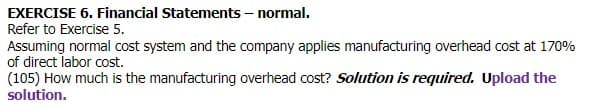

EXERCISE 6. Financial Statements - normal. Refer to Exercise 5. Assuming normal cost system and the company applies manufacturing overhead cost at 170% of direct labor cost. (105) How much is the manufacturing overhead cost? Solution is required. Upload the solution.

EXERCISE 6. Financial Statements - normal. Refer to Exercise 5. Assuming normal cost system and the company applies manufacturing overhead cost at 170% of direct labor cost. (105) How much is the manufacturing overhead cost? Solution is required. Upload the solution.

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter9: Working Capital

Section: Chapter Questions

Problem 24E

Related questions

Question

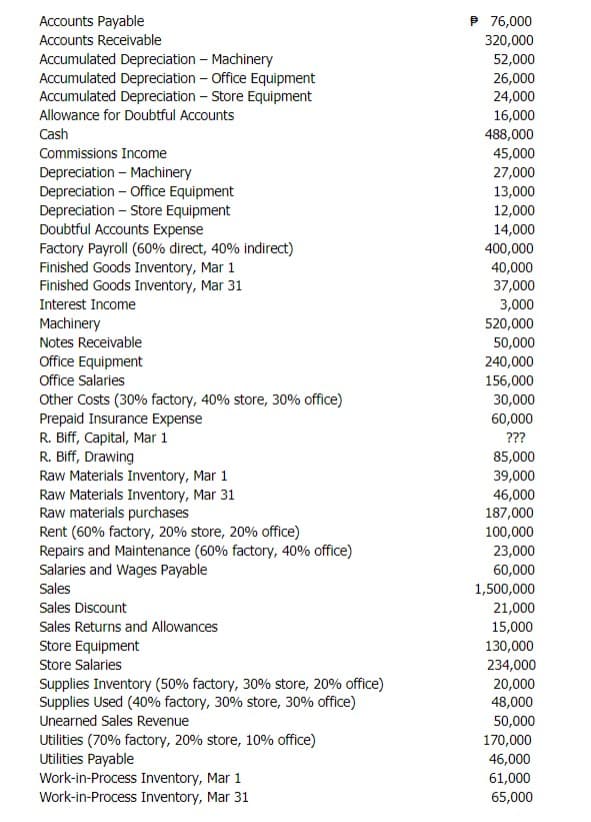

Transcribed Image Text:Accounts Payable

Accounts Receivable

Accumulated Depreciation - Machinery

Accumulated Depreciation - Office Equipment

Accumulated Depreciation - Store Equipment

Allowance for Doubtful Accounts

Cash

Commissions Income

Depreciation - Machinery

Depreciation - Office Equipment

Depreciation - Store Equipment

Doubtful Accounts Expense

Factory Payroll (60% direct, 40% indirect)

Finished Goods Inventory, Mar 1

Finished Goods Inventory, Mar 31

Interest Income

Machinery

Notes Receivable

Office Equipment

Office Salaries

Other Costs (30% factory, 40% store, 30% office)

Prepaid Insurance Expense

R. Biff, Capital, Mar 1

R. Biff, Drawing

Raw Materials Inventory, Mar 1

Raw Materials Inventory, Mar 31

Raw materials purchases

Rent (60% factory, 20% store, 20% office)

Repairs and Maintenance (60% factory, 40% office)

Salaries and Wages Payable

Sales

Sales Discount

Sales Returns and Allowances

Store Equipment

Store Salaries

Supplies Inventory (50% factory, 30% store, 20% office)

Supplies Used (40% factory, 30% store, 30% office)

Unearned Sales Revenue

Utilities (70% factory, 20% store, 10% office)

Utilities Payable

Work-in-Process Inventory, Mar 1

Work-in-Process Inventory, Mar 31

P 76,000

320,000

52,000

26,000

24,000

16,000

488,000

45,000

27,000

13,000

12,000

14,000

400,000

40,000

37,000

3,000

520,000

50,000

240,000

156,000

30,000

60,000

???

85,000

39,000

46,000

187,000

100,000

23,000

60,000

1,500,000

21,000

15,000

130,000

234,000

20,000

48,000

50,000

170,000

46,000

61,000

65,000

Transcribed Image Text:EXERCISE 6. Financial Statements - normal.

Refer to Exercise 5.

Assuming normal cost system and the company applies manufacturing overhead cost at 170%

of direct labor cost.

(105) How much is the manufacturing overhead cost? Solution is required. Upload the

solution.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College