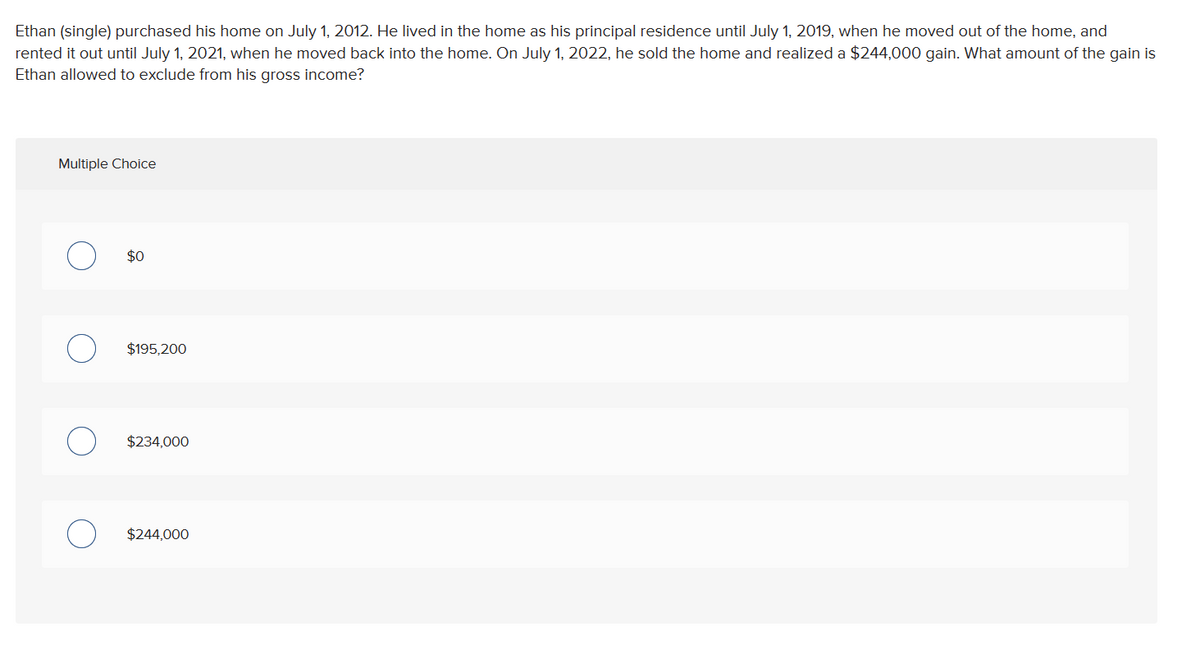

Ethan (single) purchased his home on July 1, 2012. He lived in the home as his principal residence until July 1, 2019, when he moved out of the home, and rented it out until July 1, 2021, when he moved back into the home. On July 1, 2022, he sold the home and realized a $244,000 gain. What amount of the gain is Ethan allowed to exclude from his gross income? Multiple Choice О $0 О $195,200 О $234,000 О $244,000

Ethan (single) purchased his home on July 1, 2012. He lived in the home as his principal residence until July 1, 2019, when he moved out of the home, and rented it out until July 1, 2021, when he moved back into the home. On July 1, 2022, he sold the home and realized a $244,000 gain. What amount of the gain is Ethan allowed to exclude from his gross income? Multiple Choice О $0 О $195,200 О $234,000 О $244,000

Chapter15: Property Transactions: Nontaxable Exchanges

Section: Chapter Questions

Problem 1CPA

Related questions

Question

Give Solution and provide Correct and incorrect option explanation

Transcribed Image Text:Ethan (single) purchased his home on July 1, 2012. He lived in the home as his principal residence until July 1, 2019, when he moved out of the home, and

rented it out until July 1, 2021, when he moved back into the home. On July 1, 2022, he sold the home and realized a $244,000 gain. What amount of the gain is

Ethan allowed to exclude from his gross income?

Multiple Choice

О

$0

О

$195,200

О

$234,000

О

$244,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 1 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT