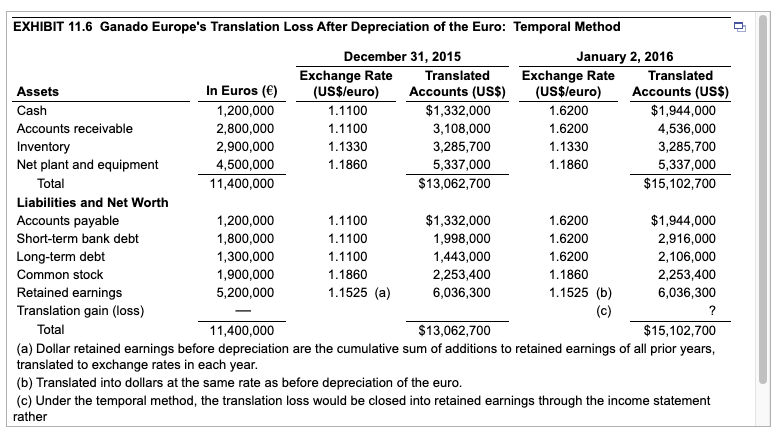

EXHIBIT 11.6 Ganado Europe's Translation Loss After Depreciation of the Euro: Temporal Method January 2, 2016 Exchange Rate (US$leuro) 1.6200 December 31, 2015 Exchange Rate (US$leuro) 1.1100 Translated Accounts (US$) $1,332,000 Translated In Euros (€) 1,200,000 Accounts (US$) $1,944,000 Assets Cash Accounts receivable 2,800,000 1.1100 3,108,000 1.6200 4,536,000 Inventory Net plant and equipment 3,285,700 5,337,000 $13,062,700 2,900,000 1.1330 1.1330 3,285,700 4,500,000 11,400,000 1.1860 1.1860 5,337,000 Total $15,102,700 Liabilities and Net Worth Accounts payable 1,200,000 1,800,000 1,300,000 1,900,000 1.1100 $1,332,000 1.6200 $1,944,000 Short-term bank debt 1.1100 1,998,000 1.6200 2,916,000 Long-term debt 1.1100 1,443,000 1.6200 2,106,000 Common stock 1.1860 2,253,400 1.1860 2,253,400 1.1525 (b) Retained earnings Translation gain (loss) 5,200,000 1.1525 (a) 6,036,300 6,036,300 (c) Total 11,400,000 $13,062,700 $15,102,700 (a) Dollar retained earnings before depreciation are the cumulative sum of additions to retained earnings of all prior years, translated to exchange rates in each year. (b) Translated into dollars at the same rate as before depreciation of the euro. (c) Under the temporal method, the translation loss would be closed into retained earnings through the income statement rather

EXHIBIT 11.6 Ganado Europe's Translation Loss After Depreciation of the Euro: Temporal Method January 2, 2016 Exchange Rate (US$leuro) 1.6200 December 31, 2015 Exchange Rate (US$leuro) 1.1100 Translated Accounts (US$) $1,332,000 Translated In Euros (€) 1,200,000 Accounts (US$) $1,944,000 Assets Cash Accounts receivable 2,800,000 1.1100 3,108,000 1.6200 4,536,000 Inventory Net plant and equipment 3,285,700 5,337,000 $13,062,700 2,900,000 1.1330 1.1330 3,285,700 4,500,000 11,400,000 1.1860 1.1860 5,337,000 Total $15,102,700 Liabilities and Net Worth Accounts payable 1,200,000 1,800,000 1,300,000 1,900,000 1.1100 $1,332,000 1.6200 $1,944,000 Short-term bank debt 1.1100 1,998,000 1.6200 2,916,000 Long-term debt 1.1100 1,443,000 1.6200 2,106,000 Common stock 1.1860 2,253,400 1.1860 2,253,400 1.1525 (b) Retained earnings Translation gain (loss) 5,200,000 1.1525 (a) 6,036,300 6,036,300 (c) Total 11,400,000 $13,062,700 $15,102,700 (a) Dollar retained earnings before depreciation are the cumulative sum of additions to retained earnings of all prior years, translated to exchange rates in each year. (b) Translated into dollars at the same rate as before depreciation of the euro. (c) Under the temporal method, the translation loss would be closed into retained earnings through the income statement rather

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter17: Multinational Financial Management

Section: Chapter Questions

Problem 6P

Related questions

Question

Transcribed Image Text:EXHIBIT 11.6 Ganado Europe's Translation Loss After Depreciation of the Euro: Temporal Method

December 31, 2015

January 2, 2016

Exchange Rate

(US$leuro)

Translated

Exchange Rate

(US$leuro)

Translated

Assets

In Euros (€)

Accounts (US$)

Accounts (US$)

Cash

1.1100

$1,332,000

3,108,000

$1,944,000

4,536,000

3,285,700

5,337,000

1,200,000

1.6200

Accounts receivable

2,800,000

1.1100

1.6200

Inventory

2,900,000

1.1330

3,285,700

1.1330

Net plant and equipment

4,500,000

1.1860

5,337,000

1.1860

Total

11,400,000

$13,062,700

$15,102,700

Liabilities and Net Worth

Accounts payable

1,200,000

1,800,000

1,300,000

$1,332,000

1,998,000

1.1100

1.6200

$1,944,000

Short-term bank debt

1.1100

1.6200

2,916,000

Long-term debt

1.1100

1,443,000

1.6200

2,106,000

Common stock

1,900,000

1.1860

2,253,400

1.1860

2,253,400

1.1525 (a)

Retained earnings

Translation gain (loss)

1.1525 (b)

(c)

5,200,000

6,036,300

6,036,300

?

|

Total

11,400,000

$13,062,700

$15,102,700

(a) Dollar retained earnings before depreciation are the cumulative sum of additions to retained earnings of all prior years,

translated to exchange rates in each year.

(b) Translated into dollars at the same rate as before depreciation of the euro.

(c) Under the temporal method, the translation loss would be closed into retained earnings through the income statement

rather

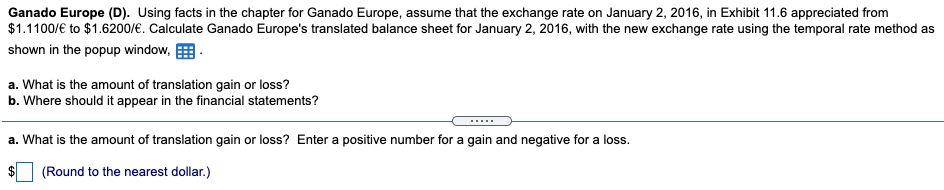

Transcribed Image Text:Ganado Europe (D). Using facts in the chapter for Ganado Europe, assume that the exchange rate on January 2, 2016, in Exhibit 11.6 appreciated from

$1.1100/€ to $1.6200/€. Calculate Ganado Europe's translated balance sheet for January 2, 2016, with the new exchange rate using the temporal rate method as

shown in the popup window, E

a. What is the amount of translation gain or loss?

b. Where should it appear in the financial statements?

.....

a. What is the amount of translation gain or loss? Enter a positive number for a gain and negative for a loss.

(Round to the nearest dollar.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning