F1 Exam 3 - Chapter X + ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/question-gro... am 3 - Chapter 15, 16, and 17 17 2 points Saved Help Save & Exit Submit The financial reporting carrying value of Boze Music's only depreciable asset exceeded its tax basis by $160,000 at December 31, 2024. This was a result of differences between straight-line depreciation for financial reporting purposes and accelerated depreciation for tax purposes. The asset was acquired earlier in the year. Boze has no other temporary differences. The enacted tax rate is 27% for 2024 and 31% thereafter. Boze should report the deferred tax effect of this difference in its December 31, 2024, balance sheet as a(n): Multiple Choice 02:14:19 eBook References О deferred tax liability of $49,600. Mc Graw Hill Type here to search W 3 E 4 deferred tax liability of $49,250. deferred tax asset of $49,250. F5 F6 Z X C V G H < Prev 17 of 38 Nex > W 00 N 9:44 PM Watchlist ideas 4/14/2024 PRZ F8 F9 F10 F11 F12 PrtScr Insert Delete Calc J. K Backspace Hom Lock 7 Home Enter 4 Shift

F1 Exam 3 - Chapter X + ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/question-gro... am 3 - Chapter 15, 16, and 17 17 2 points Saved Help Save & Exit Submit The financial reporting carrying value of Boze Music's only depreciable asset exceeded its tax basis by $160,000 at December 31, 2024. This was a result of differences between straight-line depreciation for financial reporting purposes and accelerated depreciation for tax purposes. The asset was acquired earlier in the year. Boze has no other temporary differences. The enacted tax rate is 27% for 2024 and 31% thereafter. Boze should report the deferred tax effect of this difference in its December 31, 2024, balance sheet as a(n): Multiple Choice 02:14:19 eBook References О deferred tax liability of $49,600. Mc Graw Hill Type here to search W 3 E 4 deferred tax liability of $49,250. deferred tax asset of $49,250. F5 F6 Z X C V G H < Prev 17 of 38 Nex > W 00 N 9:44 PM Watchlist ideas 4/14/2024 PRZ F8 F9 F10 F11 F12 PrtScr Insert Delete Calc J. K Backspace Hom Lock 7 Home Enter 4 Shift

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Transcribed Image Text:F1

Exam 3 - Chapter X

+

ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/question-gro...

am 3 - Chapter 15, 16, and 17

17

2

points

Saved

Help

Save & Exit

Submit

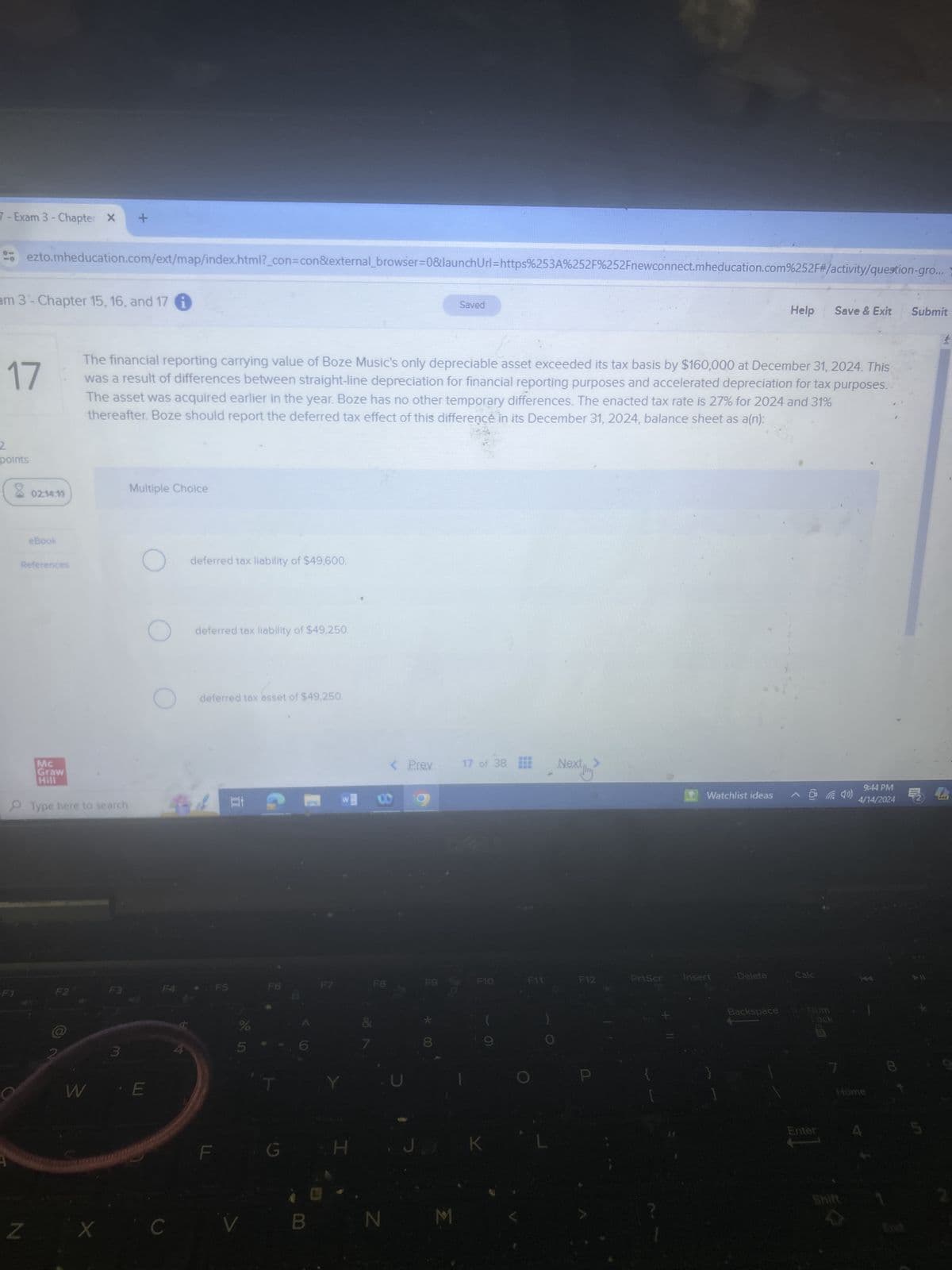

The financial reporting carrying value of Boze Music's only depreciable asset exceeded its tax basis by $160,000 at December 31, 2024. This

was a result of differences between straight-line depreciation for financial reporting purposes and accelerated depreciation for tax purposes.

The asset was acquired earlier in the year. Boze has no other temporary differences. The enacted tax rate is 27% for 2024 and 31%

thereafter. Boze should report the deferred tax effect of this difference in its December 31, 2024, balance sheet as a(n):

Multiple Choice

02:14:19

eBook

References

О

deferred tax liability of $49,600.

Mc

Graw

Hill

Type here to search

W

3

E

4

deferred tax liability of $49,250.

deferred tax asset of $49,250.

F5

F6

Z

X

C

V

G

H

< Prev

17 of 38 Nex

>

W

00

N

9:44 PM

Watchlist ideas

4/14/2024

PRZ

F8

F9

F10

F11

F12

PrtScr

Insert

Delete

Calc

J.

K

Backspace

Hom

Lock

7

Home

Enter

4

Shift

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education