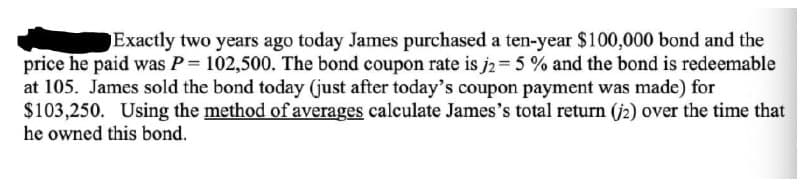

Exactly two years ago today James purchased a ten-year $100,000 bond and the price he paid was P= 102,500. The bond coupon rate is j2= 5 % and the bond is redeemable at 105. James sold the bond today (just after today's coupon payment was made) for $103,250. Using the method of averages calculate James's total return (j2) over the time that he owned this bond.

Q: A bondholder purchased an 8 percent coupon, $1,000 par three-year bond at a 7 percent yield.…

A: The coupon rate decreased from 8 percent to 7 percent. Amount invested at 6% for three years is…

Q: On January 1, 2013, Janet buys a bond for $10,000 that makes coupon payments of $600 after each of…

A: Here, Coupon Payment is $600 Face Value of Bond is $10,000 Time to maturity remaining at Feb 1, 2014…

Q: Three months ago, Jim purchased 25,000 of U.S. Treasury bonds. These bonds have a 30-year maturity…

A: Bond valuation Bond Valuation means determining the fair value of the bond. Formula for Bond…

Q: Assumed that Amanda decided to purchase a corporate bond that pays 7 percent coupon payment. The…

A: Assuming Face Value = 1000 Purchase Price = 1000 Coupon = Coupon Rate * Face Value = 7℅*1000 = 70…

Q: An investor buys a $1000 face value bond paying a semi-annual coupon at 9% APR compounded…

A: We need to use RATE in excel to calculate realised yield of bond. The realised yield =…

Q: Dean Yeagley bought a $1,000 face value, 7% coupon, 15-year bond for $1,100. Seven years after she…

A: Holding period yield: Holding period yield can be defined as the percentage return earned from…

Q: ABC Corporation issued today a bond in favor of Mr. Barboncito and the bond has a face value of…

A: given information face value = P 1,000,000 bond rate = 7% interest rate = 12% no of years = 6 years…

Q: Last year Janet purchased a $1,000 face value corporate bond with an 12% annual coupon rate and a…

A: YTM is the rate of return a bond will generate if it is held until maturity. It is that discounting…

Q: Stacy purchases a $60,000 bond for $57,500. The coupon rate is 6% per year payable quarterly. The…

A: Bonds are debt securities issued by Government or other companies, who seek to raise money from…

Q: Suppose John purchased an annual coupon bond with a face value of $1000, a coupon rate of 8% and…

A: The bond price is the discounted value of all cash flows and the maturity value with the help of a…

Q: Riley purchased a bond for 900 5 years ago. The bond rate is 2 percent and the face value is 1,000.…

A: Given, Number of years = 5 Bond rate = 2% Face value = 1,000 Rate = 1%

Q: 3. Penelope purchased a $10,000, 8% quarterly bond, held it for five years, received twenty coupon…

A: In this question, we are required to calculate Purchase Price of the Bond given that Bond value is…

Q: Last year Janet purchased a $1,000 face value corporate bond with an 8% annual coupon rate and a…

A: Face value of Bond= $1,000 Coupon Payments= $80 Yield to Maturity(r) = 10.26% Years to Maturity (t)=…

Q: David Davis just received a cash gift from his grandfather. He plans to invest in a five-year bond…

A: Bond valuing is an exact matter in the field of monetary instruments. The cost of a bond relies upon…

Q: Last year Janet purchased a $1,000 face value corporate bond with a 9% annual coupon rate and a…

A: Face Value = 1000 Coupon = Coupon Rate × Face Value = 9% × 1000 = 90 Time Period (N) = 15 years YTM…

Q: purchased a 10-year, 3.80% p.a. semi-annual paying coupon bond with a Face Value (FV) of $1 000 000,…

A: Price of bond is sum of present value of coupon payments plus present value of par value of bond

Q: An investor bought a zero-cupon bond with $1000 face value and 10 years to maturity for $630.35. She…

A: Zero Coupon Bond Face Value = $1000 YEars =10 Sold after 7 years Remaining years = 10-7 = 3 years…

Q: Ques→Manuel Bought a $100,000 bond with a 5.7% coupon for $92,470 when it had 7 years remaining to…

A: Yield to maturity is the rate of return a bond generates assuming all the coupons are reinvested at…

Q: Jamal bought a 5% $1000 20-year bond for $925. He received a semiannual dividend for 8 years, then…

A: Face value=$1000Purchase price of bond=$925

Q: Sandra has just purchased Insidia Ltd bonds.Using the following information at the time of the…

A: Nominal coupon rate: It is the stated interest rate on bond and is calculated by dividing sum of…

Q: Three years ago, Tristan bought a 30-year, 5.45%, $1,000 bond. The bond pays interest semiannually.…

A: In this problem we require to calculate the present worth of bond. We can calculate the present…

Q: An investor buys a $1000 face value bond paying a semi-annual coupon at 9% APR compounded…

A: We need to use RATE function in excel to calculate realized Formula is =RATE(NPER,PMT,-PV,FV)

Q: Ahmad purchases a bond that will pay him $123 interest each year plus a $1,560 principal that will…

A: Face value refers to the authorized value of a security. Face value does not represent the actual…

Q: You purchased a $1,000 bond with a coupon rate of 8 % on January 1, 2021 for $910. On the same date…

A: Answer:- Meaning of bond:- Bonds are corporate debt units that are securitized as assets which are…

Q: Fatima buys an 11-year, $314,530, a zero-coupon bond with an annual YTM of 1.74%. If she sells the…

A: Zero coupon bond will not pay any coupon throughout its life, hence the present value of the bond…

Q: Five years ago you purchasedan 8% coupon bond for $975. Today you sold the bond for $1,000. What is…

A: a. Calculate the rate of return as follows: rate of return=Sale price of bond+Coupon…

Q: Albert purchased a bond with exactly 20 years to redemption. The bond pays annual coupons, in…

A: N = 20 Face Value = 100 Annual coupons Coupon = Coupon Rate * Face Value = 5℅*100 = 5 Yield = 6℅

Q: Tom bought a coupon bond a year ago, and it costed him $870. The bond has a par value of $1000 and a…

A: Bonds refer to the debt security that is issued for the purpose of raising capital from the external…

Q: John bought a bond with an 7.5% coupon rate for $1,080 and sold it one year later for $1,190. His…

A: The corporation and government can raise finance by issuing bonds. The borrower i.e bond issuer is…

Q: Shane buys a 14-year, $150,500, zero-coupon bond with an annual YTM of 4.32%. If he sells the bond…

A: A Bond refers to an instrument that represents the loan being made by the investor to the company…

Q: Five years ago your grandfather purchased for you a 30-year $1,000 bond with a coupon rate of 11…

A: The sale price will be the present value of the coupons and the redemption value.

Q: Assumed that Mr. Bento decided to purchase a corporate bond that pays 7 percent coupon payment. The…

A: Given: Particulars Amount Coupon rate 7% Face value(FV) 1000 Interest rate(Rate) 8.50%…

Q: Mario bought a bond with a face amount of $1,000, a stated interest rate of 6%, and a maturity date…

A: Bonds refer to borrowing security issued by the company to raise funds from the market by making an…

Q: A savvy investor paid $7000 for a 20 year $10.000 mortgage bond that had a bond iterest ate of per…

A: Rate of return is defined as the net gain or net loss of an investment over the particular period of…

Q: Three years ago, you purchased a corporate bond that pays 5.8 percent. The purchase price was…

A: The coupon rate is the rate which is expected by a bondholder to be received over the period of time…

Q: Joel Barber purchased a $1,000 bond for $985. The coupon rate of interest is 8.5 percent, and the…

A:

Q: 10 years ago, your faughter bought 4(four),7% semi- annual coupon bond with a 25 year maturity, at…

A: A bond is financial security sold by business entities to raise borrowing capital for a financial…

Q: Pierre Dupont just received a cash gift from his grandfather. He plans to invest in a 5 year bond…

A: Excel Spreadsheet:

Q: n investor buys a $1000 face value bond paying a semi-annual coupon at 9% APR compounded…

A: We need to use RATE function in excel to calculate realised yield. Formula is =RATE(NPER,PMT,-PV,FV)

Q: a. What was the purchase price of the bond? b. What was the selling price of the bond? c.…

A: The purchase price of bond is calculated as present value of cash flows received from bond. The cash…

Q: Gwenyth has just purchased a bond for $1250 that has a maturity of 10 years and a coupon rate of…

A:

Q: Albert purchased a bond with exactly 20 years to redemption. The bond pays annual coupons, in…

A: Time Period =20 Years Coupon Rate = 5% Yield = 6% Face Value = $100

Q: A $5,000 bond had a coupon rate of 5.75% with interest paid semi-annually. Brett purchased this bond…

A: A) Calculation of Purchase price of bond:- Present value semi-annual coupons = Semi annual…

Q: Five years ago, you purchased a corporate for 942.41. At the time, the bond had a YTM of 10% and 9…

A: Facts 5 years ago: Price of bond = 942.41 YTM = 10% Time Period (N) = 9 years Face Value = 1000…

Q: A savvy investor paid $6000 for a 20-year $10,000 mortgage bond that had a bond interest rate of 8%…

A: a. The computation of quarterly rate of return is done below: The formulation for computing the…

Q: Vic Zaloom bought a corporate bond from IBEM Corporation for $100,000. The face value of the bond is…

A: In the given question we need to compute the effective rate of return on bond investment.

Q: Louis bought a $100 par value 5-year bond with 10% semiannual coupons ata purchase price of $94.…

A: In the given question we need to compute the yield to maturity for Raymond.

Q: Pierre Dupont just received a cash gift from his grandfather. He plans to invest in a five-year bond…

A: In this question we need to compute the present value of the bond.

Q: Jenna bought a bond that was issued by Sherlock Watson Industries (SWI) three years ago. The bond…

A: The price of the bond is the current price the investor is willing to pay today.

Q: Douglas purchased a $10,000, 8% quarterly bond at face value. He held the bond for five years,…

A: The sales price for bond implies to the consideration amount paid by investor for purchasing bond.…

Step by step

Solved in 2 steps

- Four years earlier, Janice purchased a $1,000 face value corporate bond with a 6% annual coupon and maturing in 10 years. At the time of the purchase, it had an expected yield to maturity of 8.76%. If Janice sold the bond today for $1,088.39, what rate of return would she have earned for the last four years?manuel bought a $100,000 bond with a 5.7% coupon for $92,470 when it had seven years remaining to maturity. what was the prevailing market rate at the time manuel purchased the bond?Last year, Sally purchased a $1,000 face value corporate bond with an 11.2 percent annual coupon rate and a 12-year maturity. At the time of the purchase, it had an expected yield to maturity of 11.9 percent. If Sally sold the bond today for $949.88, what rate of return would she have earned for the past year? a. 11.02% b. 11.20% c. 11.10% d. –0.69% e. 10.51%

- Last year Janet purchased a $1,000 face value corporate bond with an 8%annual coupon rate and a 15-year maturity. At the time of the purchase, it had an expectedyield to maturity of 10.45%. If Janet sold the bond today for $820.17, what rate of returnwould she have earned for the past year?Last year, Joan purchased a $1,000 face value corporate bond with an 8% annual coupon rate and a 20-year maturity. At the time of the purchase, it had an expected yield to maturity of 9.63%. If Joan sold the bond today for $942.31, what rate of return would she have earned for the past year? Round your answer to two decimal places.Sascha owns stock in Lewis Corp and she bought a $5,000 corporate bond. She received $52.50 in quarterly interest from the bond. Sascha also owns stock in Lewis Corp which is worth $46 per share, and it pays a $2 annual dividend. If Lewis Corp later offers corporate bonds at an annual interest rate that is one percent higher than half the of the bond Sascha bought, create an equation that models the quarterly interest earned, q, for any given bond face value, v.

- Last year Janet purchased a $1,000 face value corporate bond with an 8% annual coupon rate and a 10-year maturity. At the time of the purchase, it had an expected yield to maturity of 6.8%. If Janet sold the bond today for $1,097.73, what rate of return would she have earned for the past year? Do not round intermediate calculations. Round your answer to two decimal places ____%John bought a bond with an 7.5% coupon rate for $1,080 and sold it one year later for $1,190. His holding period return was?James purchased a bond for $3380 that had a rate compounded annually, 2 years later he sold it for $3700. What interest rate, compounded annually, did James earn on this investment? 4.32% 4.73% 4.63% 0.96%

- Four years ago, Sandra Stills bought six-year, 5.5 percent coupon bonds issued by the Oriole Corp. For $944.99 she sells these bonds at the current price of $892.26, what will be her realized yield on the bonds? Assume similar coupon-paying bonds make annual coupon payments. Assume face value is $1000. (Round to 2 decimal places)Dean Yeagley bought a $1,000 face value, 7% coupon, 15-year bond for $1,100. Seven years after she bought the bond, she sold it for $1,200. What was her holding period yield? a. 6.73% b. 7.40% c. 9.16% d. 5.26%James Smith bought 10-year bonds issued by Harvest Foods five years ago for $930.00. The bonds make semiannual coupon payments at a rate of 8.0 percent. If the current price of the bonds is $1,040.77, what is the yield that James would earn by selling the bonds today?