Exercise 5.13 A European call and put option on the same security both expire in three months, both have a strike price of 20, and both sell for the price 3. If the nominal continuously compounded interest rate is 10% and the stock price is currently 25, identify an arbitrage.

Exercise 5.13 A European call and put option on the same security both expire in three months, both have a strike price of 20, and both sell for the price 3. If the nominal continuously compounded interest rate is 10% and the stock price is currently 25, identify an arbitrage.

Linear Algebra: A Modern Introduction

4th Edition

ISBN:9781285463247

Author:David Poole

Publisher:David Poole

Chapter2: Systems Of Linear Equations

Section2.4: Applications

Problem 28EQ

Related questions

Topic Video

Question

hi could you please help solve exercise 5.13?

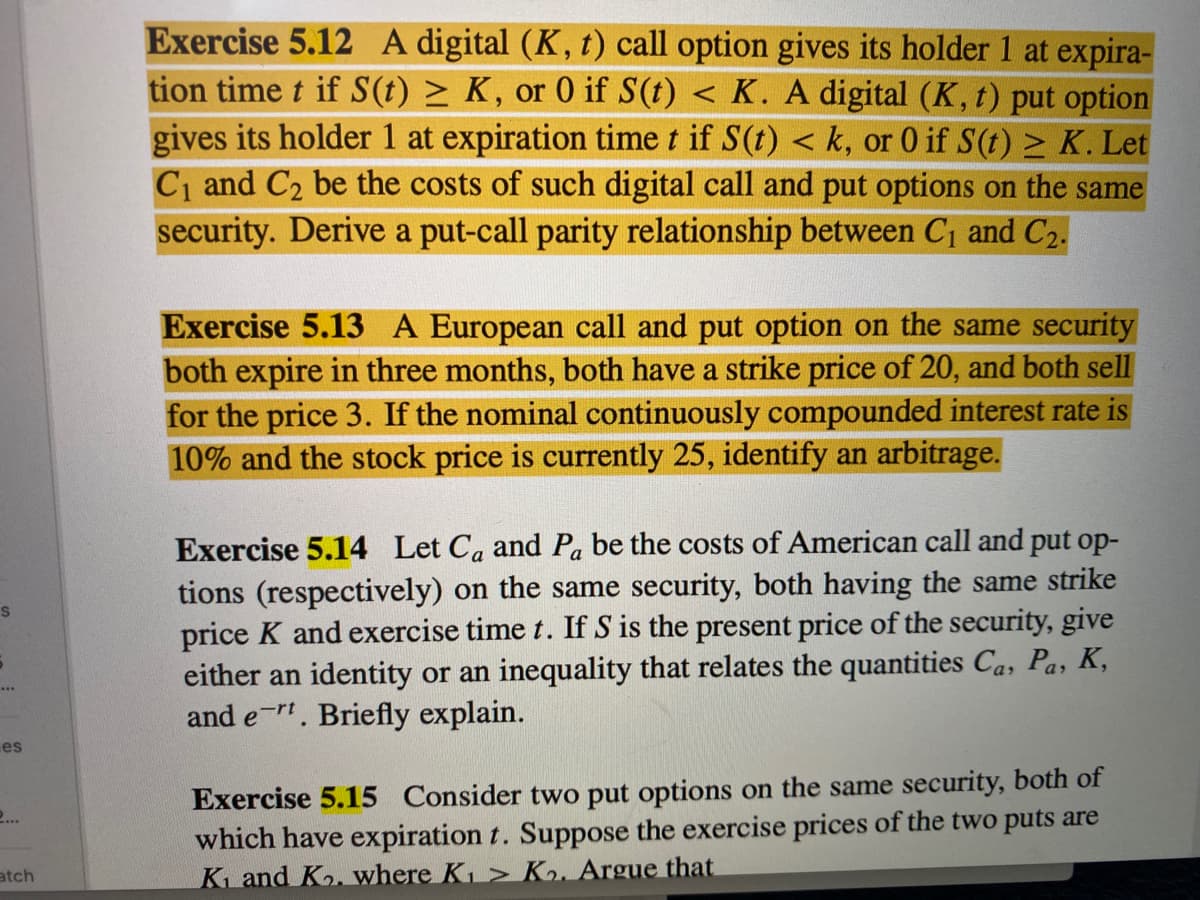

Transcribed Image Text:Exercise 5.12 A digital (K, t) call option gives its holder 1 at expira-

tion time t if S(t) > K, or 0 if S(t) < K. A digital (K, t) put option

gives its holder 1 at expiration time t if S(t) < k, or 0 if S(t) > K. Let

C and C2 be the costs of such digital call and put options on the same

security. Derive a put-call parity relationship between C¡ and C2.

Exercise 5.13 A European call and put option on the same security

both expire in three months, both have a strike price of 20, and both sell

for the price 3. If the nominal continuously compounded interest rate is

10% and the stock price is currently 25, identify an arbitrage.

Exercise 5.14 Let Ca and Pa be the costs of American call and put op-

tions (respectively) on the same security, both having the same strike

price K and exercise time t. If S is the present price of the security, give

either an identity or an inequality that relates the quantities Ca, Pa, K,

and e-r. Briefly explain.

S

es

Exercise 5.15 Consider two put options on the same security, both of

which have expiration t. Suppose the exercise prices of the two puts are

K and Ko. where K > K2. Argue that

2...

atch

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, advanced-math and related others by exploring similar questions and additional content below.Recommended textbooks for you

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning

Big Ideas Math A Bridge To Success Algebra 1: Stu…

Algebra

ISBN:

9781680331141

Author:

HOUGHTON MIFFLIN HARCOURT

Publisher:

Houghton Mifflin Harcourt

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning

Big Ideas Math A Bridge To Success Algebra 1: Stu…

Algebra

ISBN:

9781680331141

Author:

HOUGHTON MIFFLIN HARCOURT

Publisher:

Houghton Mifflin Harcourt