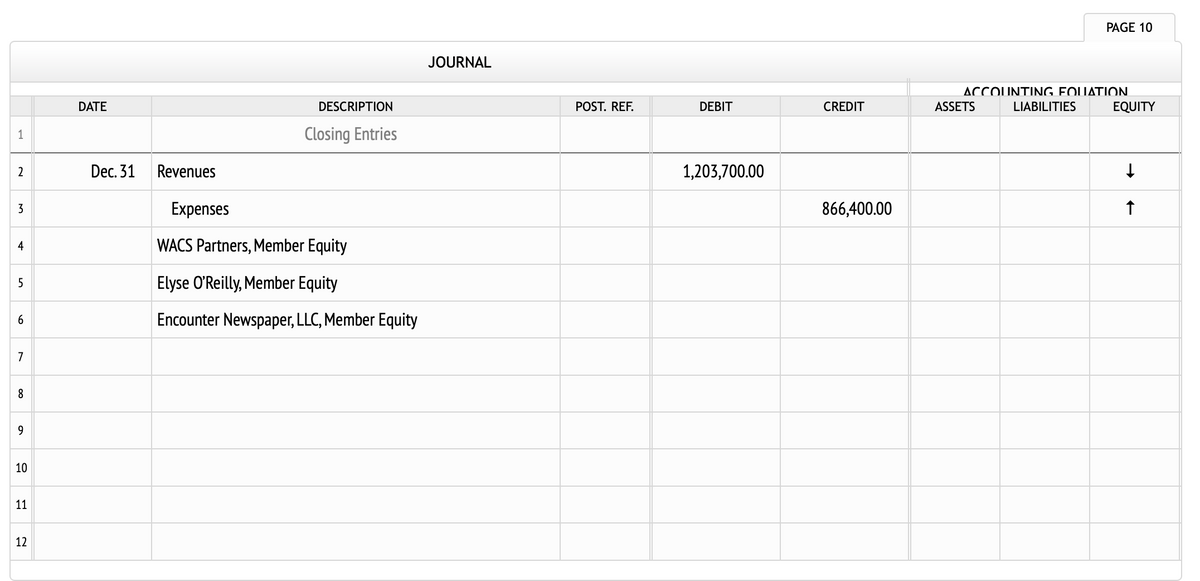

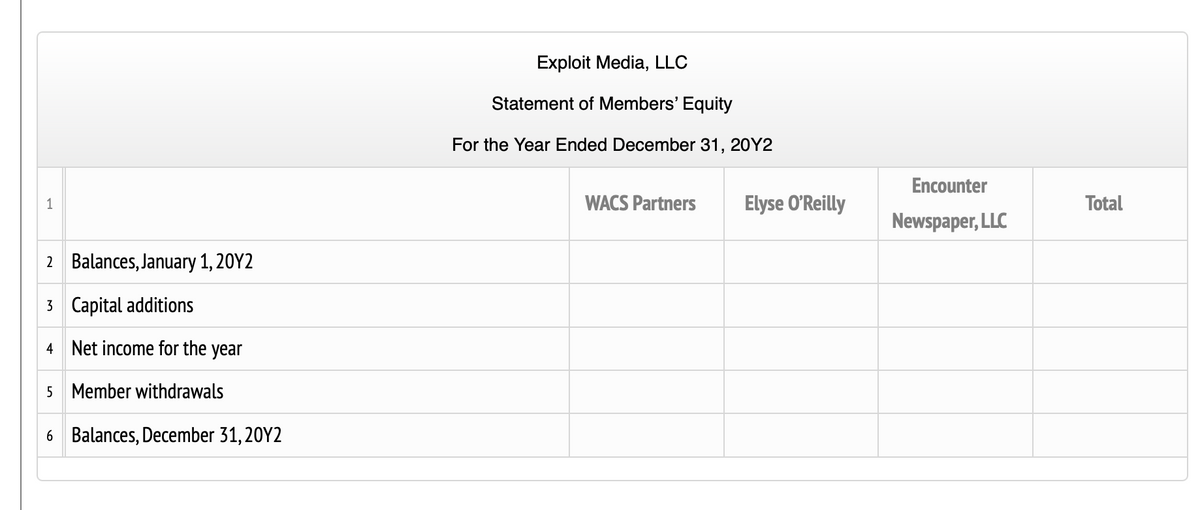

Exploit Media, LLC, has three members: WACS Partners, Elyse O’Reilly, and Encounter Newspaper, LLC. On January 1, 20Y2, the three members had equity of $218,800, $36,100, and $145,000, respectively. WACS Partners contributed an additional $53,500 to Exploit Media, LLC, on June 1, 20Y2. Elyse O’Reilly received an annual salary allowance of $53,700 during 20Y2. The members’ equity accounts are also credited with 10% interest on each member’s January 1 capital balance. Any remaining income is to be shared in the ratio of 4:3:3 among the three members. The revenues, expenses, and net income for Exploit Media, LLC, for 20Y2 were $1,203,700, 866,400 and $337,300 respectively. Amounts equal to the salary and interest allowances were withdrawn by the members. Required: a. Determine the division of income among the three members. If an amount box does not require an entry, leave it blank. b. Prepare the journal entry to close the revenues, expenses, and withdrawals to the individual member equity accounts. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. c. Prepare a statement of members’ equity for 20Y2. A decrease to members’ equity should be entered as a negative amount. If an amount box does not require an entry, leave it blank. d. What are the advantages of an income-sharing agreement for the members of this LLC? CHART OF ACCOUNTS Exploit Media, LLC General Ledger ASSETS 110 Cash 111 Petty Cash 112 Accounts Receivable 113 Allowance for Doubtful Accounts 114 Interest Receivable 115 Notes Receivable 116 Inventory 117 Office Supplies 118 Store Supplies 119 Prepaid Insurance 120 Land 123 Equipment 124 Accumulated Depreciation-Equipment 129 Asset Revaluations 133 Patent LIABILITIES 210 Accounts Payable 211 Salaries Payable 213 Sales Tax Payable 214 Interest Payable 215 Notes Payable EQUITY 310 Elyse O’Reilly, Member Equity 311 Elyse O’Reilly, Drawing 312 Encounter Newspaper, LLC, Member Equity 313 Encounter Newspaper, LLC, Drawing 314 WACS Partners, Member Equity 315 WACS Partners, Drawing REVENUE 610 Revenues EXPENSES 510 Expenses 520 Salaries Expense 521 Advertising Expense 522 Depreciation Expense-Equipment 523 Delivery Expense 524 Repairs Expense 529 Selling Expenses 531 Rent Expense 533 Insurance Expense 534 Office Supplies Expense 535 Store Supplies Expense 536 Credit Card Expense 537 Cash Short and Over 538 Bad Debt Expense 539 Miscellaneous Expense 710 Interest Expense

Reporting Cash Flows

Reporting of cash flows means a statement of cash flow which is a financial statement. A cash flow statement is prepared by gathering all the data regarding inflows and outflows of a company. The cash flow statement includes cash inflows and outflows from various activities such as operating, financing, and investment. Reporting this statement is important because it is the main financial statement of the company.

Balance Sheet

A balance sheet is an integral part of the set of financial statements of an organization that reports the assets, liabilities, equity (shareholding) capital, other short and long-term debts, along with other related items. A balance sheet is one of the most critical measures of the financial performance and position of the company, and as the name suggests, the statement must balance the assets against the liabilities and equity. The assets are what the company owns, and the liabilities represent what the company owes. Equity represents the amount invested in the business, either by the promoters of the company or by external shareholders. The total assets must match total liabilities plus equity.

Financial Statements

Financial statements are written records of an organization which provide a true and real picture of business activities. It shows the financial position and the operating performance of the company. It is prepared at the end of every financial cycle. It includes three main components that are balance sheet, income statement and cash flow statement.

Owner's Capital

Before we begin to understand what Owner’s capital is and what Equity financing is to an organization, it is important to understand some basic accounting terminologies. A double-entry bookkeeping system Normal account balances are those which are expected to have either a debit balance or a credit balance, depending on the nature of the account. An asset account will have a debit balance as normal balance because an asset is a debit account. Similarly, a liability account will have the normal balance as a credit balance because it is amount owed, representing a credit account. Equity is also said to have a credit balance as its normal balance. However, sometimes the normal balances may be reversed, often due to incorrect journal or posting entries or other accounting/ clerical errors.

| a. | Determine the division of income among the three members. If an amount box does not require an entry, leave it blank. |

| b. | Prepare the |

| c. | Prepare a statement of members’ equity for 20Y2. A decrease to members’ equity should be entered as a negative amount. If an amount box does not require an entry, leave it blank. |

| d. |

What are the advantages of an income-sharing agreement for the members of this LLC? |

| CHART OF ACCOUNTS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Exploit Media, LLC | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| General Ledger | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Trending now

This is a popular solution!

Step by step

Solved in 3 steps