3-year assurance-type warranty against manufacturer's defects.Based on industry experience, warranty costs are estimated at 2% ofsales in the year of sale, 4% in the year after sale, and 6% in the secondyear after sale. Sales and actual warranty expenditures for the first 3-year period wereas follows: Sales Actual WarrantyExpenditures 201920202021 $ 200,000500,000700,000 $ 3,00015,00045,000 $1,400,000 $63,000 What amount should Lawton report as a liability at December 31, 2021?a. $0b. $21,000C. $84,000d. $105,000

- During 2019, Angel Co. introduced a new line of appliances that carry a three-year warranty against manufacturer’s defects. Based on industry experience, warranty costs are estimated at 2% of sales in the year of sale, 4% in the year after sale, and 6% in the second year after sale. Sales and actual warranty expenditures for the first three-year period were as follows: Sales Actual Warranty Expenditures2019 P 400,000 P 6,0002020 1,000,000 30,0002021 1,400,000 90,000 P2,800,000 P126,000 assume that sales and repairs occurs evenly through-out the year, how much is the estimated warranty liability at December 31, 2021?During 2024, Foxfire Company introduced a new line of machines that carry a three-year warranty against defects. Based on experience, warranty costs are estimated at 2% of sales in the year of sale, 4% in the year after sale, and 6% in the second year after sale. Sales were P1,200,000, P3,000,000 and P4,200,000 for 2024, 2025, and 2026, respectively. Actual warranty expenditures were P18,000, P90,000 and P270,000 for 2024, 2025 and 2026, respectively. What amount should be reported as warranty liability on December 31, 2026?In 2017, Quapau Products introduced a new line of hot water heaters that carry a one-year warranty against manufacturer’s defects. Based on industry experience, warranty costs were expected to approximate 5% of sales revenue.First-year sales of the heaters were $300,000. An evaluation of the company’s claims experience in late 2018 indicated that actual claims were less than expected—4% of sales rather than 5%. Assuming sales of the heaters in 2018were $350,000 and warranty expenditures in 2018 totaled $12,000, what is the 2018 warranty expense?