Example 3-5 Taylor Talbot receives wages amounting to $116,600. Their net earnings from self-employment amount to $32,800. Talbot must count $30,400 of their earnings in determining taxable self-employment income for OASDI taxes. OASDI Taxable Wage Base Wages Received = OASDI Taxable Self-Employment Income $147,000 OASDI Ralph Henwood was paid a salary of $80,400 during 20-- by Odesto Company. In addition, during the year Henwood started his own business as a public accountant and reported a net business income of $71,000 on his income tax return for 20--. Compute the following: a. The amount of FICA taxes that was withheld from his earnings during 20-- by Odesto Company. 4,984.80 ✔ 1,165.80 ✔ HI $116,600 OASDI $30,400 b. Henwood's self-employment taxes on the income derived from the public accounting business for 20--. 9,386.80 X 1,029.50 X HI

Example 3-5 Taylor Talbot receives wages amounting to $116,600. Their net earnings from self-employment amount to $32,800. Talbot must count $30,400 of their earnings in determining taxable self-employment income for OASDI taxes. OASDI Taxable Wage Base Wages Received = OASDI Taxable Self-Employment Income $147,000 OASDI Ralph Henwood was paid a salary of $80,400 during 20-- by Odesto Company. In addition, during the year Henwood started his own business as a public accountant and reported a net business income of $71,000 on his income tax return for 20--. Compute the following: a. The amount of FICA taxes that was withheld from his earnings during 20-- by Odesto Company. 4,984.80 ✔ 1,165.80 ✔ HI $116,600 OASDI $30,400 b. Henwood's self-employment taxes on the income derived from the public accounting business for 20--. 9,386.80 X 1,029.50 X HI

Chapter13: Comparative Forms Of Doing Business

Section: Chapter Questions

Problem 32CE

Related questions

Question

Gg.15.

Transcribed Image Text:Example 3-5

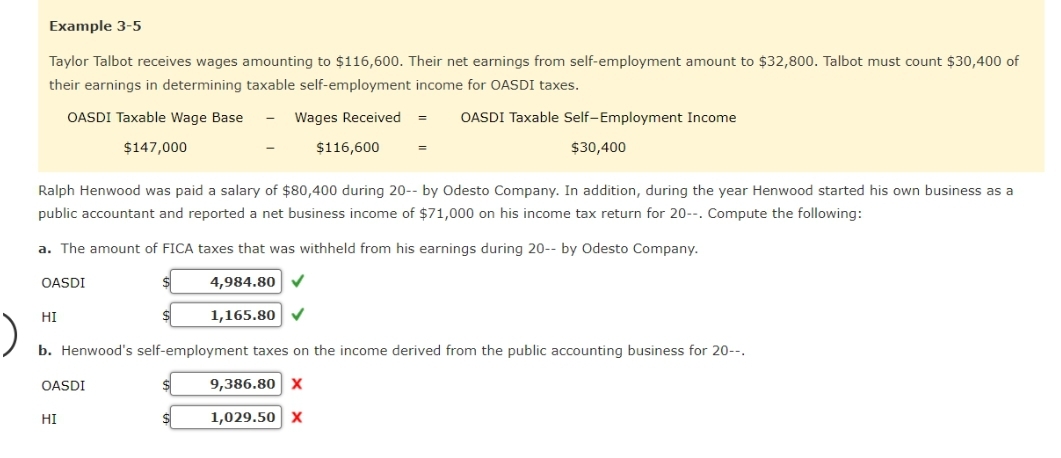

Taylor Talbot receives wages amounting to $116,600. Their net earnings from self-employment amount to $32,800. Talbot must count $30,400 of

their earnings in determining taxable self-employment income for OASDI taxes.

OASDI Taxable Wage Base

Wages Received =

OASDI Taxable Self-Employment Income

$147,000

HI

Ralph Henwood was paid a salary of $80,400 during 20-- by Odesto Company. In addition, during the year Henwood started his own business as a

public accountant and reported a net business income of $71,000 on his income tax return for 20--. Compute the following:

a. The amount of FICA taxes that was withheld from his earnings during 20-- by Odesto Company.

OASDI

4,984.80 ✔

1,165.80 ✓

OASDI

$116,600

HI

=

b. Henwood's self-employment taxes on the income derived from the public accounting business for 20--.

9,386.80 X

1,029.50 X

$

$30,400

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning