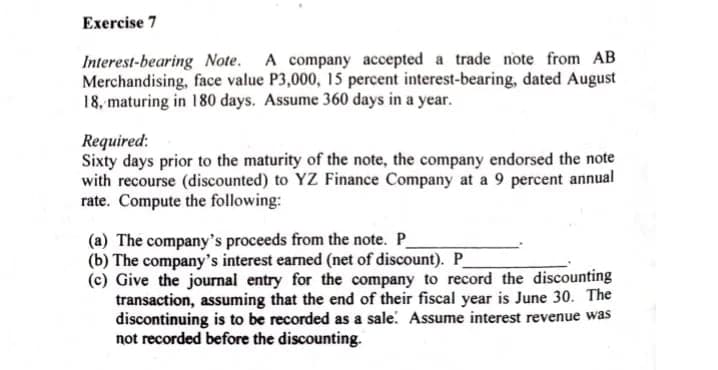

Exercise 7 Interest-bearing Note. A company accepted a trade note from AB Merchandising, face value P3,000, 15 percent interest-bearing, dated August 18, maturing in 180 days. Assume 360 days in a year. Required: Sixty days prior to the maturity of the note, the company endorsed the note with recourse (discounted) to YZ Finance Company at a 9 percent annual rate. Compute the following: (a) The company's proceeds from the note. P (b) The company's interest earned (net of discount). P (c) Give the journal entry for the company to record the discounting transaction, assuming that the end of their fiscal year is June 30. The discontinuing is to be recorded as a sale. Assume interest revenue was not recorded before the discounting.

Exercise 7 Interest-bearing Note. A company accepted a trade note from AB Merchandising, face value P3,000, 15 percent interest-bearing, dated August 18, maturing in 180 days. Assume 360 days in a year. Required: Sixty days prior to the maturity of the note, the company endorsed the note with recourse (discounted) to YZ Finance Company at a 9 percent annual rate. Compute the following: (a) The company's proceeds from the note. P (b) The company's interest earned (net of discount). P (c) Give the journal entry for the company to record the discounting transaction, assuming that the end of their fiscal year is June 30. The discontinuing is to be recorded as a sale. Assume interest revenue was not recorded before the discounting.

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter10: Liabilities: Current, Installment Notes, And Contingencies

Section: Chapter Questions

Problem 10.6BE: Journalizing installment notes On the first day of the fiscal year, a company issues 45,000, 8%,...

Related questions

Question

Transcribed Image Text:Exercise 7

Interest-bearing Note. A company accepted a trade note from AB

Merchandising, face value P3,000, 15 percent interest-bearing, dated August

18, maturing in 180 days. Assume 360 days in a year.

Required:

Sixty days prior to the maturity of the note, the company endorsed the note

with recourse (discounted) to YZ Finance Company at a 9 percent annual

rate. Compute the following:

(a) The company's proceeds from the note. P

(b) The company's interest earned (net of discount). P

(c) Give the journal entry for the company to record the discounting

transaction, assuming that the end of their fiscal year is June 30. The

discontinuing is to be recorded as a sale. Assume interest revenue was

not recorded before the discounting.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,