Extracts from the statement of comprehensive income for the year ended 31 December are as follows: Revenue Cost of sales Gross profit • ☐ C Additional information: It is the policy of the firm to mark all its goods at a constant markup of 25% on cost. The interest expense for the year ended 31 December 2023 amounted to R24 000, and for the year ended 31 December 2022, R20 000. 40% of all sales are on cash. Purchases equal 85% of cost of sales. 90% of all purchases are on credit. Assume a 365-day year. Industry-wide averages are as follows: Gross profit percentage is 33%. Net profit percentage is 20%. Trade debtors' collection period is 60 days. Trade creditors settlement periods 41 days. Inventory turnover is 8 times per year. . D E C M 2023 R a 900 000 ? 210 000 2022 R 650 000 ? 130 000 REQUIRED: Calculate the Trade debtors' collection period for both financial years ended 31 December 2023 and 2022, and interpret the results: Show the formula and your calculations. Round off all answers to 2 decimal places.

Extracts from the statement of comprehensive income for the year ended 31 December are as follows: Revenue Cost of sales Gross profit • ☐ C Additional information: It is the policy of the firm to mark all its goods at a constant markup of 25% on cost. The interest expense for the year ended 31 December 2023 amounted to R24 000, and for the year ended 31 December 2022, R20 000. 40% of all sales are on cash. Purchases equal 85% of cost of sales. 90% of all purchases are on credit. Assume a 365-day year. Industry-wide averages are as follows: Gross profit percentage is 33%. Net profit percentage is 20%. Trade debtors' collection period is 60 days. Trade creditors settlement periods 41 days. Inventory turnover is 8 times per year. . D E C M 2023 R a 900 000 ? 210 000 2022 R 650 000 ? 130 000 REQUIRED: Calculate the Trade debtors' collection period for both financial years ended 31 December 2023 and 2022, and interpret the results: Show the formula and your calculations. Round off all answers to 2 decimal places.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter16: Financial Statement Analysis

Section: Chapter Questions

Problem 6BE

Related questions

Question

![Extracts from the statement of comprehensive income for the year ended 31 December are as

follows:

Revenue

Cost of sales

Gross profit

●

n

■

"

Additional information:

It is the policy of the firm to mark all its goods at a constant markup of 25% on cost.

The interest expense for the year ended 31 December 2023 amounted to R24 000, and for

the year ended 31 December 2022, R20 000.

40% of all sales are on cash.

Purchases equal 85% of cost of sales.

90% of all purchases are on credit.

Assume a 365-day year.

Industry-wide averages are as follows:

Gross profit percentage is 33%.

Net profit percentage is 20%.

Trade debtors' collection period is 60 days.

Trade creditors settlement periods 41 days.

Inventory turnover is 8 times per year.

D

[#]

E

13

2023

R

O

900 000

7

210 000

2022

R

650 000

7

130 000

REQUIRED:

Calculate the Trade debtors' collection period for both financial years ended 31 December 2023

and 2022, and interpret the results:

Show the formula and your calculations. Round off all answers to 2 decimal places.](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Fd22e1d8a-c875-44ea-bb95-57a838252e9f%2F8fd34d07-bbaa-476e-bfb1-d0f3ff12369f%2Faonq1t_processed.jpeg&w=3840&q=75)

Transcribed Image Text:Extracts from the statement of comprehensive income for the year ended 31 December are as

follows:

Revenue

Cost of sales

Gross profit

●

n

■

"

Additional information:

It is the policy of the firm to mark all its goods at a constant markup of 25% on cost.

The interest expense for the year ended 31 December 2023 amounted to R24 000, and for

the year ended 31 December 2022, R20 000.

40% of all sales are on cash.

Purchases equal 85% of cost of sales.

90% of all purchases are on credit.

Assume a 365-day year.

Industry-wide averages are as follows:

Gross profit percentage is 33%.

Net profit percentage is 20%.

Trade debtors' collection period is 60 days.

Trade creditors settlement periods 41 days.

Inventory turnover is 8 times per year.

D

[#]

E

13

2023

R

O

900 000

7

210 000

2022

R

650 000

7

130 000

REQUIRED:

Calculate the Trade debtors' collection period for both financial years ended 31 December 2023

and 2022, and interpret the results:

Show the formula and your calculations. Round off all answers to 2 decimal places.

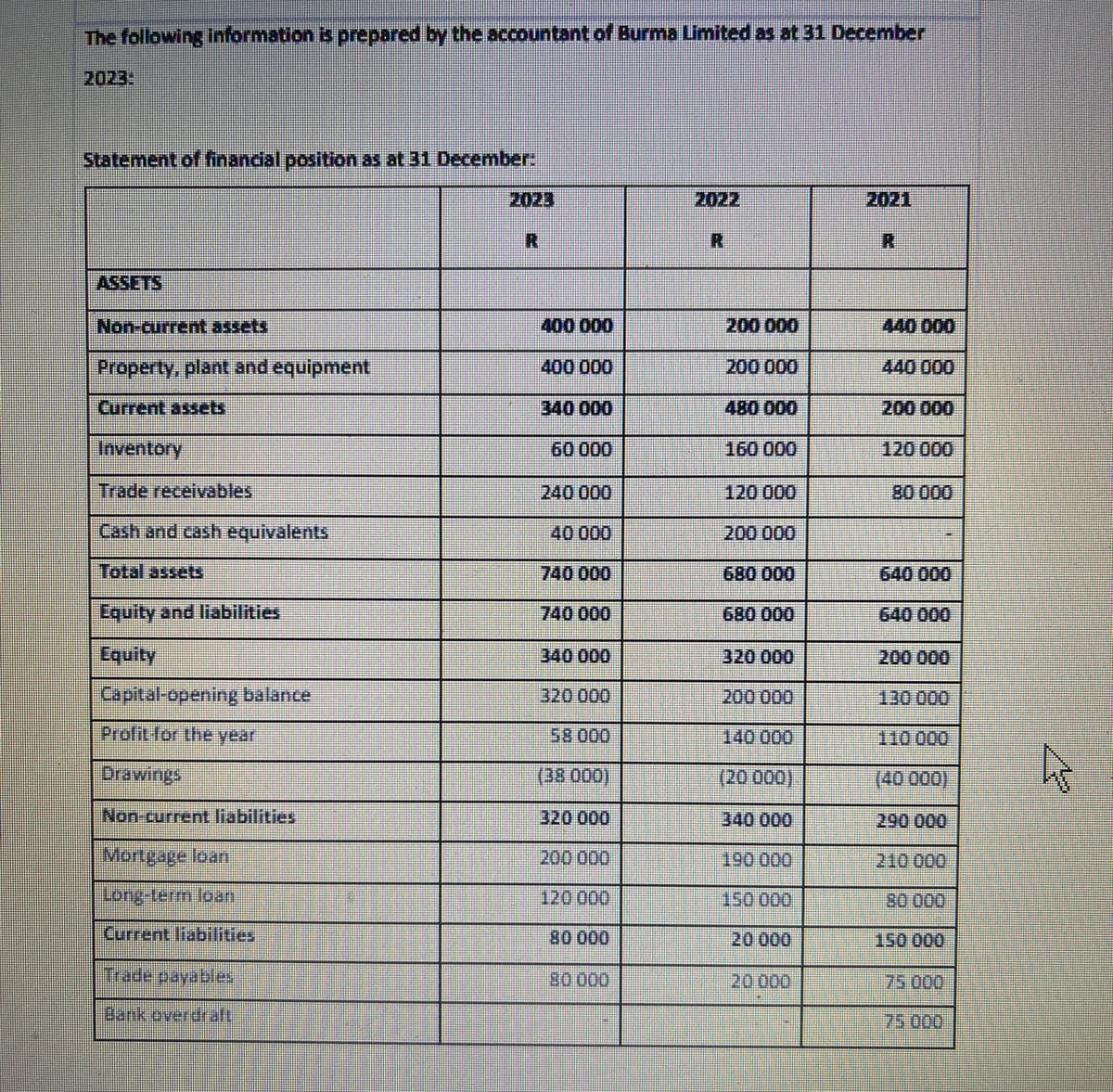

Transcribed Image Text:The following information is prepared by the accountant of Burma Limited as at 31 December

20235

Statement of financial position as at 31 December:

ASSETS

Non-current assets

Property, plant and equipment

Current assets

Inventory

Trade receivables

Cash and cash equivalents

Total assets

Equity and liabilities

Equity

Capital-opening balance

Profit for the year

Drawings

Non-current liabilities

Mortgage loan

Long-term loan

Current liabilities

Trade payables

Bank overdraft

2023

R

400 000

400 000

340 000

60 000

240 000

40 000

740 000

740 000

340 000

320 000

58 000

(38 000)

320 000

200 000

120 000

80 000

80 000

2022

R

200 000

200 000

480 000

160 000

120 000

200 000

680 000

680 000

320 000

200 000

140 000

(20 000)

340 000

190 000

150 000

20 000

20 000

2021

R

440 000

440 000

200 000

120 000

80 000

640 000

640 000

200 000

130 000

110 000

(40 000)

290 000

210 000

80 000

150 000

75 000

75 000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning