Exercise 9-21 Complete the accounting cycle using long-term liability transactions (LO9-2, 9-8) (The following information applies to the questions displayed below.) On January 1, 2021, the general ledger of Freedom Fireworks includes the following account balances: Accounts Cash Accounts Receivable Inventory Land Buildings Allowance for Uncollectible Accounts Accumulated Depreciation Accounts Payable Conmon Stock Retained Earnings Debit $ 12, 200 36,000 153,000 77, 300 130,000 Credit $2,800 10, 600 28, 700 210,000 156, 400 $408, 500 Totals $408,500 During January 2021, the following transactions occur: Borrow $110,000 from Captive Credit Corporation. The installment note bears interest at 6x annually and matures in 5 years. Payments of $2,127 are required at the end of each month for 60 months. January January Receive $32,000 fron customers on accounts receivable. Pay cash on accounts payable, $21,000. January 10 January Pay cash for salaries, $29,900. 15 Firework sales for the month total $200, 600. Sales include $66,000 for cash and $134,600 on account. The cost of the units sold is $117, 500. Pay the first monthly instal Inent of $2,127 related to the $110,000 borrowed on January 1. Round your interest caiculation to the nearest dollar January 30 January 31

Exercise 9-21 Complete the accounting cycle using long-term liability transactions (LO9-2, 9-8) (The following information applies to the questions displayed below.) On January 1, 2021, the general ledger of Freedom Fireworks includes the following account balances: Accounts Cash Accounts Receivable Inventory Land Buildings Allowance for Uncollectible Accounts Accumulated Depreciation Accounts Payable Conmon Stock Retained Earnings Debit $ 12, 200 36,000 153,000 77, 300 130,000 Credit $2,800 10, 600 28, 700 210,000 156, 400 $408, 500 Totals $408,500 During January 2021, the following transactions occur: Borrow $110,000 from Captive Credit Corporation. The installment note bears interest at 6x annually and matures in 5 years. Payments of $2,127 are required at the end of each month for 60 months. January January Receive $32,000 fron customers on accounts receivable. Pay cash on accounts payable, $21,000. January 10 January Pay cash for salaries, $29,900. 15 Firework sales for the month total $200, 600. Sales include $66,000 for cash and $134,600 on account. The cost of the units sold is $117, 500. Pay the first monthly instal Inent of $2,127 related to the $110,000 borrowed on January 1. Round your interest caiculation to the nearest dollar January 30 January 31

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter25: Departmental Accounting

Section: Chapter Questions

Problem 9SPA: INCOME STATEMENT WITH DEPART MENTAL DIRECT OPERATING MARGIN AND TOTAL OPERATING INCOME Durwood...

Related questions

Question

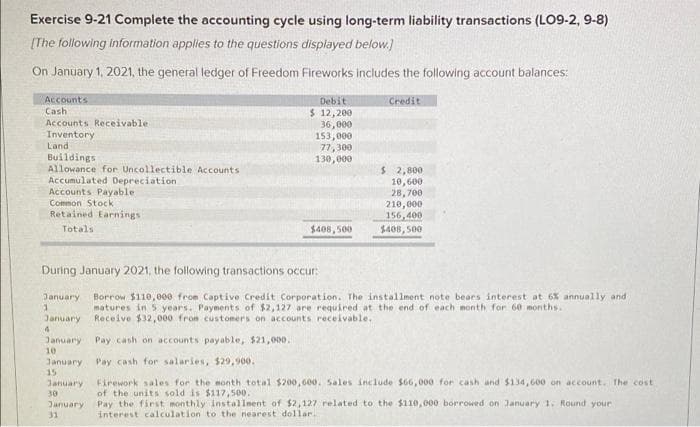

Transcribed Image Text:Exercise 9-21 Complete the accounting cycle using long-term liability transactions (LO9-2, 9-8)

[The following information applies to the questions displayed below.)

On January 1, 2021, the general ledger of Freedom Fireworks includes the following account balances:

Accounts

Cash

Accounts Receivable

Inventory

Land

Debit

Credit

$ 12,200

36,000

153,000

77, 300

130,000

Buildings

Allowance for Uncollectible Accounts

Accumulated Depreciation

Accounts Payable

Common Stock

$ 2,800

10,600

28,700

210,000

156,400

$408, 500

Retained Earnings

Totals

$408, 500

During January 2021, the following transactions occur:

Borrow $110,000 from Captive Credit Corporation. The installment note beaes interest at 6x annually and

matures in 5 years. Payments of $2,127 are required at the end of each month for 60 months.

Receive $32, 000 from customers on accounts receivable,

January

January

January

Pay cash on accounts payable, $21,000.

10

Pay cash for salaries, $29,900.

January

15

Firework sales for the month total $200,60o. Sales include $66,000 for cash and $134,600 on account. The cost

of the units sold is $117,500.

Pay the first monthly installnent of $2,127 related to the $110,000 borrowed on January 1. Round your

interest calculation to the nearest dollar

January

30

January

31

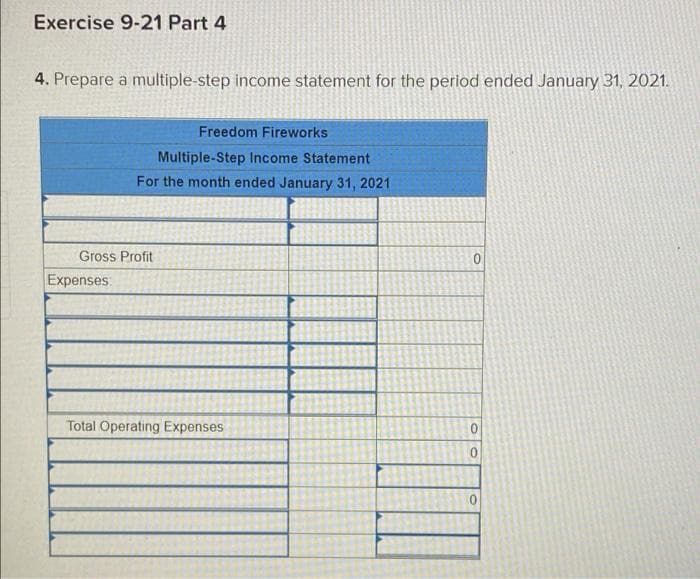

Transcribed Image Text:Exercise 9-21 Part 4

4. Prepare a multiple-step income statement for the period ended January 31, 2021.

Freedom Fireworks

Multiple-Step Income Statement

For the month ended January 31, 2021

Gross Profit

Expenses:

Total Operating Expenses

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College