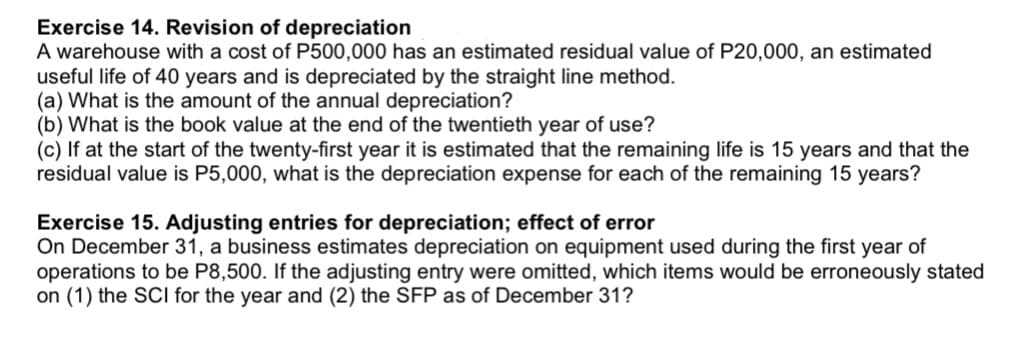

Exercise 14. Revision of depreciation A warehouse with a cost of P500,000 has an estimated residual value of P20,000, an estimated useful life of 40 years and is depreciated by the straight line method. (a) What is the amount of the annual depreciation? (b) What is the book value at the end of the twentieth year of use? (c) If at the start of the twenty-first year it is estimated that the remaining life is 15 years and that the residual value is P5,000, what is the depreciation expense for each of the remaining 15 years?

Exercise 14. Revision of depreciation A warehouse with a cost of P500,000 has an estimated residual value of P20,000, an estimated useful life of 40 years and is depreciated by the straight line method. (a) What is the amount of the annual depreciation? (b) What is the book value at the end of the twentieth year of use? (c) If at the start of the twenty-first year it is estimated that the remaining life is 15 years and that the residual value is P5,000, what is the depreciation expense for each of the remaining 15 years?

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter9: Long-term Assets: Fixed And Intangible

Section: Chapter Questions

Problem 9.12EX

Related questions

Question

Transcribed Image Text:Exercise 14. Revision of depreciation

A warehouse with a cost of P500,000 has an estimated residual value of P20,000, an estimated

useful life of 40 years and is depreciated by the straight line method.

(a) What is the amount of the annual depreciation?

(b) What is the book value at the end of the twentieth year of use?

(c) If at the start of the twenty-first year it is estimated that the remaining life is 15 years and that the

residual value is P5,000, what is the depreciation expense for each of the remaining 15 years?

Exercise 15. Adjusting entries for depreciation; effect of error

On December 31, a business estimates depreciation on equipment used during the first year of

operations to be P8,500. If the adjusting entry were omitted, which items would be erroneously stated

on (1) the SCI for the year and (2) the SFP as of December 31?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning