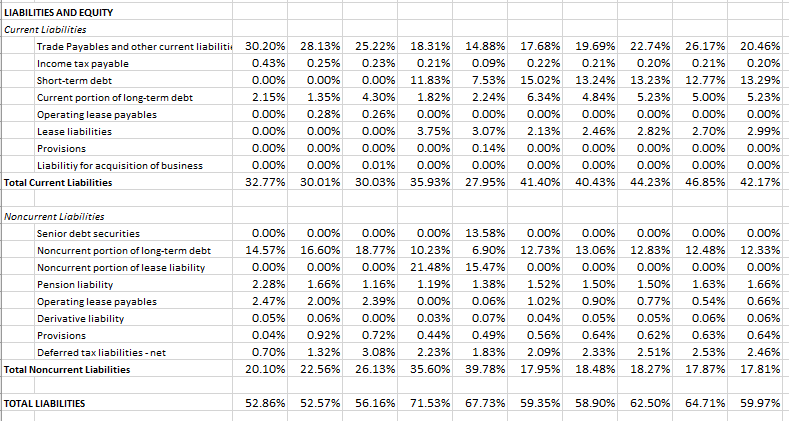

EXPLAIN THE RESULTS OF TOTAL LIABILITIES IN VERTICAL ANALYSIS

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter11: Determining The Cost Of Capital

Section: Chapter Questions

Problem 1P: 11-1 After-Tax Cost of Debt

Calculate the after-tax cost of debt under each of the following...

Related questions

Question

EXPLAIN THE RESULTS OF TOTAL LIABILITIES IN VERTICAL ANALYSIS

Transcribed Image Text:LIABILITIES AND EQUITY

Current Liabilities

Trade Payables and other current liabiliti 30.20%

28.13%

25.22%

18.31%

14.88%

17.68%

19.69%

22.74%

26.17%

20.46%

Income tax payable

0.43%

0.25%

0.23%

0.21%

0.09%

0.22%

0.21%

0.20%

0.21%

0.20%

Short-term debt

0.00%

0.00%

0.00%

11.83%

7.53%

15.02%

13.24%

13.23%

12.77%

13.29%

Current portion of long-term debt

2.15%

1.35%

4.30%

1.82%

2.24%

6.34%

4.84%

5.23%

5.00%

5.23%

Operating lease payables

0.00%

0.28%

0.26%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

Lease liabilities

0.00%

0.00%

0.00%

3.75%

3.07%

2.13%

2.46%

2.82%

2.70%

2.99%

Provisions

0.00%

0.00%

0.00%

0.00%

0.14%

0.00%

0.00%

0.00%

0.00%

0.00%

Liabilitiy for acquisition of business

0.00%

0.00%

0.01%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

Total Current Liabilities

32.77%

30.01%

30.03%

35.93%

27.95%

41.40%

40.43%

44.23%

46.85%

42.17%

Noncurrent Liabilities

Senior debt securities

0.00%

0.00%

0.00%

0.00%

13.58%

0.00%

0.00%

0.00%

0.00%

0.00%

Noncurrent portion of long-term debt

14.57%

16.60%

18.77%

10.23%

6.90%

12.73%

13.06%

12.83%

12.48%

12.33%

Noncurrent portion of lease liability

0.00%

0.00%

0.00%

21.48%

15.47%

0.00%

0.00%

0.00%

0.00%

0.00%

Pension liability

2.28%

1.66%

1.16%

1.19%

1.38%

1.52%

1.50%

1.50%

1.63%

1.66%

Operating lease payables

2.47%

2.00%

2.39%

0.00%

0.06%

1.02%

0.90%

0.77%

0.54%

0.66%

Derivative liability

0.05%

0.06%

0.00%

0.03%

0.07%

0.04%

0.05%

0.05%

0.06%

0.06%

Provisions

0.04%

0.92%

0.72%

0.44%

0.49%

0.56%

0.64%

0.62%

0.63%

0.64%

Deferred tax liabilities -net

0.70%

1.32%

3.08%

2.23%

1.83%

2.09%

2.33%

2.51%

2.53%

2.46%

Total Noncurrent Liabilities

20.10%

22.56%

26.13%

35.60%

39.78%

17.95%

18.48%

18.27%

17.87%

17.81%

TOTAL LIABILITIES

52.86%

52.57%

56.16%

71.53%

67.73%

59.35%

58.90%

62.50%

64.71%

59.97%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning