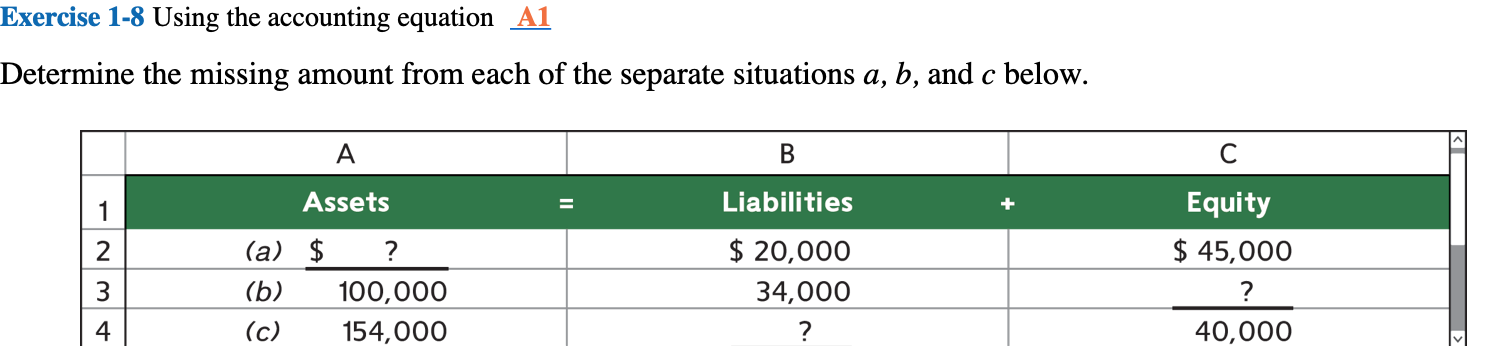

Exercise 1-8 Using the accounting equation A1 Determine the missing amount from each of the separate situations a, b, and c below. Liabilities Assets Equity $ 20,000 34,000 $ 45,000 (a) $ 2 100,000 154,000 3. (b) (c) 40,000

Exercise 1-8 Using the accounting equation A1 Determine the missing amount from each of the separate situations a, b, and c below. Liabilities Assets Equity $ 20,000 34,000 $ 45,000 (a) $ 2 100,000 154,000 3. (b) (c) 40,000

Financial & Managerial Accounting

13th Edition

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter1: Introduction To Accounting And Business

Section: Chapter Questions

Problem 1.6EX

Related questions

Question

100%

Practice Pack

Do I have to add the liabilities and equity in order to get the assests?

Transcribed Image Text:Exercise 1-8 Using the accounting equation A1

Determine the missing amount from each of the separate situations a, b, and c below.

Liabilities

Assets

Equity

$ 20,000

34,000

$ 45,000

(a) $

2

100,000

154,000

3.

(b)

(c)

40,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Includes step-by-step video

Trending now

This is a popular solution!

Learn your way

Includes step-by-step video

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning