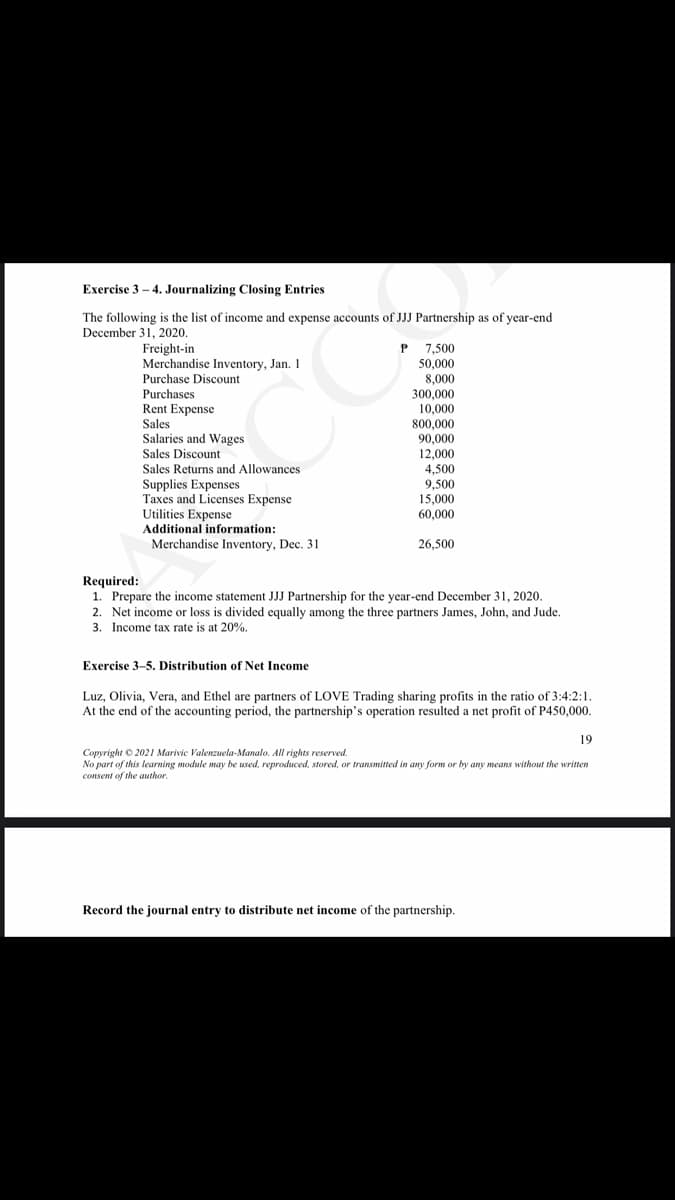

Exercise 3 - 4. Journalizing Closing Entries The following is the list of income and expense accounts of JJJ Partnership as of year-end December 31, 2020. P 7,500 50,000 8,000 300,000 10,000 800,000 90,000 12,000 4,500 9,500 15,000 60,000 Freight-in Merchandise Inventory, Jan. 1 Purchase Discount Purchases Rent Expense Sales Salaries and Wages Sales Discount Sales Returns and Allowances Supplies Expenses Taxes and Licenses Expense Utilities Expense Additional information: Merchandise Inventory, Dec. 31 26,500 Required: 1. Prepare the income statement JJJ Partnership for the year-end December 31, 2020. 2. Net income or loss is divided equally among the three partners James, John, and Jude. 3. Income tax rate is at 20%. Exercise 3-5. Distribution of Net Income Luz, Olivia, Vera, and Ethel are partners of LOVE Trading sharing profits in the ratio of 3:4:2:1. At the end of the accounting period, the partnership's operation resulted a net profit of P450,000. 19 Copyright © 2021 Marivic Valenzuela-Manalo. All rights reserved. No part of this learning module may be used, reproduced, stored, or transmitted in any form or by any means without the written consent of the author. Record the journal entry to distribute net income of the partnership.

Exercise 3 - 4. Journalizing Closing Entries The following is the list of income and expense accounts of JJJ Partnership as of year-end December 31, 2020. P 7,500 50,000 8,000 300,000 10,000 800,000 90,000 12,000 4,500 9,500 15,000 60,000 Freight-in Merchandise Inventory, Jan. 1 Purchase Discount Purchases Rent Expense Sales Salaries and Wages Sales Discount Sales Returns and Allowances Supplies Expenses Taxes and Licenses Expense Utilities Expense Additional information: Merchandise Inventory, Dec. 31 26,500 Required: 1. Prepare the income statement JJJ Partnership for the year-end December 31, 2020. 2. Net income or loss is divided equally among the three partners James, John, and Jude. 3. Income tax rate is at 20%. Exercise 3-5. Distribution of Net Income Luz, Olivia, Vera, and Ethel are partners of LOVE Trading sharing profits in the ratio of 3:4:2:1. At the end of the accounting period, the partnership's operation resulted a net profit of P450,000. 19 Copyright © 2021 Marivic Valenzuela-Manalo. All rights reserved. No part of this learning module may be used, reproduced, stored, or transmitted in any form or by any means without the written consent of the author. Record the journal entry to distribute net income of the partnership.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter1: Accounting And The Financial Statements

Section: Chapter Questions

Problem 46E: OBJECTIVE 6 Exercise 1-46 Income Statement ERS Inc. maintains and repairs office equipment. ERS had...

Related questions

Topic Video

Question

Transcribed Image Text:Exercise 3 – 4. Journalizing Closing Entries

The following is the list of income and expense accounts of JJJ Partnership as of year-end

December 31, 2020.

Freight-in

Merchandise Inventory, Jan. 1

P 7,500

50,000

8,000

300,000

10,000

800,000

90,000

12,000

4,500

Purchase Discount

Purchases

Rent Expense

Sales

Salaries and Wages

Sales Discount

Sales Returns and Allowances

Supplies Expenses

Taxes and Licenses Expense

Utilities Expense

Additional information:

Merchandise Inventory, Dec. 31

9,500

15,000

60,000

26,500

Required:

1. Prepare the income statement JJJ Partnership for the year-end December 31, 2020.

2. Net income or loss is divided equally among the three partners James, John, and Jude.

3. Income tax rate is at 20%.

Exercise 3-5. Distribution of Net Income

Luz, Olivia, Vera, and Ethel are partners of LOVE Trading sharing profits in the ratio of 3:4:2:1.

At the end of the accounting period, the partnership's operation resulted a net profit of P450,000.

19

Copyright © 2021 Marivic Valenzuela-Manalo. All rights reserved.

No part of this learning module may be used, reproduced, stored, or transmitted in any form or by any means without the written

consent of the author.

Record the journal entry to distribute net income of the partnership.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT